Qualitative analysis explores non-numerical data to uncover patterns, themes, and insights that quantitative methods might overlook. It involves techniques such as interviews, observations, and content analysis to understand behaviors, motivations, and experiences. Discover how qualitative analysis can enrich your understanding by reading the full article.

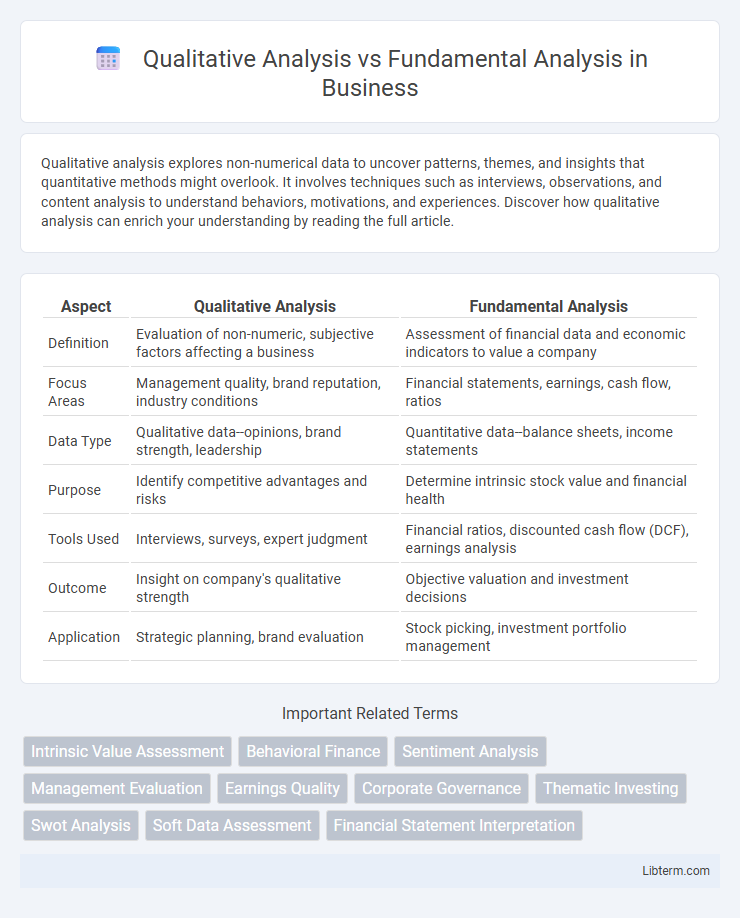

Table of Comparison

| Aspect | Qualitative Analysis | Fundamental Analysis |

|---|---|---|

| Definition | Evaluation of non-numeric, subjective factors affecting a business | Assessment of financial data and economic indicators to value a company |

| Focus Areas | Management quality, brand reputation, industry conditions | Financial statements, earnings, cash flow, ratios |

| Data Type | Qualitative data--opinions, brand strength, leadership | Quantitative data--balance sheets, income statements |

| Purpose | Identify competitive advantages and risks | Determine intrinsic stock value and financial health |

| Tools Used | Interviews, surveys, expert judgment | Financial ratios, discounted cash flow (DCF), earnings analysis |

| Outcome | Insight on company's qualitative strength | Objective valuation and investment decisions |

| Application | Strategic planning, brand evaluation | Stock picking, investment portfolio management |

Introduction to Qualitative and Fundamental Analysis

Qualitative analysis evaluates non-numerical factors such as management quality, brand strength, and competitive advantage to assess a company's potential. Fundamental analysis examines financial statements, including income statements, balance sheets, and cash flow statements, to determine a company's intrinsic value and future performance. Together, these approaches provide a comprehensive framework for investment decision-making by integrating both qualitative insights and quantitative financial metrics.

