Markup is the process of adding annotations or tags to text or data to define structure, presentation, or semantics, enabling better interpretation by browsers and machines. Common examples include HTML for web pages and XML for data interchange, which organize content for enhanced readability and functionality. Discover how understanding markup can improve your digital content and streamline communication by exploring the rest of this article.

Table of Comparison

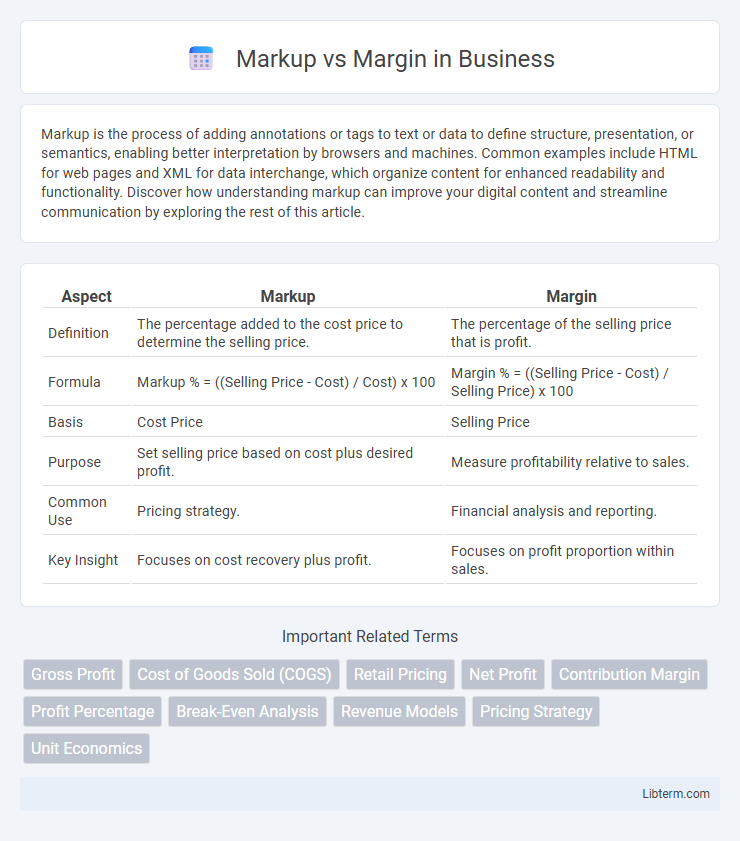

| Aspect | Markup | Margin |

|---|---|---|

| Definition | The percentage added to the cost price to determine the selling price. | The percentage of the selling price that is profit. |

| Formula | Markup % = ((Selling Price - Cost) / Cost) x 100 | Margin % = ((Selling Price - Cost) / Selling Price) x 100 |

| Basis | Cost Price | Selling Price |

| Purpose | Set selling price based on cost plus desired profit. | Measure profitability relative to sales. |

| Common Use | Pricing strategy. | Financial analysis and reporting. |

| Key Insight | Focuses on cost recovery plus profit. | Focuses on profit proportion within sales. |

Understanding Markup and Margin: Key Definitions

Markup represents the percentage added to the cost price of a product to determine its selling price, reflecting the profit margin embedded in the price. Margin, also known as gross profit margin, indicates the percentage of the selling price that constitutes profit after covering the cost of goods sold. Understanding the distinction between markup and margin is essential for accurate pricing strategies and financial analysis in business operations.

How to Calculate Markup and Margin

Markup is calculated by dividing the difference between the selling price and the cost price by the cost price, expressed as a percentage: Markup % = [(Selling Price - Cost Price) / Cost Price] x 100. Margin is calculated by dividing the difference between the selling price and the cost price by the selling price, expressed as a percentage: Margin % = [(Selling Price - Cost Price) / Selling Price] x 100. Understanding these formulas helps businesses set prices strategically and analyze profitability from production cost and sales perspectives.

The Fundamental Differences Between Markup and Margin

Markup represents the percentage added to the cost price to determine the selling price, calculated as (Selling Price - Cost) / Cost x 100%. Margin refers to the percentage of the selling price that is profit, calculated as (Selling Price - Cost) / Selling Price x 100%. Understanding the distinction is essential for pricing strategies, as markup focuses on cost relative increases, while margin emphasizes profitability relative to sales revenue.

Pros and Cons of Using Markup in Pricing

Markup in pricing allows businesses to easily cover costs and ensure profitability by adding a fixed percentage over the product's cost, simplifying pricing decisions. However, relying solely on markup can ignore market demand and competitor pricing, potentially leading to prices that are too high or too low. While markup provides straightforward cost recovery, its limitation lies in insufficient consideration of external factors influencing consumer willingness to pay.

Advantages and Disadvantages of Margin-Based Pricing

Margin-based pricing offers clear profitability insights by directly linking selling price to cost and desired profit margin, simplifying financial forecasting and inventory decisions. However, it risks underpricing in competitive markets if costs are low, and can lead to ignoring market demand or competitor pricing, potentially reducing sales volume. This method suits stable cost structures but may falter with fluctuating expenses or dynamic market conditions.

Markup vs Margin: Impact on Profitability

Markup and margin both affect profitability but measure different aspects of pricing. Markup represents the percentage added to the cost price to determine the selling price, directly influencing revenue generation. Margin, expressed as a percentage of the selling price, indicates the portion of sales that constitutes profit, providing insight into profit efficiency and business sustainability.

Common Mistakes When Interchanging Markup and Margin

Common mistakes when interchanging markup and margin arise from misunderstanding their distinct definitions and calculation methods; markup is based on cost, while margin is based on sales price. Using margin percentages in place of markup can lead to underpricing or overpricing products, causing profitability issues and distorted financial analysis. Confusing these metrics often results in inaccurate pricing strategies, negatively impacting a business's revenue and profit margins.

Industry Practices: When to Use Markup or Margin

Industries such as retail and manufacturing often apply markup to set selling prices by adding a percentage to the cost of goods, facilitating straightforward cost recovery and profit calculation. Margin is predominantly used in finance and sales analytics to assess profitability by expressing profit as a percentage of revenue, ensuring clear insights into business performance. Understanding whether to use markup or margin depends on whether the focus is on pricing strategy or profitability measurement, with markup guiding price setting and margin guiding financial health.

Tools and Formulas for Markup and Margin Calculations

Markup and margin calculations rely on distinct formulas essential for pricing and profit analysis. Markup is calculated using the formula (Selling Price - Cost) / Cost, highlighting the percentage added to the cost price. Margin is determined by (Selling Price - Cost) / Selling Price, reflecting the percentage of the selling price retained as profit. Tools such as Excel spreadsheets, online calculators, and financial software often incorporate these formulas for swift, accurate markup and margin computations.

Choosing the Right Pricing Strategy for Your Business

Markup and margin are essential metrics for pricing strategy, with markup representing the percentage increase on cost price to set the selling price, while margin reflects the percentage of selling price that is profit. Choosing the right pricing strategy depends on understanding customer demand, competitive landscape, and business goals, ensuring markup covers costs and achieves desired profit margins. Accurate calculation of both markup and margin enables businesses to set prices that maximize profitability and maintain market competitiveness.

Markup Infographic

libterm.com

libterm.com