Gross spread refers to the difference between the price at which securities are sold to the public and the price paid to the issuer, typically representing the underwriting fees and commissions. This percentage is a key factor in investment banking transactions, influencing the overall cost and profitability of the deal. Discover how understanding gross spread can impact your financial decisions by reading the rest of the article.

Table of Comparison

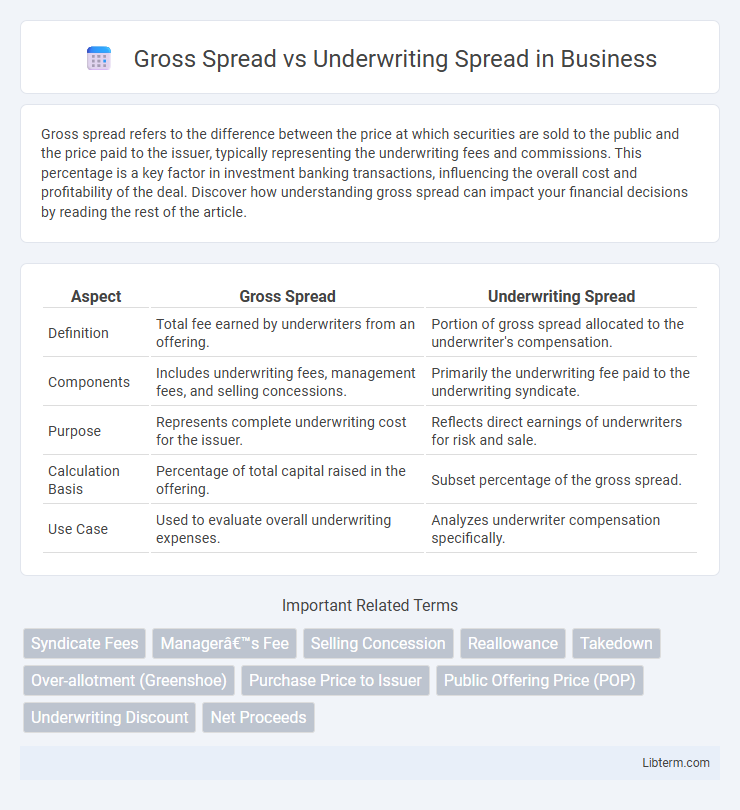

| Aspect | Gross Spread | Underwriting Spread |

|---|---|---|

| Definition | Total fee earned by underwriters from an offering. | Portion of gross spread allocated to the underwriter's compensation. |

| Components | Includes underwriting fees, management fees, and selling concessions. | Primarily the underwriting fee paid to the underwriting syndicate. |

| Purpose | Represents complete underwriting cost for the issuer. | Reflects direct earnings of underwriters for risk and sale. |

| Calculation Basis | Percentage of total capital raised in the offering. | Subset percentage of the gross spread. |

| Use Case | Used to evaluate overall underwriting expenses. | Analyzes underwriter compensation specifically. |

Introduction to Gross Spread and Underwriting Spread

Gross spread refers to the total underwriting fee earned by investment banks in an offering and typically includes management fees, underwriting fees, and selling fees. Underwriting spread specifically denotes the difference between the price paid by underwriters to the issuer and the price at which securities are sold to the public, representing the underwriters' compensation for risk and distribution. Understanding the distinction between gross spread and underwriting spread is essential in evaluating the costs and financial incentives in securities underwriting.

Defining Gross Spread

Gross spread represents the total underwriting fee earned by investment banks during securities offerings, encompassing management fees, selling concessions, and underwriting fees. It differs from underwriting spread, which specifically refers to the difference between the price paid by underwriters to issuers and the price at which securities are sold to the public. Understanding gross spread is crucial for evaluating the overall cost of issuing securities and the profitability for underwriters in the capital markets.

Understanding Underwriting Spread

Underwriting spread represents the compensation earned by investment banks and underwriters for managing and assuming the risk of issuing new securities, calculated as the difference between the price paid by underwriters to the issuer and the price at which securities are sold to investors. Gross spread, often used interchangeably, generally encompasses the total fees underwriters receive, including the underwriting spread along with additional expenses like syndicate fees and expenses. Understanding underwriting spread is crucial for issuers to evaluate the cost of capital and for investors to assess the pricing structure of new securities offerings.

Key Differences Between Gross Spread and Underwriting Spread

Gross spread represents the total fee percentage earned by investment banks during a securities offering, encompassing underwriting fees, management fees, and selling concessions. Underwriting spread specifically refers to the portion of the gross spread allocated to the underwriting risk assumed by the lead underwriters for guaranteeing the sale of securities. The key difference lies in gross spread being the aggregate compensation for all services in the offering, whereas underwriting spread is narrowly focused on the underwriters' risk assumption and credit provision.

Components of Gross Spread

The gross spread represents the total compensation earned by underwriters in a securities offering, combining the underwriting spread, selling concession, and management fee. The underwriting spread is the portion retained by the lead underwriter for assuming risk, the selling concession rewards brokers or dealers for selling shares, and the management fee compensates the managing syndicate members for organizing the offering. Understanding these components clarifies how gross spread structures the financial incentives across underwriting syndicates during public offerings.

Structure of Underwriting Spread

The underwriting spread is a crucial component of the gross spread, representing the portion of proceeds retained by underwriters as compensation for managing and assuming the risk of a securities offering. It is typically structured into three segments: the manager's fee, the underwriting fee, and the selling concession, each allocated based on the roles and contributions of participating underwriters. This layered structure ensures alignment of incentives, covers underwriting expenses, and facilitates distribution efficiency within investment banking transactions.

Impact on Issuers and Investors

Gross spread represents the total fees paid by issuers to underwriters during a securities offering, directly affecting the net proceeds an issuer receives and influencing the overall cost of capital. Underwriting spread, a key component of the gross spread, reflects the specific discount or commission retained by underwriters, impacting investor pricing and potential returns. Both spreads critically shape issuer financing costs and investor yield expectations, thereby affecting market participation and pricing efficiency.

Calculation Methods for Both Spreads

The gross spread is typically calculated as the difference between the total amount raised in a securities offering and the amount paid to the issuer, expressed as a percentage of the total proceeds, encompassing the combined fees paid to underwriters, selling concessions, and fees. The underwriting spread, a component of the gross spread, specifically reflects the portion retained by the lead underwriter and is calculated by subtracting selling concessions and other related fees from the gross spread. Precise calculation methods depend on the structure of the offering and include breaking down fees into management fees, underwriting fees, and selling fees to accurately allocate portions within the gross spread.

Industry Practices and Examples

Gross spread and underwriting spread are key metrics in investment banking that represent the compensation earned by underwriters during securities offerings. The gross spread typically ranges from 3% to 7% of the total offering size, reflecting the total fees charged by investment banks, while the underwriting spread specifically denotes the difference between the price paid by underwriters to issuers and the price at which securities are sold to the public. In industry practices, larger IPOs often negotiate lower gross spreads due to competitive underwriting syndicates, exemplified by major tech IPOs where spreads can be closer to 3%, whereas smaller or riskier offerings may see underwriting spreads at the higher end of the spectrum to compensate for increased risk.

Conclusion: Choosing the Right Approach

The choice between gross spread and underwriting spread depends on the specific transaction structure and risk allocation between the issuer and underwriters. Gross spread represents the total underwriting fee, encompassing management, underwriting, and selling fees, which is crucial for calculating overall cost. Underwriting spread focuses on the direct compensation to underwriters, influencing pricing strategies and negotiating terms for optimal capital market outcomes.

Gross Spread Infographic

libterm.com

libterm.com