Contribution margin is a key financial metric that measures the difference between sales revenue and variable costs, showing how much money is available to cover fixed costs and generate profit. Understanding your contribution margin helps in pricing decisions, cost control, and evaluating product profitability. Explore the full article to learn how to calculate and effectively use contribution margin for better business decisions.

Table of Comparison

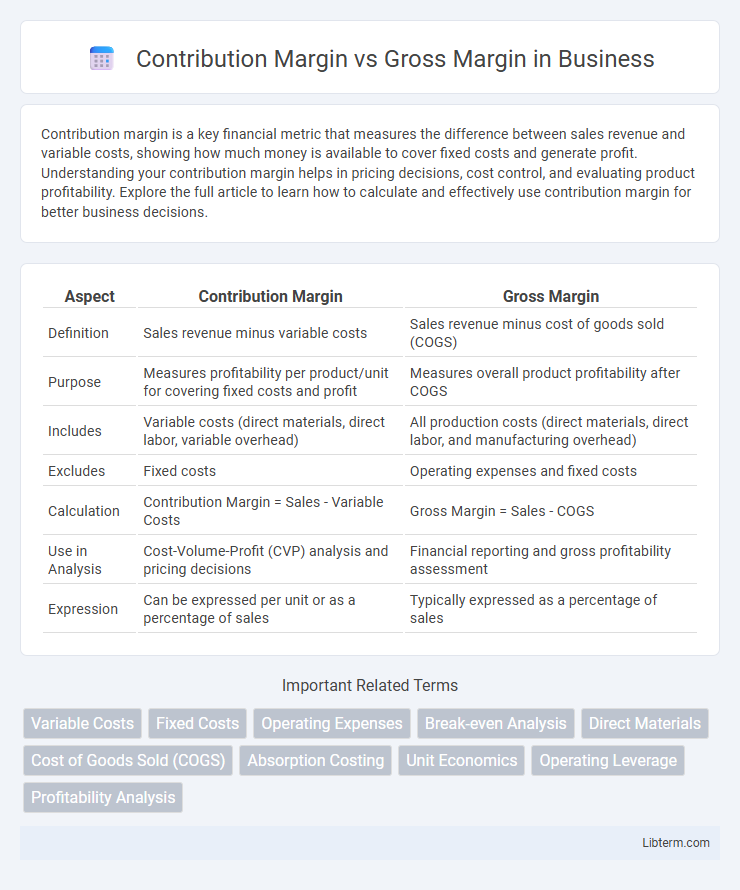

| Aspect | Contribution Margin | Gross Margin |

|---|---|---|

| Definition | Sales revenue minus variable costs | Sales revenue minus cost of goods sold (COGS) |

| Purpose | Measures profitability per product/unit for covering fixed costs and profit | Measures overall product profitability after COGS |

| Includes | Variable costs (direct materials, direct labor, variable overhead) | All production costs (direct materials, direct labor, and manufacturing overhead) |

| Excludes | Fixed costs | Operating expenses and fixed costs |

| Calculation | Contribution Margin = Sales - Variable Costs | Gross Margin = Sales - COGS |

| Use in Analysis | Cost-Volume-Profit (CVP) analysis and pricing decisions | Financial reporting and gross profitability assessment |

| Expression | Can be expressed per unit or as a percentage of sales | Typically expressed as a percentage of sales |

Introduction to Contribution Margin and Gross Margin

Contribution margin represents the revenue remaining after deducting variable costs, highlighting how much money is available to cover fixed costs and generate profit. Gross margin reflects the difference between net sales and the cost of goods sold (COGS), indicating the efficiency of production and pricing strategies. Understanding both margins is essential for financial analysis, pricing decisions, and profitability assessment in business operations.

Defining Contribution Margin

Contribution margin represents the revenue remaining after deducting variable costs directly associated with producing a product or service, highlighting the portion available to cover fixed costs and generate profit. It contrasts with gross margin, which subtracts only the cost of goods sold (COGS), typically encompassing both fixed and variable production expenses. Understanding contribution margin is crucial for pricing strategies, break-even analysis, and profitability assessment in managerial accounting.

Defining Gross Margin

Gross margin represents the percentage of revenue remaining after subtracting the cost of goods sold (COGS), highlighting the profitability of core product sales before accounting for operating expenses. It is calculated by dividing gross profit by total revenue, offering insight into how efficiently a company produces and sells its products. Unlike contribution margin, which considers variable costs specifically, gross margin includes both fixed and variable production costs baked into COGS.

Key Formulas: Contribution Margin vs Gross Margin

Contribution Margin is calculated using the formula: Sales Revenue minus Variable Costs, highlighting the amount available to cover fixed costs and profit. Gross Margin is derived from Sales Revenue minus Cost of Goods Sold (COGS), reflecting the profitability after direct production expenses. Understanding these key formulas helps businesses analyze cost behavior and profitability at different stages.

Core Differences Between Contribution Margin and Gross Margin

Contribution margin represents the revenue remaining after deducting variable costs directly tied to production, highlighting the profitability of individual products or services. Gross margin calculates the difference between total sales and the cost of goods sold (COGS), reflecting overall production efficiency and pricing strategy. The core difference lies in contribution margin focusing on variable costs for decision-making, while gross margin includes both variable and fixed production costs for broader financial analysis.

Importance in Financial Analysis

Contribution margin highlights the profitability of individual products by subtracting variable costs from sales revenue, allowing businesses to assess how each product contributes to covering fixed costs and generating profit. Gross margin measures overall production efficiency by comparing sales revenue to the cost of goods sold, providing insight into how well a company manages direct production expenses. Understanding both margins is crucial in financial analysis to make informed pricing, budgeting, and operational decisions that enhance profitability and cost control.

Role in Pricing Decisions

Contribution margin plays a critical role in pricing decisions by indicating the amount available to cover fixed costs and generate profit after variable costs are deducted from sales revenue. Gross margin reflects overall profitability by showing the percentage of revenue remaining after the cost of goods sold (COGS) is subtracted, but it does not isolate variable costs directly tied to production volume. Pricing strategies rely heavily on contribution margin analysis to set prices that ensure fixed costs are covered and desired profit margins are achieved, making it more actionable for cost-volume-profit (CVP) analysis than gross margin.

Impact on Business Strategy

Contribution Margin highlights the profitability of individual products by subtracting variable costs, enabling businesses to optimize product mix and pricing strategies for maximum profit. Gross Margin reflects overall production efficiency by measuring revenue minus cost of goods sold, guiding decisions on cost control and scalability. Understanding both margins allows companies to align operational decisions with strategic goals, improving financial health and competitive positioning.

Common Mistakes and Misconceptions

Confusing contribution margin with gross margin often leads to inaccurate financial analysis, as contribution margin strictly accounts for variable costs while gross margin includes all cost of goods sold, both fixed and variable. A common mistake is using gross margin to make decisions about product pricing and profitability, ignoring the impact of fixed costs that contribution margin highlights. Misconceptions arise when businesses overlook how contribution margin helps in break-even analysis and operational leverage, leading to flawed strategic planning.

Choosing the Right Margin Metric for Your Business

Contribution margin measures the profitability of individual products by subtracting variable costs from sales revenue, highlighting how much revenue contributes to fixed costs and profit. Gross margin calculates total sales revenue minus the cost of goods sold, reflecting overall production efficiency and pricing strategy. Choosing the right margin metric depends on your business focus: use contribution margin for product-level decision-making and cost control, while gross margin provides a broader view of financial health and operational performance.

Contribution Margin Infographic

libterm.com

libterm.com