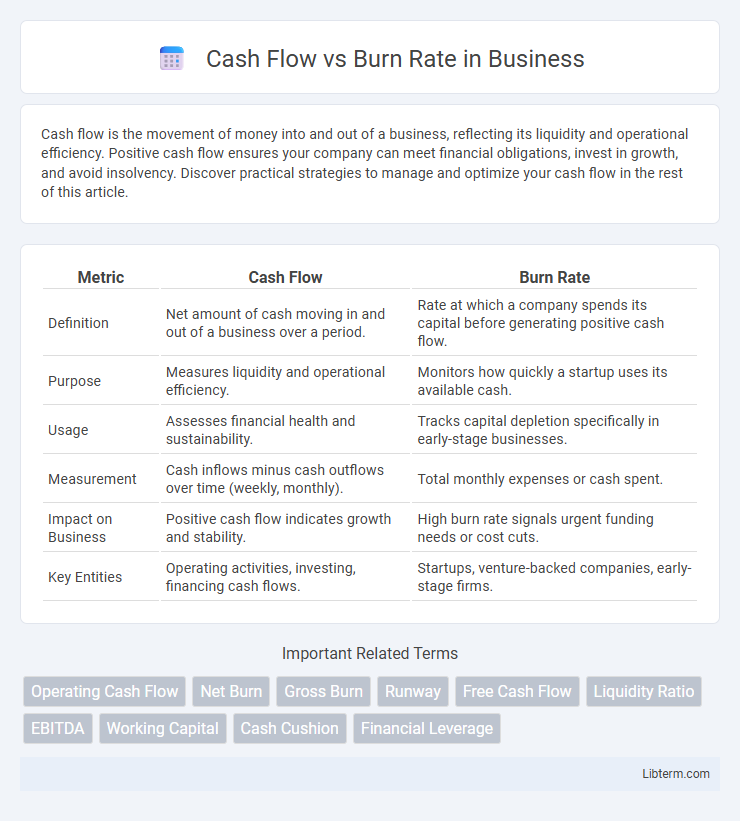

Cash flow is the movement of money into and out of a business, reflecting its liquidity and operational efficiency. Positive cash flow ensures your company can meet financial obligations, invest in growth, and avoid insolvency. Discover practical strategies to manage and optimize your cash flow in the rest of this article.

Table of Comparison

| Metric | Cash Flow | Burn Rate |

|---|---|---|

| Definition | Net amount of cash moving in and out of a business over a period. | Rate at which a company spends its capital before generating positive cash flow. |

| Purpose | Measures liquidity and operational efficiency. | Monitors how quickly a startup uses its available cash. |

| Usage | Assesses financial health and sustainability. | Tracks capital depletion specifically in early-stage businesses. |

| Measurement | Cash inflows minus cash outflows over time (weekly, monthly). | Total monthly expenses or cash spent. |

| Impact on Business | Positive cash flow indicates growth and stability. | High burn rate signals urgent funding needs or cost cuts. |

| Key Entities | Operating activities, investing, financing cash flows. | Startups, venture-backed companies, early-stage firms. |

Understanding Cash Flow: Definition and Importance

Cash flow represents the total amount of money being transferred into and out of a business, reflecting its liquidity and operational health. Understanding cash flow is crucial for ensuring a company can meet its financial obligations, invest in growth opportunities, and sustain daily operations. Positive cash flow indicates financial stability, while negative cash flow may signal potential risks or the need for strategic adjustments.

What Is Burn Rate? Key Concepts Explained

Burn rate refers to the speed at which a company spends its available cash to cover operating expenses, representing negative cash flow typically measured monthly. It is a critical metric for startups and businesses to understand how long they can sustain operations before needing additional funding. Monitoring burn rate alongside cash flow helps assess financial health and guides strategic decisions to extend the runway and achieve profitability.

Cash Flow vs Burn Rate: Core Differences

Cash flow measures the net amount of cash moving in and out of a business, reflecting its liquidity and operational efficiency, while burn rate quantifies the speed at which a startup or company spends its capital, often indicating how long it can sustain operations without additional funding. Cash flow encompasses all cash transactions, including revenue and expenses, providing a comprehensive view of financial health, whereas burn rate focuses specifically on negative cash flow over a set period, typically monthly. Understanding the core differences between cash flow and burn rate is crucial for managing financial stability and ensuring long-term business viability.

Why Monitoring Cash Flow Matters for Startups

Monitoring cash flow is crucial for startups to ensure sufficient liquidity for daily operations and to avoid insolvency risks. Accurate cash flow tracking helps predict funding needs and manage expenses proactively, maintaining financial stability during growth phases. Understanding burn rate alongside cash flow allows startups to optimize runway duration and make informed decisions about scaling or fundraising.

How Burn Rate Impacts Business Longevity

Burn rate directly measures the speed at which a company spends its available capital, critically influencing business longevity by determining the runway before additional funding is required. A high burn rate shortens the operational lifespan, increasing the risk of insolvency if revenue generation or investment inflows do not keep pace. Monitoring and managing burn rate alongside cash flow projections ensures sustainable growth and extends the financial runway for startups and established businesses alike.

Calculating Cash Flow: Methods and Metrics

Calculating cash flow involves analyzing operating, investing, and financing activities to determine the net amount of cash generated or used during a specific period. Key methods include the direct method, which tracks actual cash receipts and payments, and the indirect method, which adjusts net income for non-cash transactions and changes in working capital. Important metrics such as free cash flow, operating cash flow, and net cash flow provide insights into a company's liquidity, operational efficiency, and financial health relative to its burn rate.

Calculating Burn Rate: Step-by-Step Guide

Calculating burn rate involves determining the rate at which a company spends its cash reserves, typically measured monthly. To calculate, subtract the ending cash balance from the starting cash balance over a specific period, then divide by the number of months in that period. This metric helps businesses assess how long their funds will last and manage financial sustainability effectively.

Strategies to Improve Positive Cash Flow

Implementing strict expense management and accelerating receivables collection directly enhance positive cash flow by reducing outflows and boosting inflows. Regularly forecasting cash flow and adjusting budgets enable proactive decision-making, preventing negative burn rate scenarios. Leveraging technology for real-time financial tracking and negotiating better payment terms with suppliers optimize liquidity, supporting sustained operational stability.

Reducing Burn Rate: Practical Tips for Sustainability

Reducing burn rate is crucial for startup sustainability, involving strategies like optimizing operational expenses, delaying non-essential hires, and renegotiating vendor contracts to conserve cash flow. Monitoring monthly cash burn metrics enables founders to make informed decisions that extend runway and improve financial stability. Implementing cost-control measures without compromising growth ensures a balance between maintaining momentum and preserving capital for long-term success.

Choosing the Right Metric: When to Focus on Cash Flow vs Burn Rate

Choosing the right metric depends on a startup's stage and financial health; early-stage companies often prioritize burn rate to monitor how quickly they are depleting venture capital, ensuring runway extends until profitability or next funding round. Established businesses with steady revenue streams emphasize cash flow to assess operational efficiency and long-term sustainability by tracking actual cash inflows and outflows. Analyzing burn rate helps in short-term financial planning while focusing on cash flow provides a comprehensive view of liquidity and overall financial stability.

Cash Flow Infographic

libterm.com

libterm.com