Negative working capital occurs when a company's current liabilities exceed its current assets, indicating potential liquidity challenges. This financial situation may signal operational efficiency in some industries, but often hints at cash flow problems that can affect day-to-day business functions. Explore the rest of the article to understand how negative working capital impacts your company's financial health and strategies to manage it effectively.

Table of Comparison

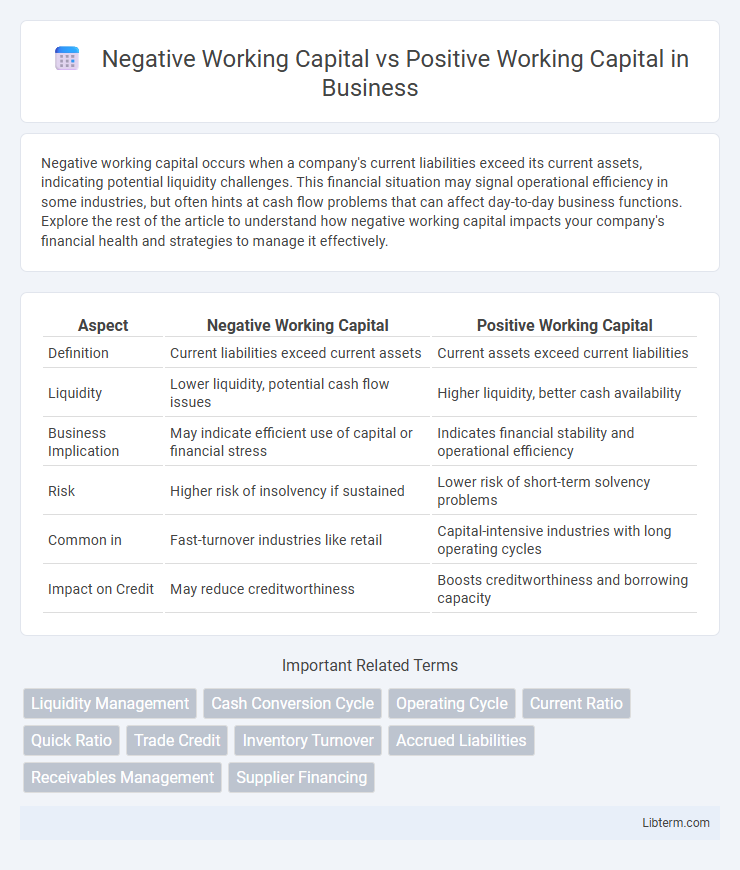

| Aspect | Negative Working Capital | Positive Working Capital |

|---|---|---|

| Definition | Current liabilities exceed current assets | Current assets exceed current liabilities |

| Liquidity | Lower liquidity, potential cash flow issues | Higher liquidity, better cash availability |

| Business Implication | May indicate efficient use of capital or financial stress | Indicates financial stability and operational efficiency |

| Risk | Higher risk of insolvency if sustained | Lower risk of short-term solvency problems |

| Common in | Fast-turnover industries like retail | Capital-intensive industries with long operating cycles |

| Impact on Credit | May reduce creditworthiness | Boosts creditworthiness and borrowing capacity |

Understanding Working Capital: A Brief Overview

Working capital measures a company's short-term financial health by comparing current assets to current liabilities. Positive working capital indicates sufficient assets to cover liabilities, supporting smooth operations and potential growth. Negative working capital suggests current liabilities exceed assets, potentially signaling liquidity issues but sometimes reflecting efficient cash management in fast-turnover businesses.

What Is Negative Working Capital?

Negative working capital occurs when a company's current liabilities exceed its current assets, indicating that it may struggle to cover short-term obligations. This financial condition often signals cash flow issues but can also suggest efficient inventory management or favorable payment terms with suppliers in some industries. Understanding the implications of negative versus positive working capital is crucial for assessing a company's liquidity and operational efficiency.

What Is Positive Working Capital?

Positive working capital occurs when a company's current assets exceed its current liabilities, indicating sufficient liquidity to cover short-term obligations. This financial state allows businesses to invest in operations, pay off debts, and manage unforeseen expenses effectively. Key components of positive working capital include cash, accounts receivable, and inventory, which collectively support smooth operational flow and financial stability.

Key Differences: Negative vs Positive Working Capital

Negative working capital occurs when a company's current liabilities exceed its current assets, indicating potential liquidity issues but possibly efficient management of payables in fast-turnover businesses. Positive working capital means current assets surpass current liabilities, reflecting strong short-term financial health and the ability to cover debts and operational expenses. Key differences include cash flow stability, with positive working capital offering more cushion for unexpected expenses, whereas negative working capital may signal risk but can also optimize cash usage in certain industries.

Pros and Cons of Negative Working Capital

Negative working capital indicates a company's current liabilities exceed its current assets, which can signal efficient use of cash by minimizing inventory and accounts receivable. Pros include improved liquidity and the ability to fund operations without external financing, benefiting industries with quick inventory turnover like retail. Cons involve increased risk of insolvency if cash inflows slow, potential supplier payment delays, and difficulty in sustaining growth during economic downturns.

Pros and Cons of Positive Working Capital

Positive working capital, representing a current ratio above 1, ensures a company can meet short-term liabilities, enhancing financial stability and creditor confidence. It enables smooth operational cash flow, supporting inventory purchase and payroll without liquidity concerns. However, excessive positive working capital may indicate inefficient asset utilization or tied-up capital that could otherwise be invested for higher returns.

Industries Favoring Negative Working Capital

Industries favoring negative working capital, such as retail, fast food, and technology companies, benefit from receiving customer payments faster than paying suppliers, improving cash flow and operational efficiency. Retail giants like Walmart and fast-food chains like McDonald's use negative working capital to fund daily operations without relying on external financing. This positive cash conversion cycle allows these industries to maintain liquidity and invest in growth despite holding minimal current assets.

Risks Associated with Negative Working Capital

Negative working capital occurs when a company's current liabilities exceed its current assets, indicating potential liquidity issues and an inability to pay short-term obligations. This condition increases the risk of bankruptcy, hinders operational efficiency, and limits access to additional financing. Companies with persistent negative working capital may face supplier distrust, higher borrowing costs, and difficulty sustaining day-to-day business activities.

Strategic Benefits of Positive Working Capital

Positive working capital enhances a company's liquidity, enabling timely payment of short-term liabilities and smoother operations, which supports supplier and customer trust. It provides the strategic flexibility to invest in growth opportunities, manage unexpected expenses, and maintain stability during economic downturns. Firms with positive working capital are better positioned to negotiate favorable terms and reduce reliance on external financing, strengthening overall financial health.

Choosing the Right Working Capital Strategy for Your Business

Choosing the right working capital strategy depends on your business model and cash flow needs. Negative working capital suits businesses with rapid inventory turnover and strong supplier credit, like retail or fast food, by freeing up cash for growth. Positive working capital provides a financial cushion for firms with longer cash conversion cycles, ensuring liquidity and operational stability during fluctuating market conditions.

Negative Working Capital Infographic

libterm.com

libterm.com