Fair market value represents the price at which an asset would change hands between a willing buyer and seller, neither under compulsion nor in a hurry, with both parties having reasonable knowledge of relevant facts. It is crucial in real estate transactions, taxation, and financial reporting to ensure transparency and fairness. Explore the rest of the article to understand how fair market value impacts your financial decisions.

Table of Comparison

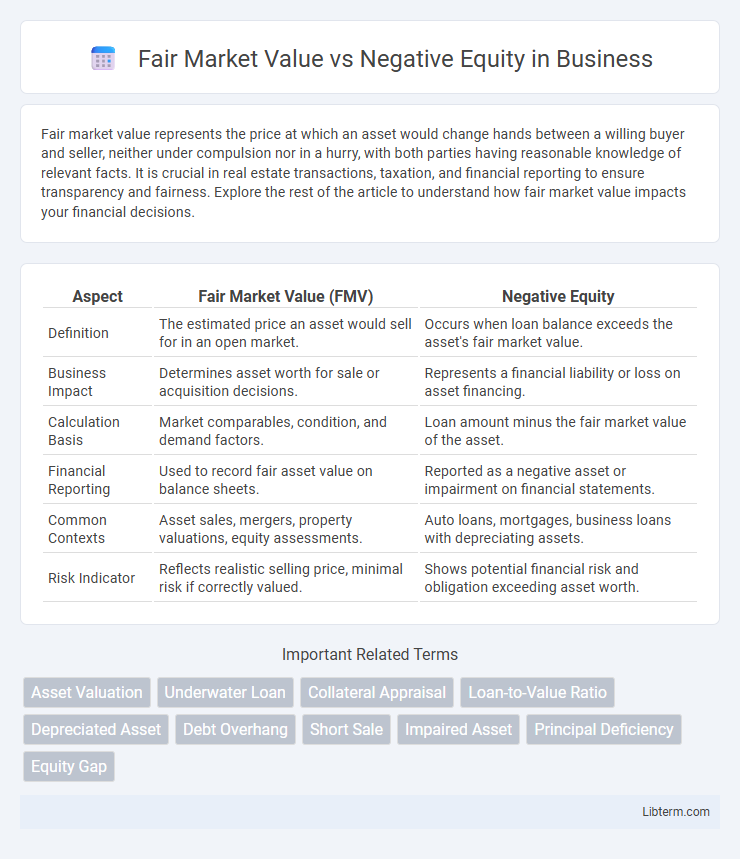

| Aspect | Fair Market Value (FMV) | Negative Equity |

|---|---|---|

| Definition | The estimated price an asset would sell for in an open market. | Occurs when loan balance exceeds the asset's fair market value. |

| Business Impact | Determines asset worth for sale or acquisition decisions. | Represents a financial liability or loss on asset financing. |

| Calculation Basis | Market comparables, condition, and demand factors. | Loan amount minus the fair market value of the asset. |

| Financial Reporting | Used to record fair asset value on balance sheets. | Reported as a negative asset or impairment on financial statements. |

| Common Contexts | Asset sales, mergers, property valuations, equity assessments. | Auto loans, mortgages, business loans with depreciating assets. |

| Risk Indicator | Reflects realistic selling price, minimal risk if correctly valued. | Shows potential financial risk and obligation exceeding asset worth. |

Understanding Fair Market Value

Fair Market Value (FMV) represents the estimated price at which an asset would sell in a competitive market under normal conditions between informed and willing buyers and sellers. It serves as a critical benchmark for assessing financial transactions, especially when comparing to Negative Equity, which occurs when a loan balance exceeds the asset's FMV. Understanding FMV helps individuals and businesses accurately evaluate asset worth, make informed decisions on refinancing, selling, or negotiating terms to avoid potential losses associated with Negative Equity.

Defining Negative Equity

Negative equity occurs when the outstanding loan balance on an asset, such as a vehicle or property, exceeds its fair market value. Fair market value represents the price an asset would sell for in an open and competitive market. Understanding negative equity is crucial for financial planning, as it indicates a situation where selling the asset would not fully cover the remaining debt.

Key Differences Between Fair Market Value and Negative Equity

Fair Market Value (FMV) represents the estimated price a property or asset would sell for under normal market conditions, reflecting its current worth based on supply, demand, and comparable sales. Negative Equity occurs when the outstanding loan balance on an asset, such as a mortgage, exceeds its Fair Market Value, resulting in a financial shortfall for the owner. The key difference lies in FMV being an objective market measurement of value, while Negative Equity signifies a financial state where liabilities surpass the asset's market value.

Factors Affecting Fair Market Value

Fair Market Value is influenced by factors such as current market demand, property condition, and recent comparable sales, which determine the asset's worth under normal conditions. Negative Equity occurs when the outstanding loan balance exceeds this fair market value, often driven by depreciation, economic downturns, or oversupply in the market. Understanding shifts in local real estate trends and economic indicators is crucial for accurately assessing fair market value relative to loan balances.

Causes of Negative Equity

Negative equity occurs when a vehicle's outstanding loan balance exceeds its fair market value, often caused by rapid depreciation, high-interest rates, or making a small down payment. Situations like extended loan terms and frequent refinancing contribute to the owed amount staying higher than the car's depreciated price. Economic downturns and limited demand for certain models also accelerate depreciation, increasing the risk of negative equity.

Impact of Fair Market Value on Asset Sales

Fair market value directly influences asset sales by determining the price at which an asset can be sold in an open market, reflecting its true worth based on current market conditions. When fair market value is lower than the outstanding loan balance, negative equity arises, increasing the risk of financial loss for sellers. Accurate fair market value assessments help businesses and individuals make informed decisions, minimizing the impact of negative equity on asset liquidation.

Financial Consequences of Negative Equity

Negative equity occurs when an asset's fair market value falls below the outstanding loan balance, often resulting in financial strain for borrowers. This situation can lead to higher monthly loan payments, difficulty refinancing, and increased risk of default or repossession. Understanding fair market value is crucial for accurately assessing equity and avoiding unexpected financial burdens associated with negative equity.

Fair Market Value in Real Estate and Auto Loans

Fair Market Value (FMV) represents the estimated price at which a property or vehicle would sell in an open market between a willing buyer and seller, reflecting current market conditions for real estate and auto loans. In real estate, FMV is determined by factors such as location, property condition, and recent comparable sales, while in auto loans, it considers mileage, age, and vehicle condition. Understanding FMV is crucial to assessing negative equity, which occurs when the outstanding loan balance exceeds the fair market value of the asset, impacting refinancing or sale decisions.

Strategies to Avoid or Manage Negative Equity

Understanding the fair market value of a vehicle is crucial in managing negative equity, which occurs when the loan balance exceeds the car's current worth. Strategies to avoid or manage negative equity include making larger down payments, opting for shorter loan terms, and regularly monitoring the vehicle's depreciation rates through reliable sources like Kelley Blue Book or Edmunds. Refinancing the loan or trading in the vehicle for one with a better value-to-loan ratio can also help mitigate financial risks associated with negative equity.

Choosing Professional Guidance for Accurate Valuation

Accurate valuation during the determination of fair market value and negative equity is critical, making professional guidance essential. Experts utilize comprehensive market data and advanced appraisal techniques to ensure precise assessments that reflect current market trends and property conditions. Relying on such professionals minimizes the risk of costly errors and supports informed financial decisions in real estate transactions.

Fair Market Value Infographic

libterm.com

libterm.com