A split-off is a type of corporate restructuring where a parent company creates a new independent company by distributing shares of the new entity to its existing shareholders. This strategic move allows the new company to operate separately while shareholders maintain ownership in both entities, often unlocking value. Explore the rest of the article to understand how a split-off can impact your investment portfolio and corporate control.

Table of Comparison

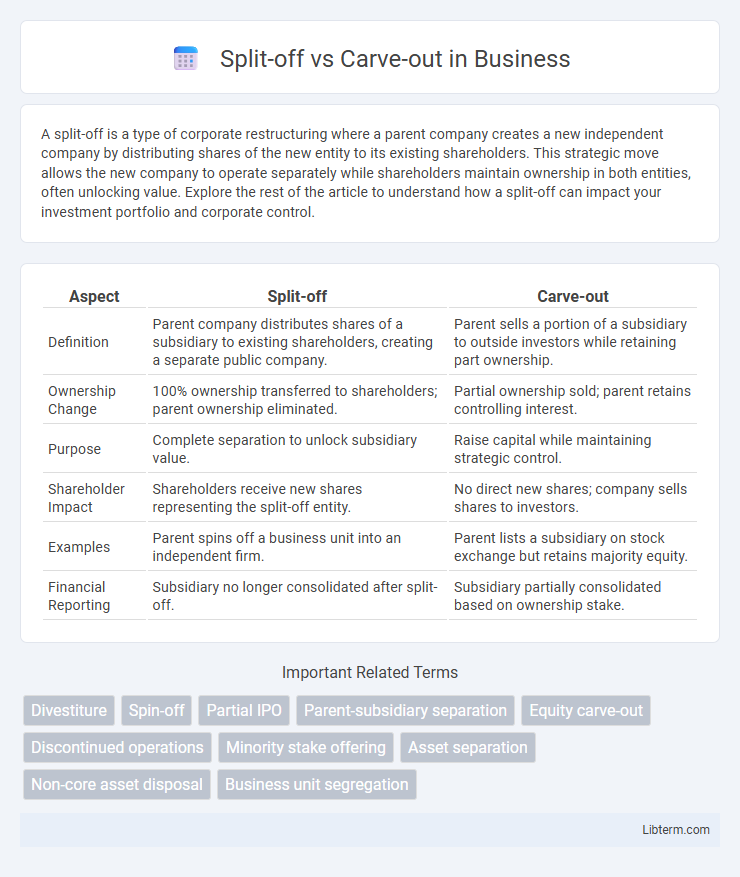

| Aspect | Split-off | Carve-out |

|---|---|---|

| Definition | Parent company distributes shares of a subsidiary to existing shareholders, creating a separate public company. | Parent sells a portion of a subsidiary to outside investors while retaining part ownership. |

| Ownership Change | 100% ownership transferred to shareholders; parent ownership eliminated. | Partial ownership sold; parent retains controlling interest. |

| Purpose | Complete separation to unlock subsidiary value. | Raise capital while maintaining strategic control. |

| Shareholder Impact | Shareholders receive new shares representing the split-off entity. | No direct new shares; company sells shares to investors. |

| Examples | Parent spins off a business unit into an independent firm. | Parent lists a subsidiary on stock exchange but retains majority equity. |

| Financial Reporting | Subsidiary no longer consolidated after split-off. | Subsidiary partially consolidated based on ownership stake. |

Introduction to Split-off and Carve-out

Split-off and carve-out are strategic corporate restructuring methods used to separate business units or subsidiaries from a parent company. A split-off involves shareholders exchanging their parent company shares for shares in a newly independent entity, effectively splitting ownership between the companies. In contrast, a carve-out entails selling a minority stake in a subsidiary to external investors through an initial public offering (IPO) or private sale, allowing the parent company to retain majority control.

Defining Split-off: Key Concepts

A split-off is a type of corporate reorganization where a parent company distributes shares of a subsidiary to its existing shareholders in exchange for their parent company shares, effectively separating the subsidiary into an independent entity. This transaction differs from a carve-out, which involves the partial sale of a subsidiary's shares to outside investors while the parent retains controlling interest. Split-offs enable focused management and enhanced shareholder value by creating distinct operational entities with dedicated shareholder bases.

