Purchasing ownership in a property or business involves careful evaluation of assets, liabilities, and future growth potential to ensure a sound investment. Understanding the legal and financial responsibilities that come with ownership is crucial for protecting your interests. Explore the article to learn how to make informed decisions when considering an ownership purchase.

Table of Comparison

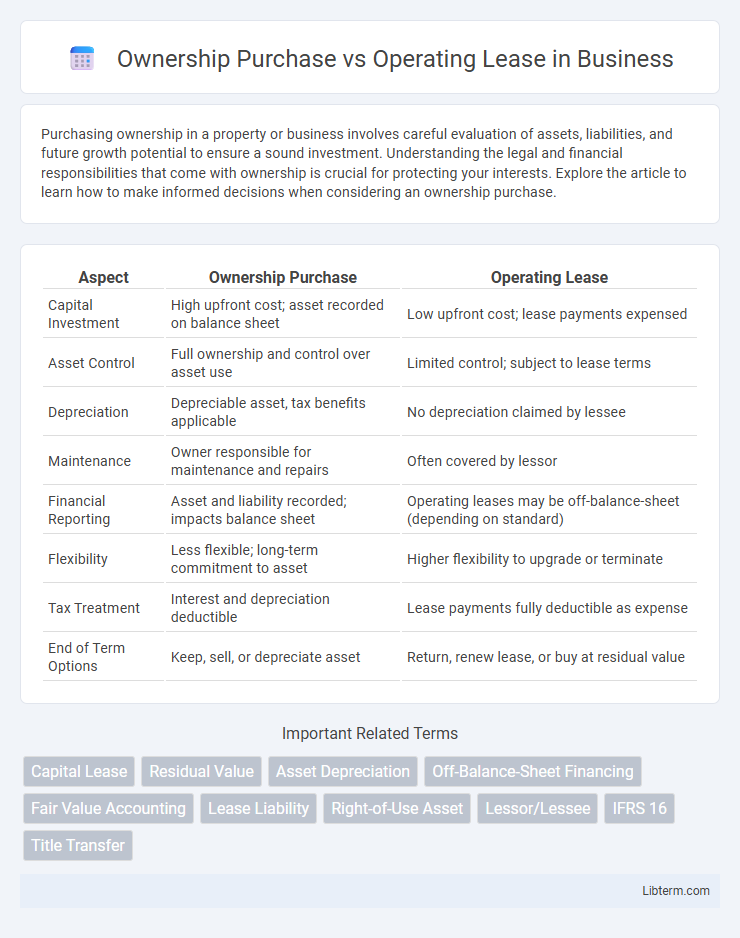

| Aspect | Ownership Purchase | Operating Lease |

|---|---|---|

| Capital Investment | High upfront cost; asset recorded on balance sheet | Low upfront cost; lease payments expensed |

| Asset Control | Full ownership and control over asset use | Limited control; subject to lease terms |

| Depreciation | Depreciable asset, tax benefits applicable | No depreciation claimed by lessee |

| Maintenance | Owner responsible for maintenance and repairs | Often covered by lessor |

| Financial Reporting | Asset and liability recorded; impacts balance sheet | Operating leases may be off-balance-sheet (depending on standard) |

| Flexibility | Less flexible; long-term commitment to asset | Higher flexibility to upgrade or terminate |

| Tax Treatment | Interest and depreciation deductible | Lease payments fully deductible as expense |

| End of Term Options | Keep, sell, or depreciate asset | Return, renew lease, or buy at residual value |

Understanding Ownership Purchase vs Operating Lease

Ownership purchase provides complete asset control and long-term financial benefits by securing full ownership, while operating leases offer flexibility with lower upfront costs and maintenance responsibilities retained by the lessor. Understanding ownership purchase versus operating lease requires evaluating factors such as asset depreciation, tax implications, cash flow impact, and balance sheet effects. Businesses must analyze their capital availability, usage duration, and financial strategies to determine the optimal choice between purchasing assets outright or leasing them under operating agreements.

