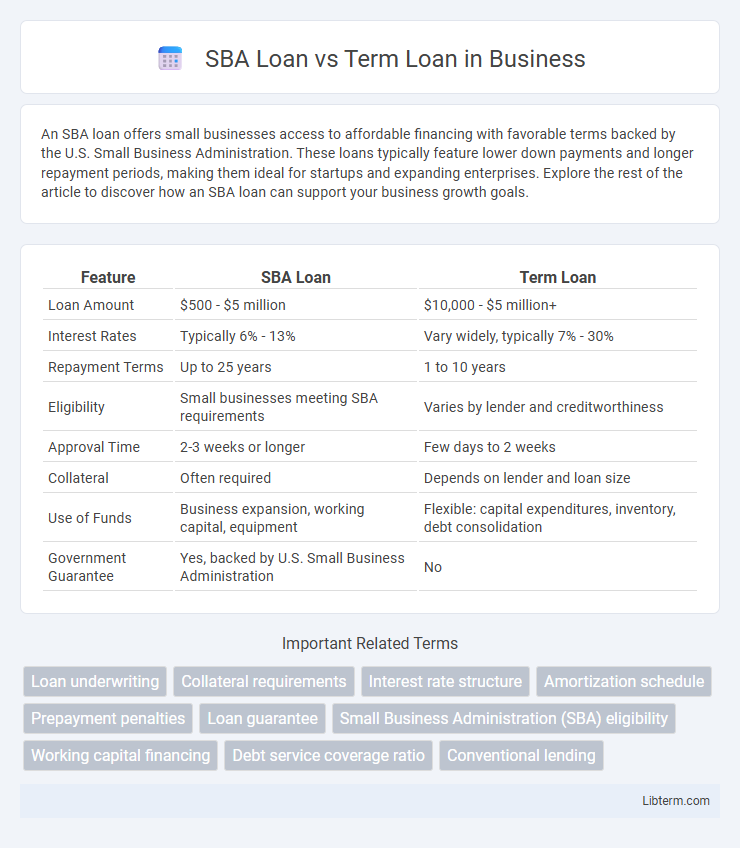

An SBA loan offers small businesses access to affordable financing with favorable terms backed by the U.S. Small Business Administration. These loans typically feature lower down payments and longer repayment periods, making them ideal for startups and expanding enterprises. Explore the rest of the article to discover how an SBA loan can support your business growth goals.

Table of Comparison

| Feature | SBA Loan | Term Loan |

|---|---|---|

| Loan Amount | $500 - $5 million | $10,000 - $5 million+ |

| Interest Rates | Typically 6% - 13% | Vary widely, typically 7% - 30% |

| Repayment Terms | Up to 25 years | 1 to 10 years |

| Eligibility | Small businesses meeting SBA requirements | Varies by lender and creditworthiness |

| Approval Time | 2-3 weeks or longer | Few days to 2 weeks |

| Collateral | Often required | Depends on lender and loan size |

| Use of Funds | Business expansion, working capital, equipment | Flexible: capital expenditures, inventory, debt consolidation |

| Government Guarantee | Yes, backed by U.S. Small Business Administration | No |

Overview: SBA Loan vs Term Loan

SBA loans are government-backed financing options designed to support small businesses with lower interest rates and longer repayment terms compared to traditional term loans. Term loans typically offer faster approval and funding processes, with fixed interest rates and shorter repayment periods suited for established businesses needing immediate capital. Choosing between SBA loans and term loans depends on factors like creditworthiness, business size, and urgency of funding requirements.

Key Differences Between SBA Loans and Term Loans

SBA loans are government-backed financing options offering lower interest rates and longer repayment terms, making them suitable for small businesses with less credit history. Term loans, provided by banks or lenders, typically have higher interest rates, shorter terms, and faster approval processes compared to SBA loans. Key differences include funding amounts, eligibility requirements, collateral demands, and application complexity, impacting borrower suitability and cost of capital.

Eligibility Requirements

SBA loans require applicants to be small businesses as defined by the SBA, demonstrate a sound business purpose, and show repayment ability, while meeting creditworthiness and operational history criteria. Term loans have broader eligibility standards, often requiring solid credit scores, consistent revenue, and collateral, but do not mandate small business status. Understanding these distinctions helps businesses determine which financing option aligns with their qualifications and growth objectives.

Application and Approval Process

SBA loans require borrowers to complete an extensive application including detailed financial documentation, and approval often involves a thorough review by both the lender and the Small Business Administration, resulting in a longer processing time compared to term loans. Term loans typically have a faster application and approval process with less stringent documentation requirements, enabling quicker access to funds. Understanding the differences in documentation and approval timelines is crucial when choosing between SBA loans and term loans for business financing.

Interest Rates and Fees Comparison

SBA loans typically offer lower interest rates ranging from 5% to 8%, compared to term loans that can have rates between 6% and 13%, influenced by borrower creditworthiness and lender policies. SBA loans often include upfront guaranty fees of 2% to 3.75%, while traditional term loans may have origination fees around 1% to 5%, depending on the lender. The longer repayment terms of SBA loans, up to 25 years, help reduce monthly payments despite initial fees, whereas term loans generally feature shorter terms of 1 to 5 years with potentially higher overall interest costs.

Repayment Terms and Schedules

SBA loans typically offer longer repayment terms, ranging from 7 to 25 years, with fixed monthly payments designed to ease borrower cash flow. Term loans usually have shorter repayment schedules, often between 1 to 5 years, with higher monthly payments due to the condensed timeline. The extended repayment period of SBA loans results in lower monthly obligations, while term loans require faster amortization, impacting overall business liquidity.

Collateral and Personal Guarantees

SBA loans typically require collateral such as real estate, equipment, or inventory, but they offer more flexible collateral requirements compared to traditional term loans. Personal guarantees are almost always mandatory for SBA loans, ensuring that business owners are personally accountable for loan repayment, while term loans may sometimes waive personal guarantees based on creditworthiness and lender policies. The collateral and personal guarantee terms in SBA loans are designed to reduce lender risk while supporting small business growth.

Use Cases: When to Choose Each Loan Type

SBA Loans are ideal for small businesses seeking long-term financing with lower down payments and favorable interest rates, often used for startup costs, equipment purchases, or real estate acquisition. Term Loans suit companies needing quick access to capital for short-to-medium-term needs such as inventory purchase, working capital, or business expansion. Choosing between SBA Loan vs Term Loan depends on factors like loan amount, repayment flexibility, and eligibility requirements aligned with specific business goals and financial situations.

Pros and Cons of SBA Loans

SBA loans offer lower interest rates and longer repayment terms compared to traditional term loans, making them ideal for small businesses seeking affordable financing. However, SBA loans involve a lengthy approval process and extensive documentation requirements, which can delay fund access. Despite these drawbacks, SBA loans provide government-backed guarantees that reduce lender risk, often resulting in higher approval rates for credit-challenged businesses.

Pros and Cons of Term Loans

Term loans provide fixed interest rates and predictable monthly payments, making budgeting straightforward for businesses seeking stable financing. They offer flexibility in repayment terms and are ideal for significant capital expenditures or expansion projects but often require strong credit profiles and collateral. However, term loans may have higher qualification standards and less favorable terms for startups compared to SBA loans, which provide government-backed guarantees and lower down payments.

SBA Loan Infographic

libterm.com

libterm.com