A commission is a fee or percentage paid to an individual or entity for facilitating a sale or transaction, often serving as a critical incentive in sales industries. Understanding how commissions work can help you maximize your earnings and make better business decisions. Explore the rest of the article to learn more about commission structures and strategies to boost your income.

Table of Comparison

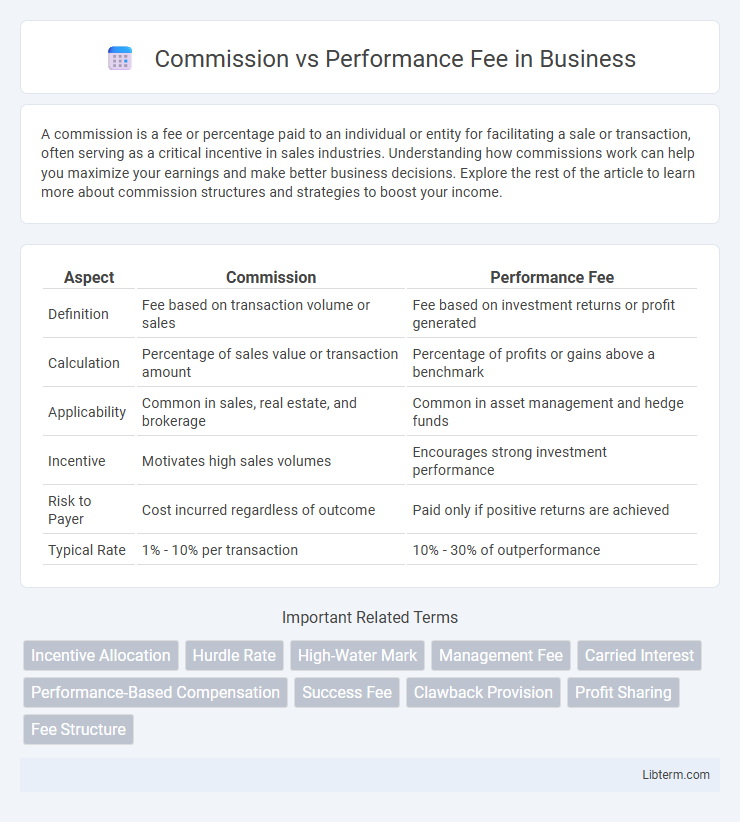

| Aspect | Commission | Performance Fee |

|---|---|---|

| Definition | Fee based on transaction volume or sales | Fee based on investment returns or profit generated |

| Calculation | Percentage of sales value or transaction amount | Percentage of profits or gains above a benchmark |

| Applicability | Common in sales, real estate, and brokerage | Common in asset management and hedge funds |

| Incentive | Motivates high sales volumes | Encourages strong investment performance |

| Risk to Payer | Cost incurred regardless of outcome | Paid only if positive returns are achieved |

| Typical Rate | 1% - 10% per transaction | 10% - 30% of outperformance |

Understanding Commission and Performance Fee: Key Definitions

Commission refers to a payment made to an agent or broker based on a percentage of a transaction's value, typically charged on buying or selling assets. Performance fee is a compensation structure where investment managers earn a percentage of profits generated above a predetermined benchmark or hurdle rate. Understanding these key definitions helps investors evaluate cost structures and aligns incentives between service providers and clients in financial transactions.

How Commission Fees Work in Financial Services

Commission fees in financial services operate as a percentage-based charge applied to the value of transactions executed by brokers or financial advisors. These fees are typically assessed on the buying or selling of securities, such as stocks, bonds, or mutual funds, incentivizing brokers to facilitate trades actively. Unlike flat rates, commission fees fluctuate with trade volume, directly linking compensation to transaction activity.

What Are Performance Fees? Structure and Calculation

Performance fees are compensation charged by investment managers based on the fund's returns exceeding a predetermined benchmark or hurdle rate. Typically structured as a percentage of the profits generated above this benchmark, common rates range from 10% to 20% of the excess returns. Calculation methods often involve high-water marks to ensure fees are paid only on new gains, aligning the manager's interests with investor performance.

Commission vs Performance Fee: Core Differences

Commission fees are fixed charges based on the transaction value, typically paid upfront or per trade, while performance fees are variable and calculated as a percentage of the profits generated by the investment. Commissions align with trading activity, incentivizing frequent transactions, whereas performance fees motivate asset managers to achieve superior returns by linking compensation directly to performance outcomes. Understanding these core differences helps investors choose pricing structures that best match their investment goals and risk tolerance.

Pros and Cons of Commission-Based Compensation

Commission-based compensation offers strong motivation for sales professionals by directly linking pay to performance, driving increased sales and revenue growth. However, this model can lead to inconsistent income streams, causing financial instability and potential stress for employees. It may also encourage aggressive selling tactics that could harm customer relationships and brand reputation over time.

Advantages and Drawbacks of Performance Fee Models

Performance fee models align asset managers' incentives with investor outcomes by rewarding portfolio gains, promoting proactive and skill-based management. However, their complexity and potential for incentivizing excessive risk-taking can lead to unpredictable costs and conflicts of interest. Investors benefit from paying fees only when profits are realized, but transparency and fee calculation methodologies must be carefully evaluated to avoid hidden expenses.

Impact on Investor Returns: Commission vs Performance Fee

Commissions are fixed fees charged per transaction, which can gradually erode investor returns through frequent trading costs. Performance fees, typically calculated as a percentage of profits above a benchmark, align the manager's interests with investors by incentivizing superior fund performance. While commissions impose predictable costs regardless of outcome, performance fees directly impact returns only when positive results are achieved, potentially enhancing net gains for investors.

Regulatory Perspectives on Fee Structures

Regulatory perspectives on fee structures emphasize transparency and fairness in distinguishing commission-based fees from performance fees to protect investors. Commission fees are typically fixed charges for transactions, regulated to prevent excessive or hidden costs, while performance fees are contingent on investment returns and subject to stricter rules to avoid conflicts of interest. Regulators such as the SEC and FCA require clear disclosures and limits on performance fees, ensuring that fee arrangements align with investor interests and comply with fiduciary standards.

Choosing the Right Fee Model: Factors to Consider

Selecting the right fee model between commission and performance fees depends on investment goals, risk tolerance, and fund management style. Commission fees offer straightforward costs based on transactions, ideal for active traders seeking frequent trades, while performance fees align manager incentives with investor returns, suitable for portfolios aiming for high growth. Key factors include evaluating expected portfolio turnover, investment horizon, and the alignment of manager compensation with desired outcomes to optimize cost-efficiency and performance alignment.

Future Trends in Investment Advisor Compensation

Future trends in investment advisor compensation are increasingly shifting towards performance fee structures that align advisor incentives with client investment outcomes, moving away from traditional fixed commissions. Enhanced regulatory scrutiny and demand for transparency are driving the adoption of fee models based on net gains rather than asset under management commissions. Technological advancements in portfolio analytics and real-time performance tracking are facilitating more dynamic and customized performance fee frameworks, enhancing alignment and client trust.

Commission Infographic

libterm.com

libterm.com