Defining Qualitative Analysis

Qualitative analysis involves evaluating non-numeric factors such as company management quality, brand strength, industry conditions, and competitive advantages to assess investment potential. It complements fundamental analysis, which focuses on quantitative financial data like earnings, revenue, and ratios. Understanding qualitative aspects helps investors gauge long-term business sustainability beyond just financial metrics.

Understanding Fundamental Analysis

Fundamental analysis evaluates a company's intrinsic value by examining financial statements, market conditions, and economic indicators, providing investors with insights into long-term growth potential and risk factors. This approach relies on key metrics such as earnings per share (EPS), price-to-earnings (P/E) ratio, revenue growth, and debt levels to determine if a stock is undervalued or overvalued. Unlike qualitative analysis, which focuses on non-numerical factors like management quality or brand strength, fundamental analysis offers a data-driven framework essential for informed investment decisions.

Key Components of Qualitative Analysis

Qualitative analysis primarily evaluates non-numeric factors such as company management quality, brand reputation, competitive advantage, and industry conditions to assess a firm's potential. It involves analyzing corporate governance, intellectual property, customer satisfaction, and employee relations to gauge long-term sustainability and risks. This approach complements fundamental analysis, which concentrates on financial metrics like earnings, revenue, and balance sheets.

Essential Elements of Fundamental Analysis

Fundamental analysis centers on essential elements such as financial statements, including income statements, balance sheets, and cash flow statements, to evaluate a company's intrinsic value. It examines economic indicators, industry trends, management quality, and competitive advantages to assess long-term growth potential. Unlike qualitative analysis, which emphasizes non-numerical factors like brand reputation and consumer sentiment, fundamental analysis relies heavily on quantitative data and economic fundamentals.

Qualitative vs Fundamental: Core Differences

Qualitative analysis evaluates non-numeric factors such as company management, brand strength, and industry conditions, providing insights into intangible elements that influence a company's long-term potential. Fundamental analysis combines both qualitative and quantitative data, including financial statements, earnings reports, and market trends, to assess a company's intrinsic value and investment viability. The core difference lies in qualitative analysis focusing on subjective, descriptive factors, while fundamental analysis integrates these with objective, financial metrics for a comprehensive evaluation.

Advantages of Qualitative Analysis

Qualitative analysis excels in evaluating non-numeric factors such as company management quality, brand strength, and industry reputation, offering deeper insights into a firm's long-term potential. It enables investors to assess intangible assets and corporate culture, which are often overlooked in purely quantitative models. This approach enhances decision-making by incorporating human judgment and contextual understanding that complements traditional financial metrics.

Strengths of Fundamental Analysis

Fundamental analysis excels in evaluating a company's intrinsic value by examining financial statements, economic factors, and industry conditions, providing investors with a comprehensive understanding of long-term growth potential. This approach enables the identification of undervalued stocks by analyzing key metrics such as earnings, revenue, and cash flow, offering a data-driven basis for investment decisions. Investors benefit from fundamental analysis by gaining insights into the stability and profitability of a business, which supports more informed and strategic portfolio management.

When to Use Qualitative or Fundamental Analysis

Qualitative analysis is best used when evaluating non-numeric factors such as company management, brand strength, and industry conditions that impact long-term potential, especially in emerging markets or startups. Fundamental analysis is more appropriate for assessing financial health and intrinsic value through quantitative data like earnings, revenue growth, and debt levels, making it ideal for mature companies with extensive financial records. Combining both approaches provides a comprehensive view, but the choice depends on the nature of the investment and available information.

Conclusion: Choosing the Right Analysis Approach

Choosing the right analysis approach depends on investment goals and market context, with qualitative analysis offering insights into brand strength, management quality, and market position, while fundamental analysis provides data-driven valuation through financial statements, ratios, and economic indicators. Investors seeking a comprehensive perspective often combine both methods to assess both intrinsic value and qualitative factors influencing long-term performance. Tailoring the approach to the specific asset class and risk tolerance enhances decision-making accuracy and portfolio strategy effectiveness.

Qualitative Analysis Infographic

libterm.com

libterm.com