Bank loans offer flexible financing options tailored to meet various personal and business needs, often featuring competitive interest rates and repayment terms. Understanding the key factors such as credit requirements, loan types, and application processes can help you secure the best loan for your financial goals. Explore the rest of the article to learn how to navigate bank loans effectively and maximize your borrowing potential.

Table of Comparison

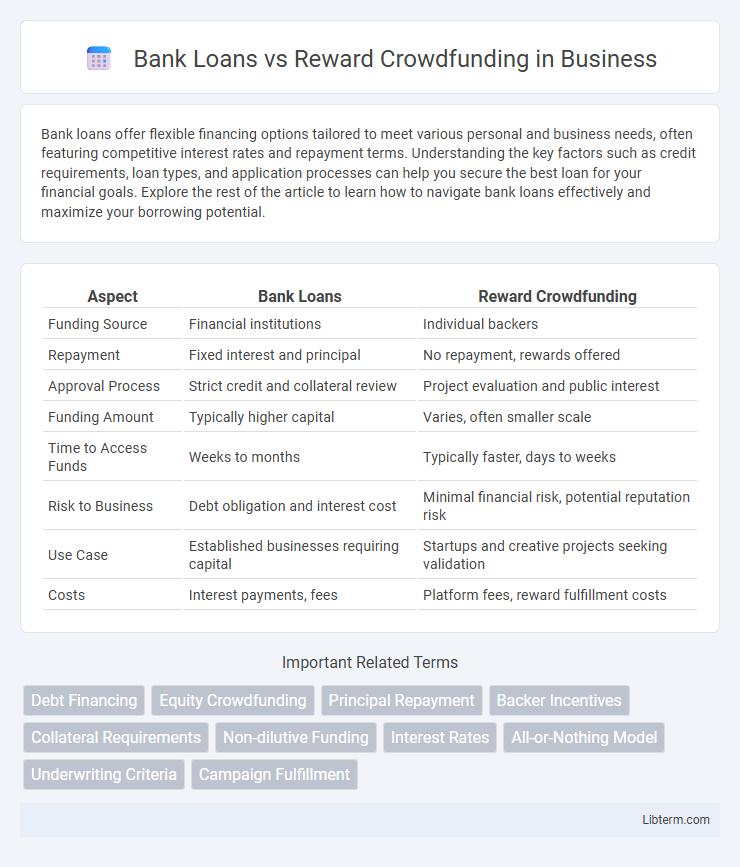

| Aspect | Bank Loans | Reward Crowdfunding |

|---|---|---|

| Funding Source | Financial institutions | Individual backers |

| Repayment | Fixed interest and principal | No repayment, rewards offered |

| Approval Process | Strict credit and collateral review | Project evaluation and public interest |

| Funding Amount | Typically higher capital | Varies, often smaller scale |

| Time to Access Funds | Weeks to months | Typically faster, days to weeks |

| Risk to Business | Debt obligation and interest cost | Minimal financial risk, potential reputation risk |

| Use Case | Established businesses requiring capital | Startups and creative projects seeking validation |

| Costs | Interest payments, fees | Platform fees, reward fulfillment costs |

Introduction to Bank Loans and Reward Crowdfunding

Bank loans are traditional financial products provided by banks that require repayment with interest over a fixed period, often secured by collateral or based on creditworthiness. Reward crowdfunding allows individuals or businesses to raise capital directly from a large number of backers through online platforms, offering non-financial incentives or rewards instead of equity or repayment. Both methods serve as crucial funding sources but differ significantly in terms of risk, accessibility, and investor expectations.

How Bank Loans Work

Bank loans provide businesses with a fixed amount of capital that must be repaid with interest over a predetermined period, typically requiring collateral and a strong credit history. The application process involves credit checks, financial documentation, and approval from lending institutions such as commercial banks or credit unions. Interest rates and repayment schedules vary based on loan type, borrower creditworthiness, and market conditions, distinguishing bank loans from the non-repayable nature of reward crowdfunding.

Understanding Reward Crowdfunding

Reward crowdfunding involves raising capital by offering non-monetary rewards or products to backers in exchange for their financial support, unlike traditional bank loans that require repayment with interest. This method leverages online platforms to connect entrepreneurs with a broad audience, effectively validating market demand and building a community around the product or project. Understanding reward crowdfunding is essential for startups seeking flexible financing without incurring debt or sacrificing equity.

Key Differences Between Bank Loans and Reward Crowdfunding

Bank loans require borrowers to repay the principal amount with interest over a fixed period, involving credit checks and collateral, while reward crowdfunding offers upfront funds from backers in exchange for non-monetary rewards without repayment obligations. Bank loans are regulated financial products with structured repayment plans, whereas reward crowdfunding relies on a community-driven model to finance creative or entrepreneurial projects. The key difference lies in the financial risk and repayment responsibility resting on the borrower in bank loans versus the risk-sharing and marketing potential inherent in reward crowdfunding campaigns.

Pros and Cons of Bank Loans

Bank loans offer predictable repayment schedules and access to larger capital amounts, making them suitable for established businesses with strong credit histories. However, they often require collateral, involve rigorous approval processes, and can lead to significant debt obligations with interest costs. Limited flexibility and the risk of default highlight the potential downsides compared to more flexible funding options like reward crowdfunding.

Advantages and Disadvantages of Reward Crowdfunding

Reward crowdfunding offers entrepreneurs access to capital without incurring debt or sacrificing equity, allowing creators to validate products and build a customer base simultaneously. However, it often requires significant marketing efforts and may limit funding potential compared to traditional bank loans, which provide predictable repayment terms but involve interest and strict eligibility criteria. The non-repayable nature and community engagement of reward crowdfunding contrast with the financial obligations and risk management associated with bank loans.

Application Process: Bank Loans vs Reward Crowdfunding

Bank loan applications require extensive financial documentation, credit checks, and detailed business plans to assess risk and repayment ability. Reward crowdfunding demands a compelling campaign presentation, creative rewards, and active marketing to attract backers without stringent credit evaluations. Both methods involve planning, but bank loans focus on financial credibility, while reward crowdfunding emphasizes community engagement and promotional strategies.

Financial Risks and Obligations

Bank loans involve fixed repayment schedules with interest rates that can burden borrowers during economic downturns, posing significant financial risks if cash flow decreases. Reward crowdfunding eliminates the obligation to repay money but requires delivering promised rewards, which can incur unexpected costs and operational risks. Unlike bank loans, crowdfunding depends on successfully managing backer expectations and product fulfillment to avoid reputational damage and indirect financial losses.

Suitability: Which Option Fits Your Business?

Bank loans suit established businesses with strong credit histories seeking predictable repayment schedules and fixed interest rates, providing reliable capital for expansion or equipment purchase. Reward crowdfunding fits startups or creative projects aiming to validate ideas while raising funds from a broad audience without incurring debt. Evaluating cash flow stability, funding amount, and willingness to offer rewards helps determine the optimal financing strategy for business growth.

Conclusion: Choosing the Right Funding Path

Selecting the ideal funding path depends on the business's financial needs, risk tolerance, and growth goals. Bank loans offer structured repayment and predictable costs but require strong credit and collateral, making them suitable for established businesses with steady cash flow. Reward crowdfunding provides access to capital without debt, fosters customer engagement, and tests market demand, ideal for startups and creative projects seeking early validation.

Bank Loans Infographic

libterm.com

libterm.com