A Managing Partner plays a crucial role in steering the strategic direction and operational efficiency of a partnership, ensuring that business goals are met while maintaining strong client and stakeholder relationships. This leadership position demands exceptional decision-making skills, financial acumen, and the ability to motivate teams in dynamic environments. Explore the article to discover how your role as a Managing Partner can drive sustained business growth and success.

Table of Comparison

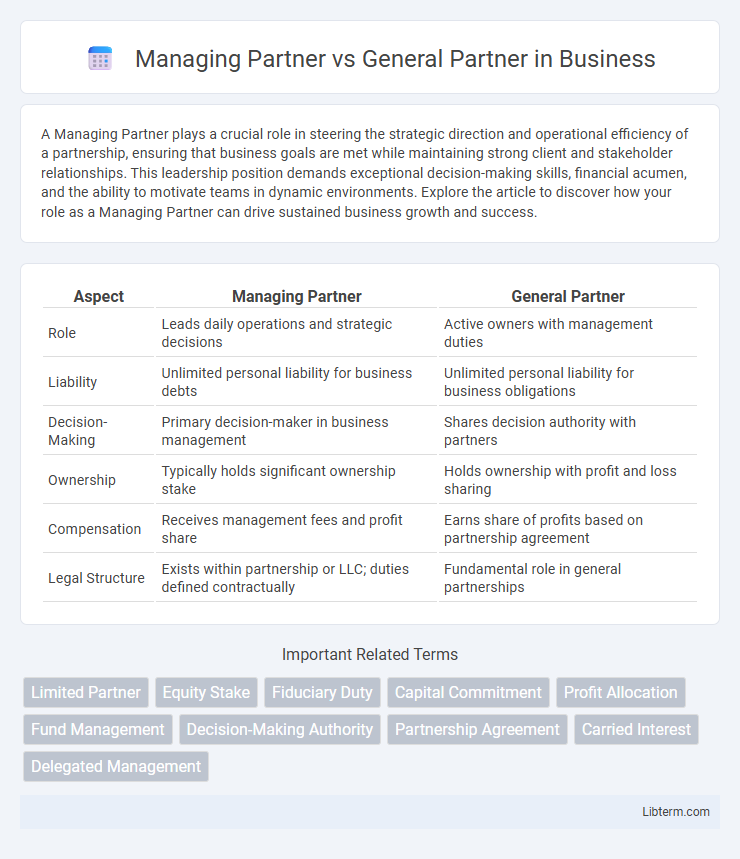

| Aspect | Managing Partner | General Partner |

|---|---|---|

| Role | Leads daily operations and strategic decisions | Active owners with management duties |

| Liability | Unlimited personal liability for business debts | Unlimited personal liability for business obligations |

| Decision-Making | Primary decision-maker in business management | Shares decision authority with partners |

| Ownership | Typically holds significant ownership stake | Holds ownership with profit and loss sharing |

| Compensation | Receives management fees and profit share | Earns share of profits based on partnership agreement |

| Legal Structure | Exists within partnership or LLC; duties defined contractually | Fundamental role in general partnerships |

Introduction to Managing Partner vs General Partner

A Managing Partner is an active participant responsible for the daily operations and strategic decisions within a partnership, often holding executive authority. A General Partner shares liability for the partnership's debts and obligations and usually contributes to management, but may not be involved in day-to-day operations. Understanding the distinctions between a Managing Partner and a General Partner is crucial for defining roles, responsibilities, and legal implications within a business structure.

Definitions: Who is a Managing Partner?

A Managing Partner is an individual in a partnership who holds the responsibility for overseeing daily business operations and making key strategic decisions. This role typically combines ownership and active management duties, distinguishing it from partners who may have ownership stakes but no operational involvement. Managing Partners often have authority to bind the partnership legally and represent it in external engagements.

Definitions: Who is a General Partner?

A General Partner (GP) is an individual or entity in a partnership who holds unlimited liability for the debts and obligations of the business, actively managing daily operations and decision-making processes. Unlike limited partners, General Partners have both management authority and personal financial risk, making them fully responsible for the partnership's performance. Typically found in limited partnerships (LPs) or limited liability partnerships (LLPs), General Partners play a crucial role in strategic direction and legal accountability.

Key Responsibilities of Managing Partners

Managing Partners hold primary responsibility for strategic decision-making, overseeing daily operations, and steering company growth initiatives. They actively manage business activities, ensuring compliance, financial performance, and effective leadership of the management team. Unlike General Partners, who primarily invest and share liabilities, Managing Partners drive execution of company objectives and stakeholder relations.

Key Responsibilities of General Partners

General Partners hold primary responsibility for the day-to-day management and operational decisions within a partnership, including securing financing, overseeing investments, and executing strategies to enhance business growth. They bear unlimited liability, meaning their personal assets are at risk for partnership debts and obligations. Managing Partners may have similar roles but typically also assume leadership duties, setting the strategic vision and representing the partnership externally.

Decision-Making Authority: Managing Partner vs General Partner

The managing partner holds primary decision-making authority, overseeing daily operations and strategic planning within a partnership. In contrast, a general partner has broader liability but may share decision-making responsibilities or act in a more passive role depending on the partnership agreement. Clear delineation of decision-making authority is crucial to avoid conflicts and ensure efficient management in business partnerships.

Legal and Financial Liabilities Compared

A Managing Partner holds decision-making authority and typically assumes greater financial and legal liabilities, including operational debts and contract obligations. In contrast, a General Partner shares in profits and losses but may have less involvement in daily management, though still bears unlimited personal liability for the partnership's debts. Both roles expose individuals to joint and several liabilities, but the Managing Partner often faces amplified responsibility due to active control over business activities.

Compensation Structures and Profit Distribution

Managing partners typically receive a fixed salary plus a share of the profits based on their active role in daily operations, while general partners earn compensation primarily through profit distribution aligned with their equity stake in the partnership. Profit distribution for managing partners often includes performance-based bonuses to incentivize management effectiveness, whereas general partners receive profits proportionate to their investment and risk-bearing capacity. Compensation structures vary depending on the partnership agreement but generally balance operational involvement with financial contribution to align interests and maximize overall profitability.

Pros and Cons of Each Role

Managing Partner oversees daily operations and strategic decisions, ensuring business growth and effective management, but faces high responsibility and potential liability risks. General Partner contributes capital and shares profits, enjoying direct control and influence without daily managerial duties, yet carries unlimited personal liability for business debts. Balancing operational control with risk exposure is essential when choosing between Managing Partner and General Partner roles.

Choosing the Right Partner Structure for Your Business

Choosing the right partner structure for your business involves understanding the distinct roles of managing partners and general partners. Managing partners actively oversee daily operations and strategic decisions, providing leadership and operational control, while general partners primarily contribute capital and share liability without necessarily managing the business. Selecting between these roles depends on whether you prioritize hands-on management or investment participation, impacting liability, profit sharing, and control within the partnership.

Managing Partner Infographic

libterm.com

libterm.com