Hiring a reliable contractor is essential for ensuring your construction project is completed on time and within budget. A skilled contractor manages resources efficiently, coordinates subcontractors, and adheres to safety regulations to deliver high-quality results. Discover key tips to choose the best contractor for your needs by reading the rest of this article.

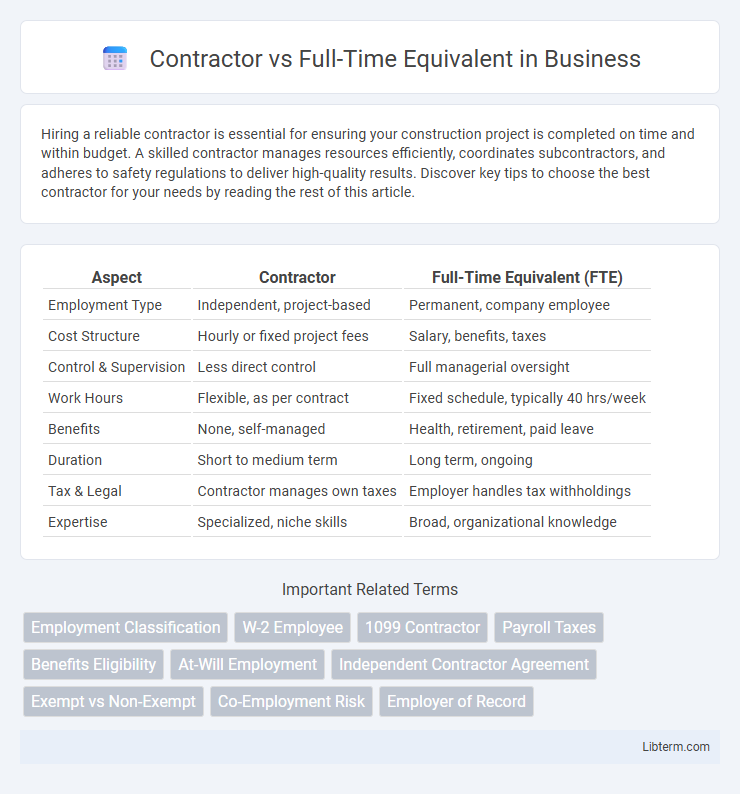

Table of Comparison

| Aspect | Contractor | Full-Time Equivalent (FTE) |

|---|---|---|

| Employment Type | Independent, project-based | Permanent, company employee |

| Cost Structure | Hourly or fixed project fees | Salary, benefits, taxes |

| Control & Supervision | Less direct control | Full managerial oversight |

| Work Hours | Flexible, as per contract | Fixed schedule, typically 40 hrs/week |

| Benefits | None, self-managed | Health, retirement, paid leave |

| Duration | Short to medium term | Long term, ongoing |

| Tax & Legal | Contractor manages own taxes | Employer handles tax withholdings |

| Expertise | Specialized, niche skills | Broad, organizational knowledge |

Understanding Contractor and Full-Time Equivalent Roles

Contractors typically operate under fixed-term agreements with specific deliverables, offering flexibility and specialized skills without long-term employment commitments. Full-Time Equivalents (FTEs) represent permanent employees who contribute to ongoing organizational goals with consistent work hours and benefits. Differentiating between contractors and FTEs is essential for workforce planning, budget allocation, and compliance with labor regulations.

Key Differences Between Contractors and FTEs

Contractors typically work on a project basis with fixed-term contracts, offering flexibility and specialized skills, while Full-Time Equivalents (FTEs) are permanent employees with ongoing responsibilities and benefits such as health insurance and retirement plans. Contractors are often paid hourly or per project without employee benefits, whereas FTEs receive a consistent salary plus employment benefits. Employer obligations differ as companies manage payroll taxes and compliance for FTEs, but contractors handle their own taxes and insurance.

Legal and Compliance Considerations

Legal and compliance considerations between contractors and full-time equivalents (FTEs) revolve around classification, tax obligations, and labor laws. Misclassifying contractors as FTEs or vice versa can lead to penalties under the Fair Labor Standards Act (FLSA) and Internal Revenue Service (IRS) regulations. Employers must ensure adherence to the Department of Labor (DOL) guidelines and state statutes to avoid risks related to benefits entitlement, wage protections, and payroll tax liabilities.

Cost Comparison: Contractor vs FTE

Contractors typically incur higher hourly rates compared to Full-Time Equivalents (FTEs) due to the absence of benefits such as health insurance, retirement plans, and paid leave, which employers must provide for FTEs. FTEs offer cost advantages in long-term employment through consistent productivity, lower turnover, and eligibility for internal training programs, leading to better retention and skill development. While contractors provide flexibility for short-term projects without long-term financial commitments, FTEs deliver more predictable budgeting and operational stability by spreading fixed costs over extended periods.

Flexibility and Scalability in Workforce Planning

Contractors offer unmatched flexibility, allowing businesses to quickly scale their workforce up or down based on project demands without long-term commitments. Full-Time Equivalents (FTEs) provide stability and consistency but often require longer hiring and onboarding processes, limiting rapid adjustment. Effective workforce planning balances contractor agility with FTE reliability to optimize operational efficiency and cost management.

Impact on Company Culture and Collaboration

Contractors often integrate less deeply into company culture than full-time equivalents, potentially leading to fragmented team cohesion and weaker collaboration. Full-time employees typically develop stronger relationships and a shared sense of purpose, fostering a more unified work environment. Companies relying heavily on contractors may face challenges in maintaining consistent communication, shared values, and long-term commitment.

Tax Implications for Employers and Workers

Employers face differing tax obligations when hiring contractors versus full-time equivalents (FTEs), as contractors are typically responsible for their own self-employment taxes, including Social Security and Medicare, while employers must withhold payroll taxes and contribute to unemployment insurance for FTEs. Workers classified as contractors must manage quarterly estimated tax payments and lack access to employer-sponsored benefits, whereas FTEs receive tax withholdings through payroll and often benefit from employer-provided health insurance and retirement plans. Misclassification risks substantial penalties for employers due to unpaid payroll taxes and compliance violations under IRS guidelines.

Onboarding and Training Requirements

Contractors typically undergo a streamlined onboarding process with minimal training, focusing on project-specific tasks to ensure rapid integration and productivity. Full-Time Equivalents (FTEs) experience comprehensive onboarding programs covering company culture, policies, and long-term development, which enhances employee retention and performance. Training for FTEs is continuous and broad-based, while contractors receive targeted, short-term training aligned with contractual deliverables.

Benefits and Compensation Structures

Contractors typically receive higher hourly rates but lack benefits such as health insurance, retirement plans, and paid time off commonly offered to full-time equivalents (FTEs). Full-time employees benefit from structured compensation packages including bonuses, stock options, and comprehensive benefits that contribute to long-term financial security. Companies often weigh the increased cost of FTE benefits against the flexibility and reduced overhead associated with hiring contractors.

Choosing the Right Model for Your Organization

Choosing between contractor and full-time equivalent (FTE) models hinges on factors like project duration, budget flexibility, and skill requirements. Contractors offer scalability and specialized expertise without long-term commitments, ideal for short-term or fluctuating workloads. FTEs provide continuity, deeper organizational knowledge, and greater control, suited for ongoing roles where integration and culture fit are crucial.

Contractor Infographic

libterm.com

libterm.com