Key Differences Between Ownership and Operating Lease

Ownership purchase grants full asset control and equity, allowing for long-term value accumulation and depreciation benefits, whereas operating lease provides temporary asset use without ownership, minimizing upfront capital expenditure and maintenance responsibility. Ownership involves higher initial costs and asset risk, while operating leases typically include lower periodic payments and off-balance-sheet accounting advantages. Businesses prioritize ownership for strategic asset control, while operating leases suit flexibility and cash flow management.

Financial Impact: CapEx vs OpEx

Ownership purchase involves a significant upfront capital expenditure (CapEx), affecting balance sheet assets and depreciation schedules, which can improve long-term equity but reduce immediate liquidity. Operating leases are recorded as operating expenses (OpEx), preserving capital and improving short-term cash flow while potentially impacting EBITDA metrics differently due to lease accounting standards. Financial strategies must consider how CapEx acquisitions increase asset base and liabilities, whereas OpEx leasing maintains flexibility and off-balance-sheet operational cost treatment under current accounting frameworks.

Asset Control and Flexibility

Ownership purchase grants full asset control, enabling customized use, modifications, and long-term investment benefits. Operating leases offer greater flexibility, allowing businesses to upgrade or return assets without the burden of ownership or depreciation. This flexibility supports adapting to changing needs while maintaining operational efficiency.

Tax Implications of Each Option

Ownership purchase allows for depreciation deductions and interest expense write-offs, reducing taxable income over the asset's useful life. Operating leases typically offer rental expense deductions without asset depreciation, providing immediate tax benefits but no equity build-up. Tax strategies should consider potential Section 179 expensing limits, lease classification rules under ASC 842 or IFRS 16, and the impact on balance sheet presentation.

Risk Management Considerations

Ownership purchase transfers asset risk such as depreciation, maintenance, and obsolescence to the buyer, requiring careful assessment of long-term financial exposure and asset lifecycle management. Operating leases mitigate these risks by allowing businesses to use assets without ownership, preserving cash flow and limiting balance sheet liabilities while enabling flexibility to upgrade or return equipment. Effective risk management involves evaluating total cost of ownership, asset utilization patterns, and potential financial impacts of asset residual values or lease renewal terms.

Impact on Balance Sheets and Financial Statements

Ownership purchase of assets results in the recognition of both an asset and corresponding liability on the balance sheet, increasing total assets and liabilities while allowing for depreciation and interest expense deductions on financial statements. Operating leases generally keep leased assets and liabilities off the balance sheet, leading to lower reported assets and liabilities, and lease payments are recognized as operating expenses, impacting the income statement without affecting depreciation or interest expenses. Recent accounting standards such as IFRS 16 and ASC 842 require operating leases to be recognized on balance sheets, reducing the traditional difference between ownership purchase and operating lease treatment.

Maintenance, Repairs, and Responsibilities

Ownership purchase requires the owner to handle all maintenance, repairs, and related responsibilities, often leading to higher long-term costs and direct control over upkeep. In contrast, an operating lease typically includes maintenance and repairs as part of the agreement, reducing the lessee's operational burden and unexpected expenses. This distinction significantly impacts budget planning and risk management strategies for businesses deciding between purchasing and leasing assets.

End-of-Term Scenarios: Buyout, Renewal, or Return

End-of-term scenarios for ownership purchase typically include a buyout option where the lessee acquires full asset ownership, enhancing long-term investment value. Operating lease agreements often provide flexibility at term-end through renewal opportunities or asset return without residual liability, favoring short-term operational needs. Evaluating buyout costs, renewal terms, and return conditions is crucial for optimizing financial impact and asset management strategies.

Choosing the Right Option for Your Business Needs

Ownership purchase provides long-term asset control and potential tax benefits through depreciation, making it ideal for businesses seeking to build equity and maintain equipment for extended periods. Operating leases offer flexibility with lower upfront costs and the ability to upgrade assets frequently, suited for companies needing to preserve cash flow and avoid obsolescence. Evaluating factors like budget constraints, asset lifespan, and usage patterns is crucial in selecting the right financing strategy to align with your business objectives.

Ownership Purchase Infographic

libterm.com

libterm.com