Book value represents the net asset value of a company, calculated by subtracting total liabilities from total assets on the balance sheet. It provides insight into a company's intrinsic worth, often used by investors to assess whether a stock is undervalued or overvalued compared to its market price. Explore the rest of this article to understand how book value impacts your investment decisions.

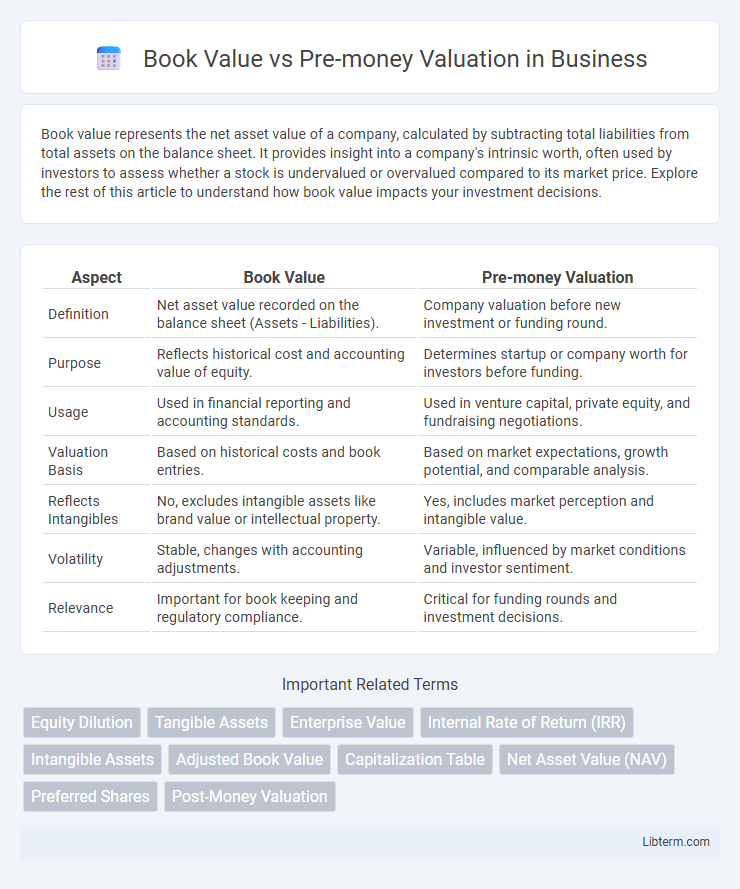

Table of Comparison

| Aspect | Book Value | Pre-money Valuation |

|---|---|---|

| Definition | Net asset value recorded on the balance sheet (Assets - Liabilities). | Company valuation before new investment or funding round. |

| Purpose | Reflects historical cost and accounting value of equity. | Determines startup or company worth for investors before funding. |

| Usage | Used in financial reporting and accounting standards. | Used in venture capital, private equity, and fundraising negotiations. |

| Valuation Basis | Based on historical costs and book entries. | Based on market expectations, growth potential, and comparable analysis. |

| Reflects Intangibles | No, excludes intangible assets like brand value or intellectual property. | Yes, includes market perception and intangible value. |

| Volatility | Stable, changes with accounting adjustments. | Variable, influenced by market conditions and investor sentiment. |

| Relevance | Important for book keeping and regulatory compliance. | Critical for funding rounds and investment decisions. |

Understanding Book Value: Definition and Components

Book value represents a company's net asset value calculated by subtracting total liabilities from total assets, reflecting its intrinsic worth on the balance sheet. Key components include tangible assets like property and equipment, along with intangible assets such as patents, minus accumulated depreciation and liabilities. Understanding book value provides a grounded benchmark for assessing a company's financial health but often differs from pre-money valuation, which incorporates market expectations and growth potential.

