Working interest refers to the percentage of ownership a party holds in an oil or gas lease, entitling them to a proportional share of production revenue and obligations for operational expenses. It plays a crucial role in determining your financial commitment and returns in energy exploration projects. Explore the rest of the article to gain deeper insights into managing and optimizing your working interest.

Table of Comparison

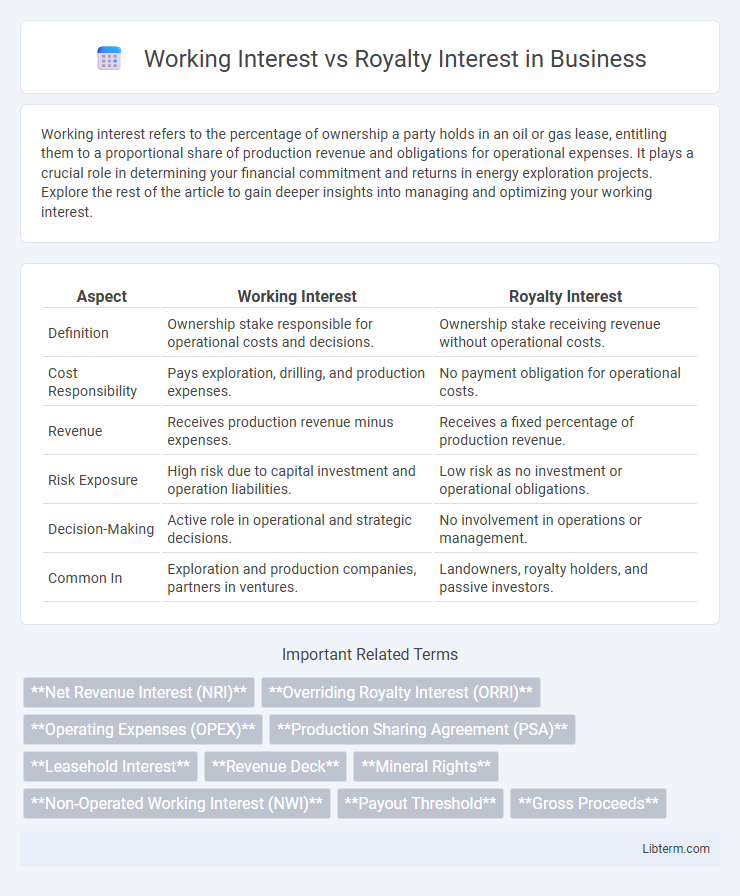

| Aspect | Working Interest | Royalty Interest |

|---|---|---|

| Definition | Ownership stake responsible for operational costs and decisions. | Ownership stake receiving revenue without operational costs. |

| Cost Responsibility | Pays exploration, drilling, and production expenses. | No payment obligation for operational costs. |

| Revenue | Receives production revenue minus expenses. | Receives a fixed percentage of production revenue. |

| Risk Exposure | High risk due to capital investment and operation liabilities. | Low risk as no investment or operational obligations. |

| Decision-Making | Active role in operational and strategic decisions. | No involvement in operations or management. |

| Common In | Exploration and production companies, partners in ventures. | Landowners, royalty holders, and passive investors. |

Introduction to Oil and Gas Interests

Working interest in oil and gas refers to the ownership stake responsible for exploration, drilling, and production costs, entitling the holder to a proportional share of the revenue. Royalty interest represents a non-operating interest receiving a percentage of the production revenue without bearing expenses. Understanding these distinctions is critical in evaluating investment risks, revenue streams, and operational responsibilities in the oil and gas industry.

What is a Working Interest?

A Working Interest represents the ownership percentage in an oil or gas lease that entitles the holder to both the costs and profits associated with exploration, drilling, and production activities. Owners of a Working Interest are responsible for paying operational expenses such as drilling costs, equipment maintenance, and production taxes. This contrasts with a Royalty Interest, which provides income from production without bearing any operational expenses.

Understanding Royalty Interest

Royalty interest represents the right to receive a portion of the revenue from oil and gas production without bearing any of the operational costs, making it a passive income stream for mineral owners. This interest is typically a percentage of the gross production revenues paid to royalty owners based on production volumes or sales, independent of the expenses incurred during extraction or processing. Understanding royalty interest is crucial for investors and landowners to evaluate potential earnings and the impact of lease agreements on their mineral asset returns.

Key Differences Between Working and Royalty Interests

Working Interest represents the ownership percentage in an oil or gas lease responsible for paying exploration and production costs, entitling the owner to a proportional share of generated revenue. Royalty Interest, however, is a non-operating share that receives a fixed percentage of production revenue without bearing any expenses or operational liabilities. The key difference lies in financial risk and reward: Working Interest owners assume costs and operational responsibilities, while Royalty Interest owners earn passive income without cost exposure.

Financial Responsibilities: Working Interest vs Royalty Interest

Working Interest holders bear financial responsibilities including exploration, drilling, production, and operational costs, directly impacting their profit margins but also providing potential for higher returns. Royalty Interest owners receive a share of production revenue without incurring expenses, making their income more predictable and less risky. This key financial distinction means Working Interest involves active investment and risk, while Royalty Interest offers passive income based on production output.

Income and Revenue Streams

Working Interest generates income through direct participation in the operational costs and revenue of oil and gas production, resulting in a proportional share of both expenses and profits. Royalty Interest provides a revenue stream by entitling the owner to a fixed percentage of production or sales, free of operational costs, ensuring income without financial risk. Income from Working Interest fluctuates with production costs and output, whereas Royalty Interest income depends solely on gross production revenue.

Risk Factors for Investors

Working interest involves direct participation in the costs and operations of oil and gas production, exposing investors to higher financial risk due to potential operational delays, cost overruns, and fluctuating production levels. Royalty interest provides a passive income stream based on production revenue without bearing operational expenses, reducing investor exposure to operational risks but leaving income vulnerable to commodity price volatility and changes in lease terms. Investors should evaluate the balance between control and risk tolerance, as working interests offer higher potential returns offset by greater financial commitments, whereas royalty interests mitigate risk through steady, though potentially lower, cash flows.

Legal and Contractual Considerations

Working Interest involves the operator's legal obligation to manage and finance exploration and production activities, granting rights to a share of production minus operational costs. Royalty Interest represents a non-operating party's contractual right to receive a predetermined percentage of production revenue, free of exploration and operational expenses. Legal agreements must clearly delineate responsibilities, revenue distribution, and risk exposure to avoid disputes and ensure compliance with regulatory frameworks.

Tax Implications for Both Interests

Working interest owners are responsible for paying operational expenses and are taxed on the gross income from production, allowing deduction of related costs which can reduce taxable income. Royalty interest owners receive a portion of production revenue free of operational costs and pay taxes on their share of production income without associated expense deductions. Tax treatment varies as working interest holders can claim intangible drilling cost deductions while royalty owners cannot, impacting the overall tax liability for each interest type.

Choosing Between Working and Royalty Interests

Choosing between working interest and royalty interest depends on risk tolerance and desired involvement level in oil and gas projects. Working interest holders bear operational costs and risks but benefit from production revenues and decision-making control. Royalty interest owners receive a percentage of production revenue without bearing costs or operational responsibilities, favoring passive income with limited risk exposure.

Working Interest Infographic

libterm.com

libterm.com