Strategic alliances enable companies to combine resources, expertise, and market reach to achieve mutual goals more efficiently. These partnerships often drive innovation, reduce costs, and enhance competitive advantage in global markets. Discover how forming the right strategic alliance can transform your business by reading the rest of the article.

Table of Comparison

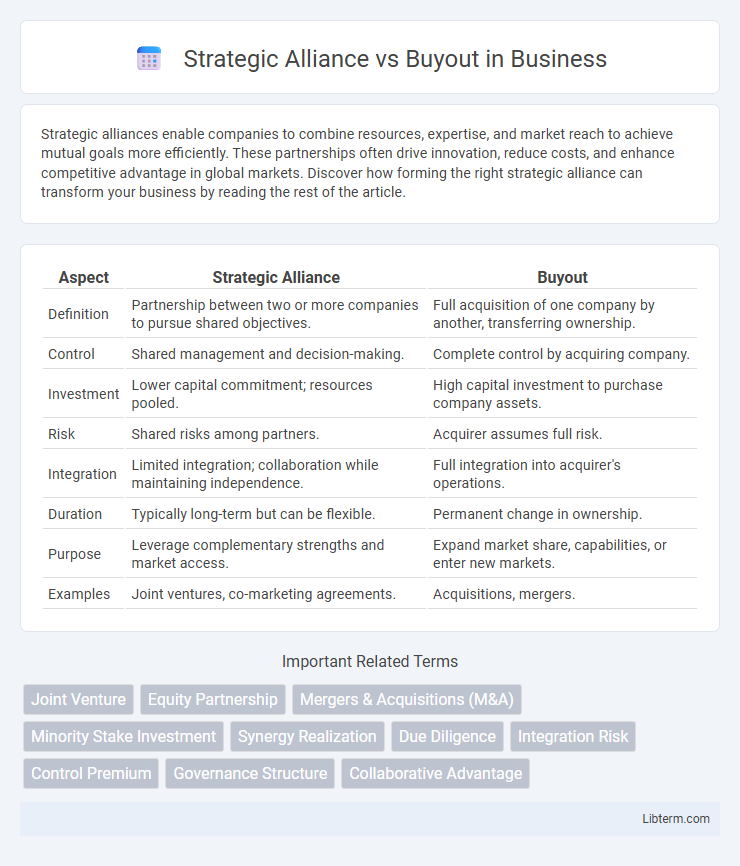

| Aspect | Strategic Alliance | Buyout |

|---|---|---|

| Definition | Partnership between two or more companies to pursue shared objectives. | Full acquisition of one company by another, transferring ownership. |

| Control | Shared management and decision-making. | Complete control by acquiring company. |

| Investment | Lower capital commitment; resources pooled. | High capital investment to purchase company assets. |

| Risk | Shared risks among partners. | Acquirer assumes full risk. |

| Integration | Limited integration; collaboration while maintaining independence. | Full integration into acquirer's operations. |

| Duration | Typically long-term but can be flexible. | Permanent change in ownership. |

| Purpose | Leverage complementary strengths and market access. | Expand market share, capabilities, or enter new markets. |

| Examples | Joint ventures, co-marketing agreements. | Acquisitions, mergers. |

Introduction to Strategic Alliance and Buyout

Strategic alliances involve two or more companies collaborating to achieve common goals while remaining independent entities, often sharing resources, expertise, and markets. Buyouts, in contrast, occur when one company acquires controlling interest or full ownership of another, integrating assets and operations under a single management. Both approaches impact competitive positioning and growth strategies but differ significantly in control, risk, and capital investment.

Defining Strategic Alliances

Strategic alliances are collaborative agreements between two or more companies that share resources, expertise, or markets to achieve mutual goals without merging ownership. Unlike buyouts, where one company acquires full control of another, alliances maintain independent operations while leveraging complementary strengths. These partnerships optimize innovation, market access, and risk-sharing without the financial commitments of acquisitions.

Understanding Buyouts

Buyouts involve one company acquiring a controlling interest in another, gaining full operational control and access to its assets. This approach allows for complete integration and decision-making authority, unlike strategic alliances, which are partnerships without ownership exchange. Understanding buyouts is essential for companies aiming to expand rapidly through acquisition or enter new markets by fully absorbing target businesses.

Key Differences Between Strategic Alliance and Buyout

Strategic alliances involve collaboration between two or more companies to achieve mutual goals while maintaining their independence, focusing on shared resources, expertise, and market access without ownership changes. Buyouts entail one company acquiring another, resulting in full ownership transfer and integration of operations, assets, and liabilities. Key differences include control level, risk exposure, financial commitment, and long-term strategic impact on competitive positioning.

Advantages of Forming a Strategic Alliance

Forming a strategic alliance offers companies the advantage of shared resources and expertise without the financial burden of a full acquisition, allowing for enhanced innovation and quicker market entry. It enables firms to leverage complementary strengths while maintaining operational independence, reducing risk compared to a buyout. Strategic alliances also facilitate flexibility in partnership duration and scope, allowing businesses to adapt and collaborate effectively in dynamic markets.

Benefits of Pursuing a Buyout

Pursuing a buyout offers complete control over the acquired company's operations, enabling streamlined decision-making and unified strategic direction. It allows for full integration of assets, resources, and technologies, maximizing operational efficiency and cost savings. Ownership consolidation also enhances long-term value creation by capturing all financial benefits without sharing profits with partners.

Risks and Challenges: Strategic Alliance vs Buyout

Strategic alliances involve risks such as misaligned objectives, cultural clashes, and potential conflicts over control, which can hinder collaboration and lead to operational inefficiencies. Buyouts, while offering full control, present challenges like significant financial burden, integration difficulties, and potential loss of key talent or customer loyalty. Both approaches require careful due diligence, risk management strategies, and clear communication to mitigate these inherent challenges.

Factors to Consider When Choosing Between Alliance and Buyout

Choosing between a strategic alliance and a buyout depends on factors such as financial capacity, desired level of control, and long-term objectives. Strategic alliances are preferred when companies seek collaborative innovation, market expansion, or shared resources without full ownership. Buyouts offer complete control and integration but require significant investment and carry higher risks related to cultural alignment and operational restructuring.

Real-World Examples: Strategic Alliance and Buyout

In the tech industry, the strategic alliance between Microsoft and Nokia in 2011 aimed to combine software and hardware expertise without ownership transfer, fostering innovation while maintaining independence. In contrast, Salesforce's 2020 buyout of Slack Technologies represented a full acquisition to integrate communication tools and expand its enterprise software ecosystem under one corporate umbrella. These contrasting approaches illustrate how strategic alliances facilitate collaboration and resource sharing, whereas buyouts consolidate control and streamline operations.

Conclusion: Which Option is Right for Your Business?

Choosing between a strategic alliance and a buyout depends on your business goals, available resources, and risk tolerance. Strategic alliances offer flexibility, shared expertise, and lower financial commitment, ideal for businesses seeking collaboration without losing autonomy. Buyouts provide full control and long-term growth potential but require significant capital and risk, making them suitable for companies ready to invest heavily in expansion.

Strategic Alliance Infographic

libterm.com

libterm.com