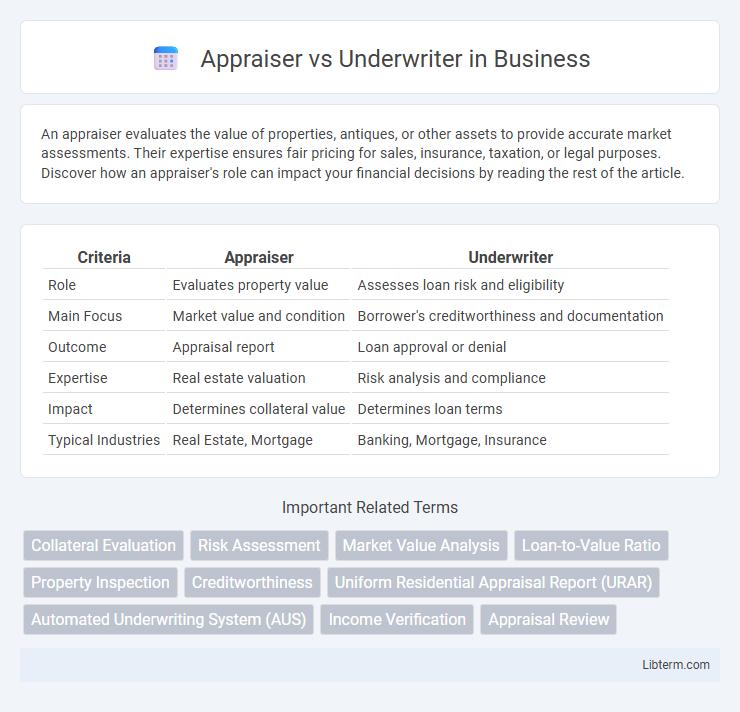

An appraiser evaluates the value of properties, antiques, or other assets to provide accurate market assessments. Their expertise ensures fair pricing for sales, insurance, taxation, or legal purposes. Discover how an appraiser's role can impact your financial decisions by reading the rest of the article.

Table of Comparison

| Criteria | Appraiser | Underwriter |

|---|---|---|

| Role | Evaluates property value | Assesses loan risk and eligibility |

| Main Focus | Market value and condition | Borrower's creditworthiness and documentation |

| Outcome | Appraisal report | Loan approval or denial |

| Expertise | Real estate valuation | Risk analysis and compliance |

| Impact | Determines collateral value | Determines loan terms |

| Typical Industries | Real Estate, Mortgage | Banking, Mortgage, Insurance |

Introduction to Appraiser and Underwriter Roles

Appraisers evaluate the market value of properties by conducting detailed inspections, analyzing comparable sales, and assessing property conditions to provide accurate valuations essential for loan approval. Underwriters assess the risk of lending by reviewing the borrower's financial information, credit history, and the appraiser's valuation to determine loan eligibility and terms. Both roles are critical in the mortgage process, ensuring property value accuracy and borrower creditworthiness for informed lending decisions.

Defining the Role of an Appraiser

An appraiser determines the market value of a property by conducting detailed inspections and analyzing comparable sales data to ensure accurate valuation. They play a critical role in the mortgage process by providing an impartial and professional estimate that helps lenders assess risk. Unlike underwriters who evaluate loan applications and borrower creditworthiness, appraisers focus exclusively on property valuation and condition.

Key Responsibilities of an Underwriter

Underwriters are responsible for evaluating loan applications by assessing risk factors such as credit history, income verification, and property value to determine eligibility for mortgage approval. They analyze appraisal reports, income documents, and debt-to-income ratios to ensure compliance with lending guidelines and risk mitigation. Underwriters play a critical role in approving or denying loans based on comprehensive financial analysis and regulatory standards.

Education and Certification Requirements

Appraisers typically require a bachelor's degree or college coursework in real estate or finance and must obtain state licensure through training hours, experience, and passing the Uniform Appraisal Certification Exam. Underwriters generally need a bachelor's degree in finance, economics, business, or a related field and often pursue certifications such as the Mortgage Underwriter Certification (MUC) or Chartered Property Casualty Underwriter (CPCU) to demonstrate expertise. Both roles demand ongoing education to maintain credentials and stay updated with industry regulations and standards.

Appraisal Process Explained

The appraisal process involves a licensed appraiser evaluating a property's market value by examining comparable sales, assessing the condition and features, and considering current market trends. This detailed report helps lenders determine loan risk before approving a mortgage. Unlike underwriters who analyze financial documents and borrower qualifications, appraisers focus solely on the property's worth to ensure accurate loan-to-value ratios.

Underwriting Process Breakdown

The underwriting process involves a thorough evaluation of a borrower's creditworthiness, financial history, and the property's value to mitigate lender risk. Underwriters analyze income, employment, credit reports, and property appraisals to ensure loan eligibility and compliance with guidelines. This meticulous assessment determines loan approval, terms, and conditions, distinguishing underwriting from the appraisal process focused solely on property valuation.

Major Differences Between Appraisers and Underwriters

Appraisers primarily assess the market value of properties by conducting inspections and analyzing comparable sales data, ensuring accurate property valuation for lending decisions. Underwriters evaluate the overall risk of loan applications, reviewing financial documents, credit history, and appraisal reports to determine borrower eligibility and loan terms. The major difference lies in appraisers focusing on property valuation while underwriters concentrate on creditworthiness and loan risk assessment.

How Appraisers and Underwriters Collaborate

Appraisers and underwriters collaborate closely to ensure accurate property evaluations and risk assessments for loan approvals. Appraisers provide detailed property valuations based on current market conditions, which underwriters use to verify loan eligibility and assess financial risk. This collaboration streamlines decision-making, balancing property value accuracy with creditworthiness analysis in the mortgage process.

Impact on the Mortgage Approval Process

The appraiser determines the property's market value, which directly influences the loan amount a lender is willing to approve, playing a critical role in risk assessment. The underwriter evaluates the overall mortgage application, including the appraiser's report, financial documents, and creditworthiness, to ensure compliance with lending guidelines. Together, their roles impact the mortgage approval process by balancing property valuation accuracy with borrower risk evaluation, ultimately affecting loan approval and terms.

Choosing a Career: Appraiser vs Underwriter

Choosing a career between an appraiser and an underwriter depends on your skills and interests in the real estate and finance sectors. Appraisers specialize in property valuation by analyzing market trends, comparable sales, and property conditions, while underwriters assess loan risks by evaluating credit history, financial documents, and regulatory compliance. Understanding these roles helps determine if you prefer hands-on property evaluation or analytical risk assessment in lending decisions.

Appraiser Infographic

libterm.com

libterm.com