What is Pre-money Valuation? Key Concepts Explained

Pre-money valuation refers to the estimated value of a company before receiving new external funding or investment. It plays a crucial role in determining ownership percentages and equity stakes during funding rounds by quantifying the company's worth prior to capital infusion. Understanding pre-money valuation helps investors and entrepreneurs negotiate fair deals and assess the potential growth and financial health of startups or private companies.

Book Value vs Pre-money Valuation: Core Differences

Book value represents a company's net asset value calculated from its balance sheet, subtracting liabilities from total assets, and reflects historical costs. Pre-money valuation is the estimated market value of a company before receiving new external investment, determined by factors such as growth potential, market conditions, and investor sentiment. The core difference lies in book value being an accounting metric based on past financials, while pre-money valuation captures forward-looking market expectations and investor perceptions.

How Book Value is Calculated in Financial Statements

Book value is calculated in financial statements by subtracting total liabilities from total assets, representing the net asset value of a company. It is derived from the balance sheet, reflecting the historical costs of assets minus accumulated depreciation and liabilities. In contrast, pre-money valuation estimates a company's worth before new equity investment, incorporating market conditions and future growth potential rather than historical accounting data.

Assessing Pre-money Valuation in Startup Funding

Assessing pre-money valuation in startup funding requires understanding its distinction from book value, as pre-money valuation reflects the estimated market value of a company before new investment, while book value is based on the company's accounting assets minus liabilities. Pre-money valuation involves analyzing factors such as projected growth, competitive landscape, intellectual property, and management team quality rather than solely relying on historical financial metrics. Accurate assessment is crucial for negotiating equity stakes and informs investor confidence in the startup's future potential.

Importance of Book Value for Investors

Book value represents a company's net asset value as recorded on its balance sheet, serving as a critical indicator of financial health for investors assessing intrinsic worth. Pre-money valuation reflects the company's estimated value before external funding, heavily influenced by market sentiment and growth potential rather than tangible assets. Investors prioritize book value to gauge downside risk and ensure a margin of safety, especially in industries with stable asset bases, making it essential for informed decision-making alongside pre-money valuation.

The Role of Pre-money Valuation in Venture Capital

Pre-money valuation represents the estimated worth of a startup before receiving new external funding, playing a critical role in venture capital negotiations by determining the equity stake investors receive. It directly influences investment terms, ownership dilution, and startup valuation metrics compared to book value, which reflects historical financial data rather than market potential. Accurate pre-money valuation enables venture capitalists to assess risk and growth prospects, aligning investment strategy with market conditions and innovation-driven value creation.

Limitations of Book Value in Modern Valuation

Book value reflects a company's net asset value based on historical costs, failing to capture intangible assets like intellectual property and brand equity crucial in modern valuation. It often undervalues growth potential and future earnings, making pre-money valuation a more dynamic metric for investors during funding rounds. Pre-money valuation incorporates market conditions, comparable company analysis, and projected financial performance, providing a forward-looking perspective that book value lacks.

When to Use Book Value vs Pre-money Valuation

Book value is ideal for assessing a company's net asset value based on its historical costs, making it useful for accounting purposes and evaluating existing shareholders' equity. Pre-money valuation is essential during fundraising rounds to determine a startup's worth before new investments, guiding investment negotiations and ownership dilution. Use book value for financial stability analysis and pre-money valuation for investment and growth potential assessments.

Practical Examples: Book Value and Pre-money Valuation Compared

Book value represents a company's net asset value calculated from its balance sheet, reflecting historical cost of assets minus liabilities, while pre-money valuation estimates a startup's value before new investment, often based on future growth prospects. For example, a company with $5 million in assets and $2 million in liabilities has a book value of $3 million, but if it seeks $2 million in funding with a pre-money valuation of $8 million, its value incorporates intangible factors like market potential. These practical distinctions highlight book value's accounting focus versus pre-money valuation's market-driven approach crucial for investment decisions.

Book Value Infographic

libterm.com

libterm.com