Venture capital fuels the growth of startups by providing essential funding in exchange for equity, enabling innovative ideas to scale rapidly. This form of financing involves high risk but offers the potential for substantial returns, attracting investors ready to support disruptive technologies and business models. Discover how venture capital can transform your startup journey and the critical factors to consider before seeking investment.

Table of Comparison

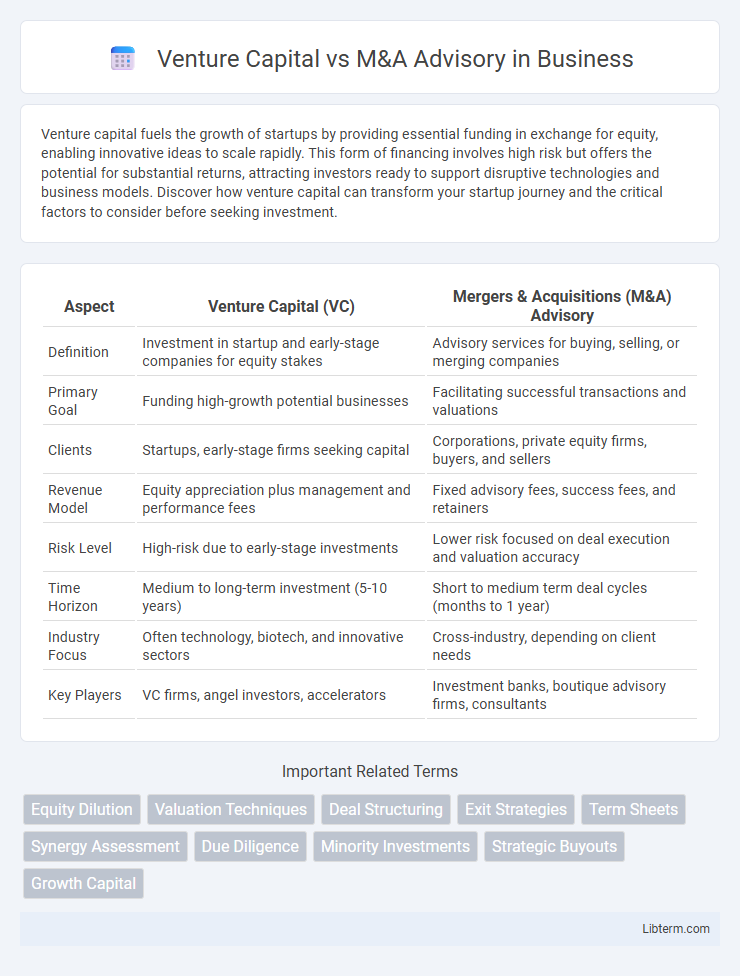

| Aspect | Venture Capital (VC) | Mergers & Acquisitions (M&A) Advisory |

|---|---|---|

| Definition | Investment in startup and early-stage companies for equity stakes | Advisory services for buying, selling, or merging companies |

| Primary Goal | Funding high-growth potential businesses | Facilitating successful transactions and valuations |

| Clients | Startups, early-stage firms seeking capital | Corporations, private equity firms, buyers, and sellers |

| Revenue Model | Equity appreciation plus management and performance fees | Fixed advisory fees, success fees, and retainers |

| Risk Level | High-risk due to early-stage investments | Lower risk focused on deal execution and valuation accuracy |

| Time Horizon | Medium to long-term investment (5-10 years) | Short to medium term deal cycles (months to 1 year) |

| Industry Focus | Often technology, biotech, and innovative sectors | Cross-industry, depending on client needs |

| Key Players | VC firms, angel investors, accelerators | Investment banks, boutique advisory firms, consultants |

Introduction to Venture Capital and M&A Advisory

Venture capital involves investing in early-stage startups with high growth potential, providing both funding and strategic guidance to accelerate innovation and market entry. M&A advisory focuses on facilitating mergers, acquisitions, and corporate restructuring by offering expert advice on valuation, negotiation, and due diligence to optimize transaction outcomes. Both sectors play crucial roles in shaping business growth but cater to different stages and types of corporate development.

Key Roles and Responsibilities

Venture Capital firms primarily focus on identifying and funding high-growth startups, conducting due diligence, portfolio management, and providing strategic guidance to scale businesses. M&A Advisory professionals specialize in deal origination, valuation, negotiation, financial modeling, and integration planning for mergers, acquisitions, divestitures, and restructuring. Both roles require deep market analysis and financial expertise, but venture capital emphasizes growth-stage investment whereas M&A advisory centers on transaction execution and client advisory services.

