Discounted Cash Flow (DCF) is a valuation method used to estimate the value of an investment based on its expected future cash flows, which are adjusted to present value using a discount rate. This technique helps you determine whether an investment is worth pursuing by factoring in the time value of money and risk. Discover how to apply DCF effectively and enhance your financial decision-making by reading the rest of this article.

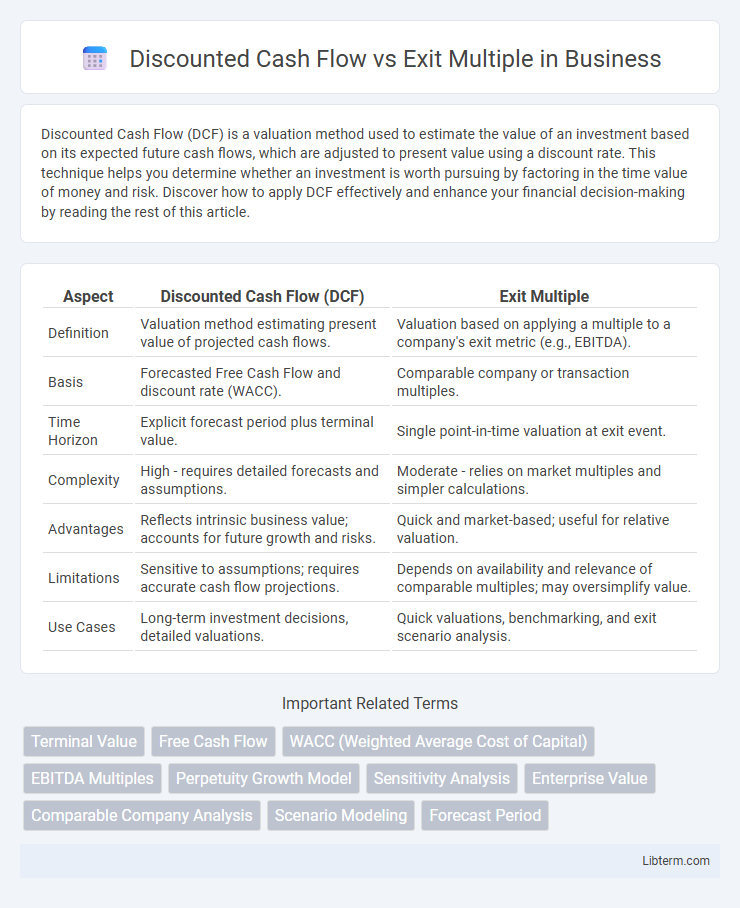

Table of Comparison

| Aspect | Discounted Cash Flow (DCF) | Exit Multiple |

|---|---|---|

| Definition | Valuation method estimating present value of projected cash flows. | Valuation based on applying a multiple to a company's exit metric (e.g., EBITDA). |

| Basis | Forecasted Free Cash Flow and discount rate (WACC). | Comparable company or transaction multiples. |

| Time Horizon | Explicit forecast period plus terminal value. | Single point-in-time valuation at exit event. |

| Complexity | High - requires detailed forecasts and assumptions. | Moderate - relies on market multiples and simpler calculations. |

| Advantages | Reflects intrinsic business value; accounts for future growth and risks. | Quick and market-based; useful for relative valuation. |

| Limitations | Sensitive to assumptions; requires accurate cash flow projections. | Depends on availability and relevance of comparable multiples; may oversimplify value. |

| Use Cases | Long-term investment decisions, detailed valuations. | Quick valuations, benchmarking, and exit scenario analysis. |

Introduction to Business Valuation Methods

Discounted Cash Flow (DCF) and Exit Multiple are essential business valuation methods used to estimate a company's intrinsic value and market value, respectively. The DCF method projects future free cash flows and discounts them to present value using the weighted average cost of capital (WACC), emphasizing detailed financial forecasts and time value of money. Exit Multiple valuation calculates value based on comparable company multiples, such as EV/EBITDA, at a future exit point, leveraging market-driven benchmarks to estimate terminal value.

