Par value shares represent the nominal value assigned to a company's stock at the time of issuance, serving as a baseline for the share's minimum price. This value is typically stated on the share certificate and plays a role in legal capital requirements, protecting creditors by ensuring that the company maintains a minimum capital amount. Explore the rest of the article to understand how par value shares impact your investment decisions and company finances.

Table of Comparison

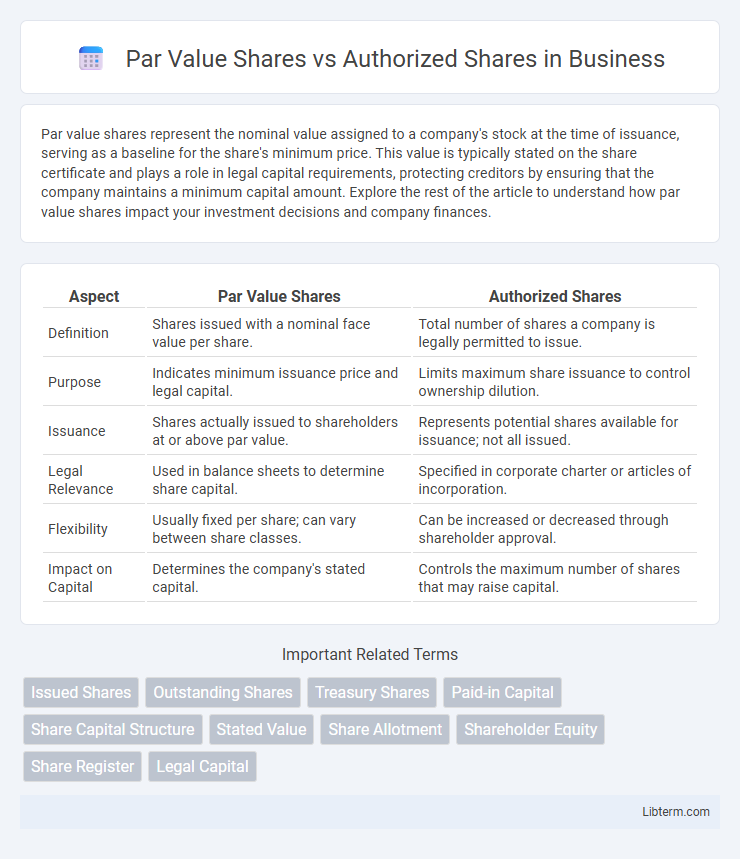

| Aspect | Par Value Shares | Authorized Shares |

|---|---|---|

| Definition | Shares issued with a nominal face value per share. | Total number of shares a company is legally permitted to issue. |

| Purpose | Indicates minimum issuance price and legal capital. | Limits maximum share issuance to control ownership dilution. |

| Issuance | Shares actually issued to shareholders at or above par value. | Represents potential shares available for issuance; not all issued. |

| Legal Relevance | Used in balance sheets to determine share capital. | Specified in corporate charter or articles of incorporation. |

| Flexibility | Usually fixed per share; can vary between share classes. | Can be increased or decreased through shareholder approval. |

| Impact on Capital | Determines the company's stated capital. | Controls the maximum number of shares that may raise capital. |

Understanding Par Value Shares: A Basic Overview

Par value shares represent the nominal or face value assigned to each share of stock when it is authorized, often set at a minimal amount such as $0.01 or $1.00 per share, serving as a legal accounting value with limited reflection of market price. Authorized shares refer to the maximum number of shares a corporation is legally permitted to issue, as specified in its corporate charter, which may be significantly higher than the number of par value shares issued and outstanding. Understanding par value shares is crucial for grasping a company's equity structure, shareholder rights, and the basis for regulatory compliance and financial reporting.

What Are Authorized Shares?

Authorized shares represent the maximum number of shares a corporation is legally permitted to issue as defined in its corporate charter. These shares set the upper limit for issuing stock to investors and can include both issued and unissued shares. Companies often authorize more shares than they initially issue to allow flexibility for future financing, stock options, or other corporate actions.

Key Differences Between Par Value and Authorized Shares

Par value shares represent the nominal value assigned to each share at issuance, serving as a baseline for accounting purposes and shareholder liability. Authorized shares define the maximum number of shares a corporation is legally permitted to issue as specified in its corporate charter. Key differences include par value shares reflecting a fixed monetary value per share, whereas authorized shares indicate the total potential equity available for issuance without implying actual economic value.

Legal Implications of Par Value Shares

Par value shares have a legally assigned nominal value that establishes the minimum price at which shares can be issued, affecting company capitalization and shareholder liabilities. Issuing shares below par value may lead to legal consequences such as liability for directors or claims by creditors, ensuring protection against undervaluation of capital. Authorized shares define the maximum number of shares a corporation can issue but hold no inherent legal value or minimum price constraints.

How Authorized Shares Impact Corporate Structure

Authorized shares determine the maximum number of shares a corporation can issue, directly influencing its capital structure and fundraising potential. Having a high number of authorized shares provides flexibility for future stock issuance, which can affect voting power distribution and ownership dilution. This control mechanism shapes corporate governance and equity management strategies within the company's organizational framework.

The Role of Par Value in Financial Reporting

Par value represents the nominal value assigned to a share in a company's charter and serves as the baseline for legal capital in financial reporting, ensuring protection for creditors by setting a minimum amount that must be retained in the business. Authorized shares denote the maximum number of shares a corporation can issue as specified in its articles of incorporation, influencing the potential equity structure but not affecting the reported value on financial statements directly. The par value per share, multiplied by issued shares, appears in the shareholders' equity section of the balance sheet, providing a foundation for legal capital disclosure and compliance with regulatory requirements.

Adjusting Authorized Shares: When and Why

Adjusting authorized shares becomes necessary when a company plans to raise additional capital, issue stock options, or accommodate stock splits, ensuring sufficient shares are available without altering par value shares already issued. This adjustment allows companies to maintain flexibility in corporate finance strategies while staying compliant with regulatory requirements. Authorized shares serve as a cap set by the corporate charter, and revising this number through shareholder approval aligns the equity structure with future growth or investment goals.

Par Value Shares and Shareholder Rights

Par value shares represent the nominal value assigned to each share at issuance, serving as a legal minimum price for selling stock and establishing the baseline equity investment. These shares confer specific shareholder rights, including voting privileges, dividend entitlements, and claims on assets in liquidation, which are essential for corporate governance and investor protection. Unlike authorized shares, which define the maximum number of shares a company can issue, par value shares directly impact the company's capital structure and shareholders' equity rights.

Impacts on Stock Issuance and Capital Raising

Par value shares establish a minimum legal capital per share, influencing the baseline pricing during stock issuance, while authorized shares define the maximum number of shares a company can issue, directly limiting capital raising capacity. Issuing shares above par value generates additional paid-in capital, enhancing financial flexibility without diluting ownership beyond authorized limits. The interplay between par value and authorized shares shapes corporate capital structure strategies, affecting investor perceptions and compliance with regulatory capital requirements.

Choosing Between Par Value and No-Par Shares

Choosing between par value shares and no-par shares depends on a company's capital structure and legal requirements. Par value shares have a nominal value assigned, which can provide a baseline for accounting and investor assurance, while no-par shares offer greater flexibility in pricing and issuance without fixed nominal value constraints. Companies seeking straightforward equity issuance and fewer regulatory complexities often prefer no-par shares, whereas businesses aiming for a traditional capital framework might opt for par value shares.

Par Value Shares Infographic

libterm.com

libterm.com