Marginal cost measures the additional expense incurred from producing one more unit of a good or service, playing a crucial role in pricing and production decisions. Understanding how marginal cost fluctuates helps businesses optimize output levels to maximize profit while minimizing unnecessary expenditures. Explore the rest of the article to learn how mastering marginal cost can improve your financial strategies.

Table of Comparison

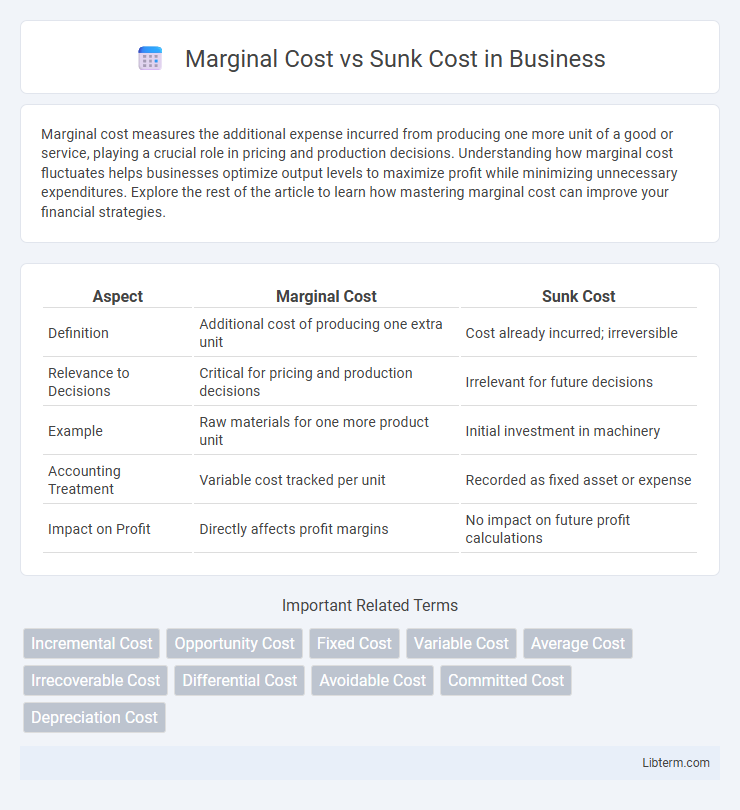

| Aspect | Marginal Cost | Sunk Cost |

|---|---|---|

| Definition | Additional cost of producing one extra unit | Cost already incurred; irreversible |

| Relevance to Decisions | Critical for pricing and production decisions | Irrelevant for future decisions |

| Example | Raw materials for one more product unit | Initial investment in machinery |

| Accounting Treatment | Variable cost tracked per unit | Recorded as fixed asset or expense |

| Impact on Profit | Directly affects profit margins | No impact on future profit calculations |

Understanding Marginal Cost: Definition and Importance

Marginal cost refers to the additional expense incurred when producing one more unit of a good or service, playing a critical role in decision-making processes for businesses. Understanding marginal cost helps firms optimize production levels and pricing strategies, ensuring resources are efficiently allocated to maximize profit. Unlike sunk costs, which are past expenses that cannot be recovered, marginal cost directly impacts future financial outcomes and operational adjustments.

What Is Sunk Cost? Key Concepts Explained

Sunk cost refers to expenses that have already been incurred and cannot be recovered, making them irrelevant to future decision-making. Unlike marginal cost, which considers the additional cost of producing one more unit, sunk costs should be ignored when evaluating current or future business choices. Understanding sunk cost helps avoid the common fallacy of throwing good money after bad, ensuring more rational financial decisions.

Core Differences: Marginal Cost vs Sunk Cost

Marginal cost refers to the additional expense incurred when producing one more unit of a good or service, directly impacting decision-making and pricing strategies. Sunk cost, however, represents past expenditures that cannot be recovered and should not influence future business decisions. The core difference lies in marginal cost being relevant for future production choices, while sunk cost is a historical cost irrelevant to prospective analysis.

Real-World Examples of Marginal Cost

Marginal cost represents the additional expense incurred to produce one more unit of a good or service, critical in industries such as manufacturing where producing extra items involves costs for materials and labor. For example, a car manufacturer's marginal cost includes the price of extra parts and assembly time needed for each additional vehicle. In contrast, sunk costs like previous investments in factory machinery remain unchanged regardless of current production levels and should not influence future operational decisions.

Recognizing Sunk Costs in Business Decisions

Recognizing sunk costs in business decisions involves identifying expenses that have already been incurred and cannot be recovered, such as past investments in equipment or marketing campaigns. These costs should not influence current or future decision-making, as focusing on marginal cost--the additional expense of a choice--leads to more rational and profitable outcomes. Ignoring sunk costs helps businesses avoid the fallacy of escalating commitment and supports optimizing resource allocation.

How Marginal Cost Influences Pricing Strategies

Marginal cost plays a crucial role in determining pricing strategies by guiding businesses to price products based on the cost of producing one additional unit, ensuring profitability on incremental sales. Unlike sunk costs, which are irrecoverable and should not impact pricing decisions, marginal cost reflects current variable expenses directly tied to production output. Companies leverage marginal cost analysis to optimize prices, balance supply and demand, and achieve competitive advantages in dynamic markets.

The Irrelevance of Sunk Cost in Future Decisions

Sunk costs are past expenses that cannot be recovered, making them irrelevant in future decision-making processes. Marginal cost represents the additional cost incurred by producing one more unit of output and is the critical factor in evaluating future options. Rational decisions should be based solely on comparing marginal costs and marginal benefits, ignoring sunk costs to avoid inefficient resource allocation.

Marginal Cost and Sunk Cost in Cost Analysis

Marginal cost represents the increase in total cost when producing one additional unit of output, crucial for decision-making in cost analysis to optimize production levels. Sunk cost refers to expenses already incurred and unrecoverable, which should be excluded from future economic decisions to avoid misleading evaluations. Effective cost analysis distinguishes marginal cost from sunk cost to ensure resources are allocated based on relevant, incremental costs rather than past expenditures.

Avoiding the Sunk Cost Fallacy: Best Practices

To avoid the sunk cost fallacy, decision-makers should focus on marginal cost, which reflects the true expense of continuing a project or investment. Evaluating only future costs and benefits prevents irrational commitment to past irrecoverable costs. Regularly reassessing projects with updated marginal cost analysis promotes more economically sound decisions and resource allocation.

Strategic Decision-Making: Marginal Cost vs Sunk Cost

Marginal cost represents the additional expense incurred from producing one more unit, guiding firms in strategic decision-making by highlighting incremental resource allocation benefits. Sunk costs are past expenditures that cannot be recovered and should not influence current or future decisions, preventing irrational commitment to unprofitable projects. Effective strategic decision-making involves ignoring sunk costs while focusing on marginal costs to maximize profitability and optimize resource use.

Marginal Cost Infographic

libterm.com

libterm.com