Retained earnings represent the cumulative net income that a company retains rather than distributes as dividends, providing a key source of internal financing for growth and expansion. Tracking these earnings offers insights into your company's profitability and financial health over time. Explore the rest of this article to understand how retained earnings impact your business decisions and long-term strategy.

Table of Comparison

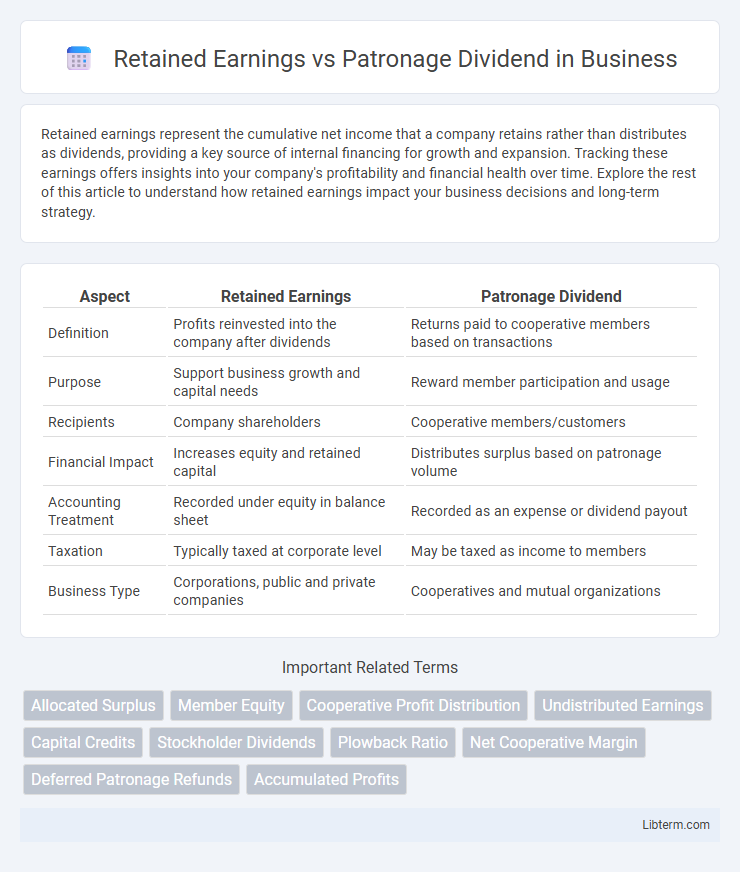

| Aspect | Retained Earnings | Patronage Dividend |

|---|---|---|

| Definition | Profits reinvested into the company after dividends | Returns paid to cooperative members based on transactions |

| Purpose | Support business growth and capital needs | Reward member participation and usage |

| Recipients | Company shareholders | Cooperative members/customers |

| Financial Impact | Increases equity and retained capital | Distributes surplus based on patronage volume |

| Accounting Treatment | Recorded under equity in balance sheet | Recorded as an expense or dividend payout |

| Taxation | Typically taxed at corporate level | May be taxed as income to members |

| Business Type | Corporations, public and private companies | Cooperatives and mutual organizations |

Introduction to Retained Earnings and Patronage Dividend

Retained earnings represent the cumulative net income a company retains rather than distributing as dividends, serving as a key indicator of financial health and reinvestment capability. Patronage dividends are payments made to cooperative members, reflecting their share of profits based on individual transactions and participation. Understanding the distinction helps differentiate corporate profit retention from cooperative profit distribution models.

Defining Retained Earnings

Retained earnings represent the portion of a company's net income that is kept within the business rather than distributed to shareholders as dividends, serving as a key source of internal financing for growth and debt reduction. In contrast, patronage dividends are payments made by cooperatives to their members, based on the amount of business each member has conducted with the cooperative. Understanding retained earnings highlights its role in reinvesting profits to enhance long-term value, whereas patronage dividends emphasize profit distribution aligned with member participation.

Understanding Patronage Dividend

Patronage dividends represent the portion of a cooperative's net earnings distributed to members based on their individual participation or purchases, reflecting a return on their patronage rather than equity investment. Unlike retained earnings, which are profits kept within the company to fund operations or growth, patronage dividends directly allocate earnings back to members to encourage continued engagement and support. Understanding patronage dividends is essential for cooperative members as these payments align member benefits with cooperative success, promoting financial transparency and member loyalty.

Key Differences Between Retained Earnings and Patronage Dividend

Retained earnings represent the accumulated net income a company reinvests into the business after distributing dividends, primarily reflecting internal growth and financial stability. Patronage dividends are payments made by cooperatives to their members based on the amount of business conducted with the cooperative, emphasizing member benefit rather than company reinvestment. The key difference lies in retained earnings serving as corporate capital reserves, while patronage dividends function as profit-sharing distributions tied to member participation.

How Retained Earnings Are Calculated

Retained earnings are calculated by subtracting total dividends distributed to shareholders from the net income of a company over a specific period, then adding any retained earnings balance from the previous period. This figure represents the cumulative amount of profit reinvested in the business rather than paid out to shareholders, reflecting the company's capacity for growth and financial stability. In contrast, patronage dividends are distributions of surplus earnings to members of cooperatives based on their transactions with the cooperative, not calculated through net income and retained earnings.

Patronage Dividend Distribution Process

Patronage dividend distribution involves allocating a portion of a cooperative's earnings back to members proportionate to their transactions with the cooperative, emphasizing member equity and engagement. Unlike retained earnings, which are profits reinvested into the cooperative for future growth and stability, patronage dividends are typically distributed annually based on individual member patronage. The distribution process requires accurate member transaction tracking, financial statement verification, and adherence to cooperative bylaws to ensure equitable and transparent dividend allocation.

Impact on Members and Shareholders

Retained earnings represent the portion of net income kept by a company to reinvest in growth, directly increasing shareholder equity and long-term value. Patronage dividends distribute profits back to cooperative members based on their participation, reinforcing member loyalty and providing immediate financial benefits. This fundamental difference impacts members by enhancing cooperative engagement, while shareholders experience value accumulation primarily through retained earnings.

Tax Implications: Retained Earnings vs Patronage Dividend

Retained earnings in a corporation are subject to corporate income tax before any dividends are distributed to shareholders, which may lead to double taxation at the corporate and individual levels. Patronage dividends, typically issued by cooperatives, are allocated based on member patronage and often deducted from taxable income, reducing the overall tax burden for the cooperative. The tax treatment of patronage dividends generally results in a more favorable tax position compared to retained earnings, as they avoid double taxation and provide members with direct tax benefits.

Usage in Cooperatives vs Corporations

Retained earnings in corporations represent accumulated net income reinvested into the business to fuel growth, pay debts, or enhance shareholder value, reflecting corporate profit retention strategies. Patronage dividends in cooperatives are allocated based on members' usage or patronage, returning surplus revenues to those who actively participate in the cooperative's services, aligning with cooperative principles of member benefit distribution. The key distinction lies in retained earnings being controlled by corporate management for general business purposes, while patronage dividends directly reward cooperative members according to their transactions with the cooperative.

Choosing the Right Profit Allocation Method

Selecting the appropriate profit allocation method between retained earnings and patronage dividends hinges on a company's financial strategy and stakeholder goals. Retained earnings prioritize reinvestment and long-term growth, enhancing shareholder value by funding expansion and innovation. Patronage dividends, common in cooperatives, directly reward member contributions, fostering loyalty and equitable profit distribution among participants.

Retained Earnings Infographic

libterm.com

libterm.com