Understanding Carve-out: The Basics

Carve-out refers to the process where a company separates a business unit, asset, or subsidiary, creating a new independent entity while retaining ownership of a portion of it. This approach enables focused management and attracts external investors through partial sale or initial public offering (IPO). Understanding carve-out is essential for strategic corporate restructuring, as it improves operational efficiency and unlocks shareholder value without full divestiture.

Structural Differences Between Split-off and Carve-out

A split-off involves shareholders exchanging their shares in the parent company for shares in a newly created independent entity, effectively reducing the parent company's ownership stake, while a carve-out sells a portion of the subsidiary's shares to the public without altering existing ownership percentages significantly. In a split-off, the parent company's ownership typically decreases as shareholders absorb the new entity, whereas a carve-out maintains parent ownership but introduces new public shareholders. Structurally, split-offs require a share exchange mechanism among existing shareholders, whereas carve-outs execute an initial public offering (IPO) of subsidiary shares to external investors.

Strategic Objectives: When to Choose Split-off vs Carve-out

Split-offs are strategically ideal when a parent company aims to streamline operations by creating a fully independent entity, allowing shareholders to exchange their shares in the parent company for shares in the new company. Carve-outs suit situations where the parent intends to raise capital or test the market value of a subsidiary while maintaining significant control through retained equity. Selecting between split-off and carve-out depends on objectives such as shareholder value optimization, capital structure considerations, and level of desired operational separation.

Financial Implications and Outcomes

A Spin-off creates an independent company by distributing new shares to existing shareholders, often leading to a clearer valuation and potential tax advantages, while preserving the parent company's capital structure. A Carve-out involves selling a minority equity stake to outside investors through an IPO or private sale, generating immediate cash flow but resulting in partial ownership dilution and ongoing governance responsibilities. Financial outcomes differ as spin-offs typically improve market valuation and operational focus without upfront cash inflows, whereas carve-outs provide liquidity and reduce risk exposure but may complicate financial reporting and control.

Tax Considerations in Split-off and Carve-out

Tax considerations in split-offs typically involve the distribution of shares to shareholders without immediate tax liability if structured under IRS Section 355, enabling tax-free treatment for both the parent company and its shareholders. In carve-outs, the parent company sells a minority stake in a subsidiary to the public or private investors, often triggering taxable gains due to the sale of assets or equity interests, which may result in immediate tax consequences. Careful analysis of the transaction's structure is essential to optimize tax outcomes, as split-offs can preserve shareholder basis and defer taxes, while carve-outs generally generate taxable events affecting corporate and shareholder tax liabilities.

Legal and Regulatory Factors

Split-offs require shareholder approval as they involve exchanging shares and typically trigger complex securities regulatory compliance, while carve-outs involve selling a minority stake in a subsidiary through public offerings or private placements under stringent disclosure requirements. Legal considerations in split-offs focus on the proper valuation and fairness to shareholders, ensuring adherence to corporate governance standards. Carve-outs must navigate multiple regulatory frameworks, including antitrust laws and stock exchange listing rules, to maintain compliance throughout the divestiture process.

Real-World Examples of Split-offs and Carve-outs

Split-offs and carve-outs serve different strategic purposes in corporate restructuring by separating assets or business units. An example of a split-off is Kraft Foods' 2012 separation into Kraft Foods Group and Mondelez International, allowing shareholders to exchange shares for stakes in the new entity. In contrast, carve-outs include General Electric's 2016 IPO of its Baker Hughes unit, where GE sold a minority stake to public investors while retaining control, raising capital without a full divestiture.

Conclusion: Selecting the Right Strategy for Business Transformation

Selecting the right strategy for business transformation depends on the company's long-term objectives and financial goals. Split-offs offer full ownership transfer, enhancing focus on core operations, while carve-outs retain partial ownership, providing capital infusion and strategic partnerships. Evaluating factors such as control, valuation, and market positioning ensures the choice aligns with sustainable growth and shareholder value maximization.

Split-off Infographic

libterm.com

libterm.com