Exchange-Traded Funds (ETFs) offer a flexible way to invest in diversified portfolios, combining the liquidity of stocks with the diversification benefits of mutual funds. They typically have lower fees and transparent holdings, making them attractive for both novice and experienced investors. Explore the rest of the article to discover how ETFs can enhance your investment strategy.

Table of Comparison

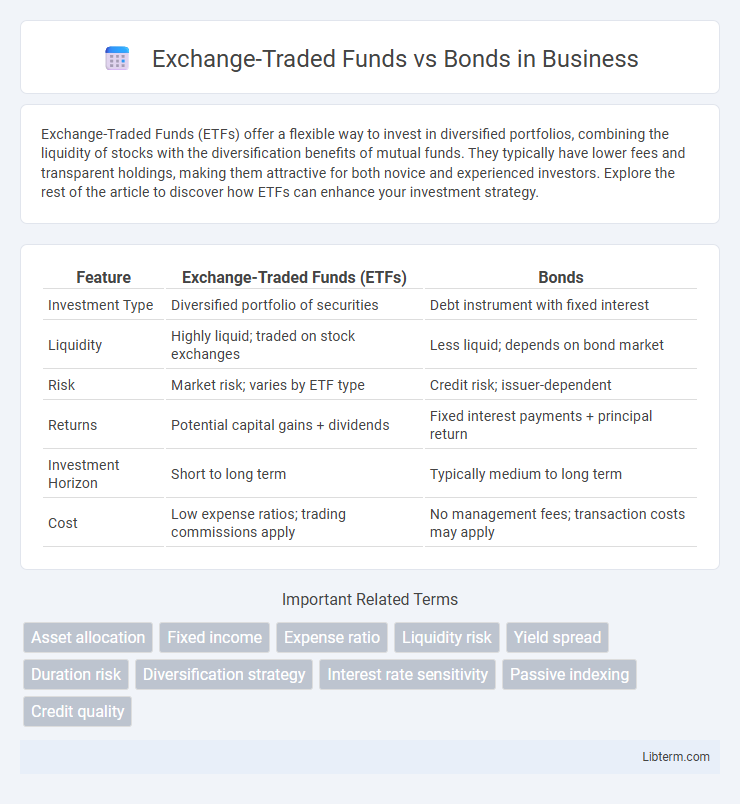

| Feature | Exchange-Traded Funds (ETFs) | Bonds |

|---|---|---|

| Investment Type | Diversified portfolio of securities | Debt instrument with fixed interest |

| Liquidity | Highly liquid; traded on stock exchanges | Less liquid; depends on bond market |

| Risk | Market risk; varies by ETF type | Credit risk; issuer-dependent |

| Returns | Potential capital gains + dividends | Fixed interest payments + principal return |

| Investment Horizon | Short to long term | Typically medium to long term |

| Cost | Low expense ratios; trading commissions apply | No management fees; transaction costs may apply |

Introduction to Exchange-Traded Funds and Bonds

Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges, designed to track indices, sectors, commodities, or assets, offering liquidity and diversification similar to stocks. Bonds are fixed-income securities issued by governments or corporations, providing regular interest payments and return of principal at maturity, typically with lower risk compared to equities. ETFs combine flexibility and diversification, while bonds emphasize income stability and capital preservation in investment portfolios.

Key Differences Between ETFs and Bonds

Exchange-Traded Funds (ETFs) offer diversified exposure to a basket of assets and trade like stocks on exchanges, while bonds represent fixed-income debt securities issued by governments or corporations. ETFs provide liquidity and intraday trading flexibility, whereas bonds typically have fixed maturity dates and pay periodic interest over the life of the bond. Risk profiles differ as ETFs carry market risk linked to underlying assets, whereas bonds carry credit risk and interest rate risk tied to the issuer's ability to repay.

How Exchange-Traded Funds Work

Exchange-Traded Funds (ETFs) function by pooling investors' capital to buy a diversified portfolio of assets, such as stocks, bonds, or commodities, which are then divided into shares traded on stock exchanges. These shares can be bought and sold throughout the trading day at market prices, providing liquidity and real-time pricing unlike mutual funds. ETFs use an arbitrage mechanism involving authorized participants to keep their market prices closely aligned with their underlying net asset values (NAV).

Understanding Bonds: Types and Functions

Bonds are fixed-income securities representing loans made by investors to entities such as governments, municipalities, or corporations, with types including Treasury bonds, municipal bonds, and corporate bonds, each varying in risk and yield. Treasury bonds offer government-backed security with lower risk, municipal bonds provide tax-exempt income often used to fund public projects, and corporate bonds tend to offer higher yields with increased risk based on the issuer's credit rating. Understanding bond functions involves recognizing their role in portfolio diversification, income generation through interest payments, and capital preservation, contrasting with Exchange-Traded Funds (ETFs) that offer diversified exposure across multiple asset classes.

Risk Comparison: ETFs vs Bonds

Exchange-Traded Funds (ETFs) typically offer diversified exposure across various asset classes, reducing individual security risk compared to Bonds, which are subject to credit and interest rate risk depending on the issuer. Bonds provide predictable income streams but face risks such as default risk, interest rate fluctuations, and inflation erosion, whereas ETFs can experience market volatility influenced by the underlying assets. Risk profiles vary broadly within ETFs depending on their holdings, making them generally more volatile but potentially higher yielding than individual Bonds.

Liquidity and Accessibility

Exchange-Traded Funds (ETFs) offer higher liquidity compared to bonds due to their continuous trading on stock exchanges, enabling investors to buy or sell shares throughout market hours at market prices. Bonds, especially individual corporate or municipal bonds, often lack this intraday liquidity and may require holding until maturity or trading over-the-counter, which can limit accessibility. ETFs also provide easier access to diversified bond portfolios with low investment minimums, whereas direct bond investments typically involve higher capital requirements and less transparent pricing.

Yield and Return Potential

Exchange-Traded Funds (ETFs) generally offer higher yield and return potential compared to bonds due to their diversified exposure to equities and sectors with growth opportunities. Bonds typically provide fixed income with lower yield, prioritizing capital preservation and stable interest payments over higher returns. Investors seeking income stability may prefer bonds, while those targeting capital appreciation often favor ETFs for greater return variability and growth prospects.

Costs and Fees Analysis

Exchange-Traded Funds (ETFs) typically have lower expense ratios compared to bonds due to passive management and higher liquidity, resulting in reduced annual management fees. Bond investments often incur higher transaction costs and bid-ask spreads, especially in less liquid corporate or municipal bonds, increasing overall expenses for investors. Investors should analyze factors such as ETF expense ratios, brokerage commissions, bond underwriting fees, and potential premium or discount pricing to comprehensively evaluate total cost impact.

Suitability for Different Investor Profiles

Exchange-Traded Funds (ETFs) offer diversified exposure and greater liquidity, making them suitable for investors seeking flexibility and moderate risk. Bonds provide more predictable income and lower volatility, appealing to conservative investors prioritizing capital preservation and steady cash flow. Understanding individual risk tolerance, investment horizon, and income requirements is essential when choosing between ETFs and bonds for portfolio allocation.

Conclusion: Choosing Between ETFs and Bonds

Choosing between Exchange-Traded Funds (ETFs) and bonds depends on investment goals, risk tolerance, and liquidity needs. ETFs offer diversified exposure across asset classes with higher liquidity and potential for capital appreciation, while bonds provide stable income through fixed interest payments and lower volatility. Investors seeking growth and flexibility may prefer ETFs, whereas conservative investors focused on predictable returns might favor bonds.

Exchange-Traded Funds Infographic

libterm.com

libterm.com