Equity financing involves raising capital by selling shares of ownership in a company, allowing businesses to access funds without incurring debt. It provides investors with a stake in the company's future profits and growth potential. Explore the full article to understand how equity financing can impact your business strategy and growth opportunities.

Table of Comparison

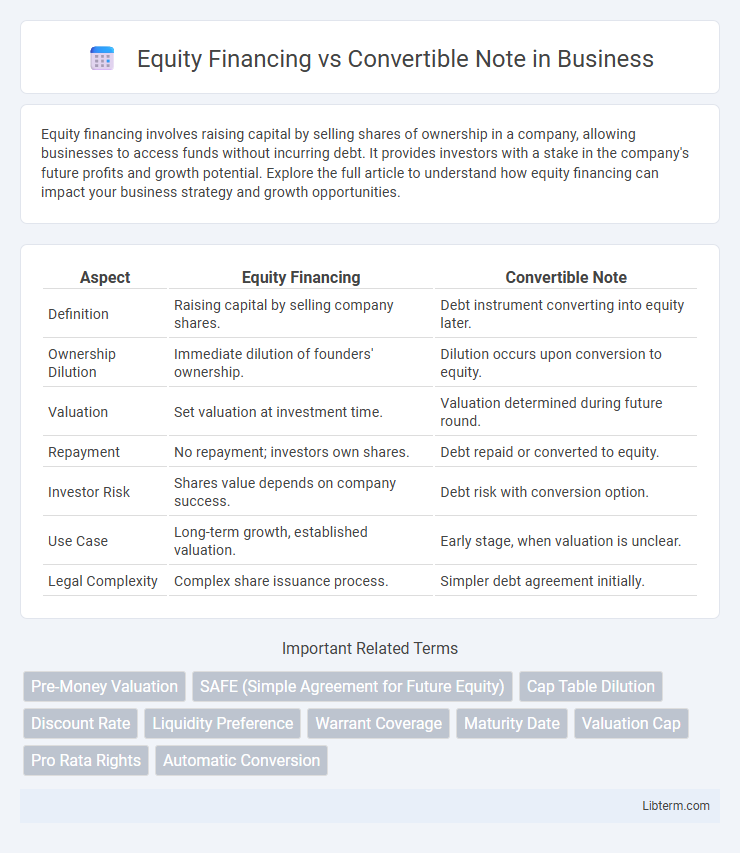

| Aspect | Equity Financing | Convertible Note |

|---|---|---|

| Definition | Raising capital by selling company shares. | Debt instrument converting into equity later. |

| Ownership Dilution | Immediate dilution of founders' ownership. | Dilution occurs upon conversion to equity. |

| Valuation | Set valuation at investment time. | Valuation determined during future round. |

| Repayment | No repayment; investors own shares. | Debt repaid or converted to equity. |

| Investor Risk | Shares value depends on company success. | Debt risk with conversion option. |

| Use Case | Long-term growth, established valuation. | Early stage, when valuation is unclear. |

| Legal Complexity | Complex share issuance process. | Simpler debt agreement initially. |

Introduction to Equity Financing and Convertible Notes

Equity financing involves raising capital by selling shares of ownership in a company, allowing investors to gain equity stakes and potential dividends. Convertible notes are debt instruments that convert into equity at a later financing round, typically offering initial debt protection with potential upside if the company grows. Both methods provide flexible financing options for startups, balancing risk and investor incentives.

Key Differences Between Equity Financing and Convertible Notes

Equity financing involves selling ownership shares in a company to investors, granting them immediate equity and voting rights, while convertible notes are debt instruments that convert into equity at a later financing round, typically with a discount or valuation cap. Equity financing provides investors with direct equity stakes upfront, whereas convertible notes delay equity conversion until triggering events such as Series A funding. Key differences also include dilution timing, investor risk profile, and regulatory implications, with equity financing causing immediate dilution and convertible notes offering deferred dilution and debt protection.

How Equity Financing Works

Equity financing involves raising capital by selling shares of the company to investors, who then gain ownership stakes proportional to their investment. This process dilutes existing shareholders but provides permanent capital without repayment obligations. Startups often use equity financing to secure long-term funding while aligning investor interests with company growth and success.

How Convertible Notes Work

Convertible notes are a form of short-term debt that converts into equity, typically during a future financing round, allowing investors to lend money to startups with the expectation of receiving shares instead of repayment. These notes often include a discount rate and valuation cap, providing early investors with favorable terms compared to later equity investors. The flexibility of convertible notes helps startups avoid the immediate need for valuation, streamlining early-stage fundraising while aligning investor and company interests.

Advantages of Equity Financing

Equity financing provides the advantage of securing capital without incurring debt or interest obligations, enabling startups to access funds in exchange for ownership shares. It aligns investor interests with company growth, often resulting in long-term strategic partnerships and support. Unlike convertible notes, equity financing offers clear valuation and ownership structures from the outset, reducing complexity in future funding rounds.

Advantages of Convertible Notes

Convertible notes offer flexible financing by deferring valuation discussions until a future equity round, reducing negotiation complexities. They provide investors with debt security and interest accrual while allowing conversion to equity at a discount or with valuation caps, incentivizing early investment. This structure accelerates fundraising timelines and lowers upfront legal costs compared to traditional equity financing.

Risks and Challenges of Equity Financing

Equity financing involves selling company shares, which can lead to ownership dilution and loss of control for founders, posing significant risks. Investors may demand significant influence over business decisions, potentially creating conflicts and strategic misalignment. Furthermore, equity financing requires thorough valuation, complex legal procedures, and ongoing regulatory compliance, increasing costs and administrative burdens.

Risks and Challenges of Convertible Notes

Convertible notes carry risks including valuation uncertainty since the conversion price is determined during a future funding round, potentially diluting early investors if the company's valuation is higher than expected. They also pose challenges related to maturity dates and interest accrual, which can pressure startups to raise new capital or negotiate extensions under unfavorable terms. Furthermore, convertible notes can create complexity in cap table management and investor relations, especially if multiple notes convert simultaneously or if liquidation preferences clash with future equity rounds.

Choosing Between Equity Financing and Convertible Notes

Choosing between equity financing and convertible notes depends on startup valuation certainty and fundraising speed. Equity financing establishes ownership percentages upfront by issuing shares, ideal when the company's valuation is clear and investors seek immediate equity. Convertible notes delay valuation discussions by functioning as debt that converts into equity at a future equity round, providing flexibility and faster capital with reduced dilution risk during early fundraising stages.

Which Option is Right for Your Startup?

Choosing between equity financing and a convertible note depends on your startup's current valuation certainty and fundraising timeline. Equity financing offers immediate ownership dilution but establishes clear valuation and investor rights, ideal for startups confident in their market value. Convertible notes delay valuation discussions by converting debt into equity during a future funding round, making them suitable for early-stage startups seeking quick capital without setting a firm valuation.

Equity Financing Infographic

libterm.com

libterm.com