Target Clients and Industries

Venture capital primarily targets early-stage startups and high-growth companies within technology, healthcare, and biotech sectors seeking funding to scale operations. M&A advisory serves established businesses across diverse industries such as manufacturing, retail, and financial services, focusing on strategic acquisitions, mergers, and divestitures. Both services cater to clients aiming for business expansion, but venture capital emphasizes capital infusion while M&A advisory centers on transactional expertise.

Investment Structures and Processes

Venture capital investment structures typically involve equity financing through preferred shares, with terms such as liquidation preferences, anti-dilution provisions, and staged funding rounds to manage risk and growth. M&A advisory focuses on negotiating deal structures including asset purchases, stock acquisitions, or mergers, emphasizing due diligence, valuation, and integration planning. The venture capital process prioritizes long-term value creation through active portfolio management, whereas M&A advisory centers on transaction execution and strategic fit alignment.

Deal Sourcing and Origination Methods

Venture capital firms leverage extensive networks, industry events, and accelerator programs to source early-stage investment opportunities, prioritizing startups with high growth potential and disruptive technologies. M&A advisory firms rely on proprietary databases, strategic industry relationships, and targeted outreach to identify and originate merger and acquisition deals involving established companies seeking growth, consolidation, or divestiture. Both sectors emphasize leveraging market intelligence and data analytics to efficiently identify and evaluate high-value transaction targets.

Valuation Approaches and Metrics

Venture capital valuation primarily relies on methods like the discounted cash flow (DCF) analysis, comparable company multiples, and precedent transaction multiples tailored to early-stage companies with high growth potential but limited financial history. M&A advisory valuations emphasize detailed enterprise value assessments using EBITDA multiples, precedent transactions, and synergy valuations, reflecting the strategic fit and cash flow stability of mature businesses. Key metrics differ, with venture capital focusing on revenue growth rates and user/customer acquisition costs, while M&A advisors prioritize profitability ratios, earnings before interest, taxes, depreciation, and amortization (EBITDA), and free cash flow projections.

Risk Management Strategies

Venture capital risk management strategies emphasize portfolio diversification and staged funding to mitigate potential losses from high-risk startups, leveraging in-depth market analysis and founder assessment to identify scalable opportunities. M&A advisory firms prioritize thorough due diligence, including financial audits and legal compliance checks, to uncover liabilities and assess synergies that reduce post-transaction risks. Both sectors employ scenario planning and stress testing, but M&A advisory focuses more on integration risks while venture capital concentrates on market and operational uncertainties.

Regulatory and Compliance Considerations

Venture capital firms must navigate complex securities regulations, including compliance with the Securities Act and rules governing accredited investors, to ensure lawful fundraising and investment activities. M&A advisory services require thorough due diligence in antitrust laws, financial disclosures, and compliance with the Hart-Scott-Rodino Act to facilitate successful mergers and acquisitions without regulatory penalties. Both sectors face stringent oversight from the SEC, FINRA, and other regulatory bodies, necessitating robust compliance programs to mitigate legal and reputational risks.

Post-Deal Involvement and Value Creation

Venture capital firms actively engage in post-deal involvement by providing strategic guidance, operational support, and leveraging networks to accelerate portfolio company growth and increase valuation. M&A advisory primarily focuses on transaction execution, with limited ongoing involvement, leaving value creation to the merged entities' management teams post-closing. The hands-on post-deal approach of venture capital fosters continuous value creation, whereas M&A advisory's value realization depends on effective integration and synergy capture after deal completion.

Choosing Between Venture Capital and M&A Advisory

Choosing between venture capital and M&A advisory depends on your career goals and risk tolerance; venture capital offers high risk with potential for significant returns through startup investments, while M&A advisory provides a more structured environment focused on financial analysis and deal execution. Venture capital professionals leverage market trends and entrepreneurial insights to identify high-growth opportunities, whereas M&A advisors work with established companies to facilitate mergers, acquisitions, and strategic transactions. Understanding the distinct skill sets, industry dynamics, and financial models in each field will guide informed decisions for long-term career success.

Venture Capital Infographic

libterm.com

libterm.com