Understanding Discounted Cash Flow (DCF)

Discounted Cash Flow (DCF) valuation estimates a company's intrinsic value by projecting future cash flows and discounting them to their present value using the weighted average cost of capital (WACC). This method emphasizes detailed financial forecasting, accounting for operational performance, capital expenditures, and working capital changes over multiple years. DCF provides a fundamental perspective by reflecting the company's ability to generate cash over time, unlike Exit Multiple, which relies on comparable company valuation metrics at a point of exit.

How Exit Multiple Method Works

The Exit Multiple method estimates a company's terminal value by applying a market-based earnings multiple, such as EV/EBITDA or EV/EBIT, to projected financial metrics at the end of a forecast period. This approach relies on comparable company analysis to determine an appropriate exit multiple reflecting industry conditions and growth prospects. The calculated terminal value, combined with discounted forecasted cash flows, provides a basis for comprehensive business valuation.

Key Differences Between DCF and Exit Multiple

Discounted Cash Flow (DCF) valuation relies on projecting a company's free cash flows and discounting them to present value using a chosen discount rate, emphasizing intrinsic value based on future performance. Exit Multiple valuation estimates value by applying a market-based multiple, such as EV/EBITDA, to financial metrics at the time of exit, focusing on comparative and transactional benchmarks. Key differences include DCF's forward-looking, detailed cash flow analysis versus Exit Multiple's reliance on market comparables and terminal period assumptions.

Advantages of Discounted Cash Flow Analysis

Discounted Cash Flow (DCF) analysis offers precise valuation by projecting future cash flows and discounting them to present value, capturing the intrinsic worth of a business based on its operational performance. Unlike Exit Multiple methods, DCF incorporates company-specific growth rates, risk factors, and capital structure, providing a tailored valuation rather than relying on market comparables. This approach enables investors to assess long-term value and make informed decisions grounded in fundamental financial metrics.

Benefits of the Exit Multiple Approach

The Exit Multiple approach offers simplicity and speed in valuation by using market-based data, making it particularly useful for benchmarking against comparable companies. This method reflects the likely selling price based on current market conditions, providing a realistic and market-validated estimate of terminal value. Firms benefit from this approach when precise cash flow forecasts are difficult, as it leverages multiples derived from recent transactions or public company valuations.

Limitations of DCF Valuation

Discounted Cash Flow (DCF) valuation relies heavily on accurate cash flow projections and an appropriate discount rate, making it sensitive to subjective assumptions and forecasting errors. It often struggles to capture the impact of market conditions and industry-specific risks, potentially leading to over- or undervaluation. Unlike the Exit Multiple method, DCF does not incorporate comparable company data, limiting its effectiveness in rapidly changing markets or sectors with high volatility.

Limitations of the Exit Multiple Method

The Exit Multiple method often relies heavily on comparable company data, which may not accurately reflect the unique growth prospects or risks of the target firm, leading to potential valuation inaccuracies. Market conditions and investor sentiment can cause exit multiples to fluctuate significantly, introducing volatility in the valuation outcome. This approach typically ignores projected future cash flows, limiting its ability to capture the company's long-term value creation potential compared to the Discounted Cash Flow method.

When to Use DCF vs Exit Multiple

Discounted Cash Flow (DCF) is ideal for valuing companies with stable, predictable cash flows and longer-term growth visibility, as it captures intrinsic value based on future free cash flow projections and discount rates. Exit Multiple valuation suits scenarios involving shorter investment horizons or when comparable company data is readily available, relying on market-based multiples such as EV/EBITDA to estimate terminal value. Choosing between DCF and Exit Multiple depends on the quality of financial forecasts, the nature of the business lifecycle, and the availability of relevant market comparables.

Choosing the Right Valuation Method for Your Business

Choosing the right valuation method depends on your business stage, industry, and available data quality. Discounted Cash Flow (DCF) offers a detailed intrinsic value by projecting future cash flows and discounting them to present value, ideal for stable companies with predictable earnings. Exit Multiple valuation relies on comparing similar businesses' sale multiples, providing a quick market-based estimate suitable for fast-growing sectors or when cash flow forecasts are unreliable.

Discounted Cash Flow Infographic

libterm.com

libterm.com