Fiserv is a global leader in financial technology, providing innovative payment solutions and services that streamline banking, lending, and commerce. Its cutting-edge platforms help businesses enhance customer experiences through secure, efficient transactions and data-driven insights. Explore the rest of this article to understand how Fiserv can transform your financial operations and drive growth.

Table of Comparison

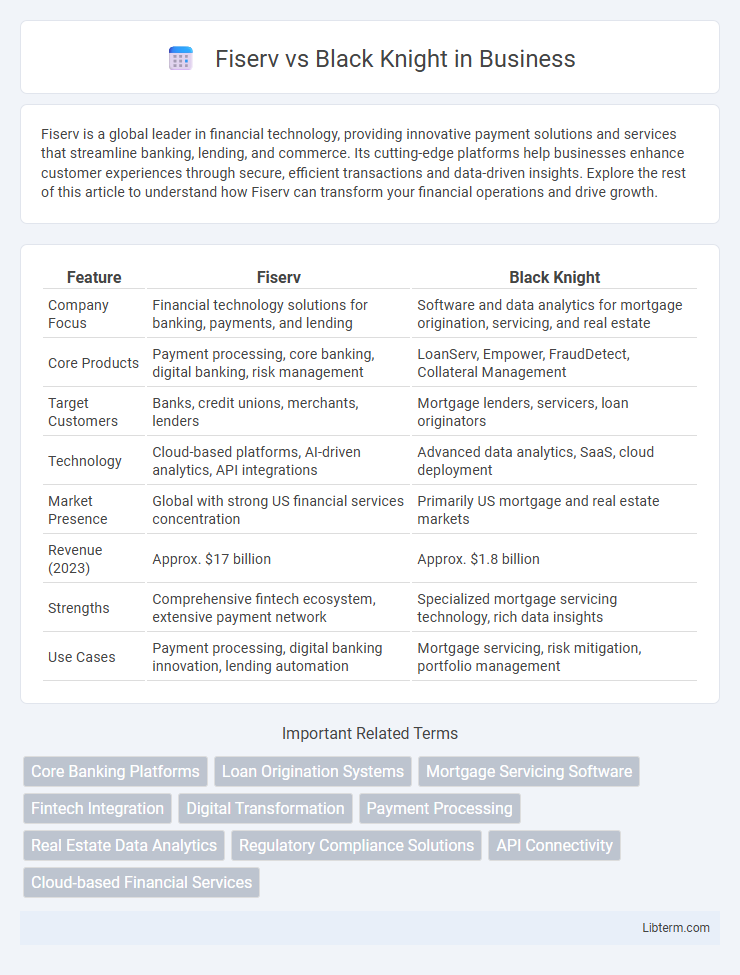

| Feature | Fiserv | Black Knight |

|---|---|---|

| Company Focus | Financial technology solutions for banking, payments, and lending | Software and data analytics for mortgage origination, servicing, and real estate |

| Core Products | Payment processing, core banking, digital banking, risk management | LoanServ, Empower, FraudDetect, Collateral Management |

| Target Customers | Banks, credit unions, merchants, lenders | Mortgage lenders, servicers, loan originators |

| Technology | Cloud-based platforms, AI-driven analytics, API integrations | Advanced data analytics, SaaS, cloud deployment |

| Market Presence | Global with strong US financial services concentration | Primarily US mortgage and real estate markets |

| Revenue (2023) | Approx. $17 billion | Approx. $1.8 billion |

| Strengths | Comprehensive fintech ecosystem, extensive payment network | Specialized mortgage servicing technology, rich data insights |

| Use Cases | Payment processing, digital banking innovation, lending automation | Mortgage servicing, risk mitigation, portfolio management |

Overview of Fiserv and Black Knight

Fiserv is a global leader in financial technology, providing payment processing, risk management, and digital banking solutions to banks, credit unions, and merchants. Black Knight specializes in mortgage technology, loan servicing, and real estate data analytics, serving mortgage lenders, investors, and servicers. Both companies drive efficiency and innovation in the financial services industry, with Fiserv focusing broadly on payment and banking technology, while Black Knight concentrates on mortgage lifecycle software.

Core Business Solutions: Fiserv vs Black Knight

Fiserv and Black Knight both excel in delivering core business solutions tailored to the financial services sector, with Fiserv offering comprehensive payment processing, account processing, and digital banking platforms that emphasize scalability and integration. Black Knight specializes in mortgage servicing software, loan origination, and data analytics solutions, providing robust tools for loan lifecycle management and regulatory compliance. Fiserv targets a broader range of financial institutions with end-to-end operational support, whereas Black Knight focuses predominantly on mortgage-specific technology and risk management capabilities.

Key Features Comparison

Fiserv excels with its comprehensive payment processing solutions, robust digital banking platforms, and advanced fraud detection capabilities, catering mainly to financial institutions. Black Knight stands out with its end-to-end mortgage servicing software, real estate data analytics, and loan origination systems, targeting mortgage lenders and servicers. Both companies emphasize automation and compliance, but Fiserv offers broader payment solutions while Black Knight specializes in mortgage technology.

Technology and Platform Integration

Fiserv leverages advanced cloud-based technologies and open APIs to enable seamless platform integration, supporting real-time data processing and enhancing scalability for financial institutions. Black Knight focuses on robust end-to-end mortgage servicing and loan origination systems, emphasizing deep integration with legacy systems and comprehensive data analytics capabilities. Both companies prioritize technology interoperability but differ in specialization, with Fiserv excelling in broad financial services integration and Black Knight in mortgage and real estate technology platforms.

Market Share and Industry Presence

Fiserv holds a significant market share in the financial technology sector, particularly in payment processing and banking solutions, serving over 12,000 financial institutions globally. Black Knight dominates the mortgage technology market with its comprehensive loan servicing platforms, managing nearly half of the U.S. mortgage servicing rights. Both companies maintain strong industry presence, with Fiserv expanding through strategic acquisitions and Black Knight leveraging data analytics to enhance loan performance and compliance.

Pricing Models and Cost Analysis

Fiserv employs a subscription-based pricing model tailored to various financial services, emphasizing scalability and integration with existing systems, while Black Knight offers a modular pricing approach allowing clients to select specific solutions, which can provide cost efficiencies for targeted needs. Cost analysis reveals Fiserv's model may result in higher initial fees but predictable ongoing expenses, whereas Black Knight's modular pricing can lead to variable costs depending on the extent of service adoption and customization. Both companies factor in implementation, licensing, and maintenance fees, making detailed cost comparisons essential for financial institutions aiming to optimize technology investments.

Customer Support and Service Quality

Fiserv offers robust customer support with 24/7 availability and dedicated account managers, ensuring rapid issue resolution and personalized assistance. Black Knight emphasizes comprehensive service quality through extensive training programs and proactive client engagement, resulting in high customer satisfaction ratings. Both companies leverage advanced technology to streamline support processes, but Fiserv's global support infrastructure often provides broader coverage compared to Black Knight's specialized financial services focus.

Security and Compliance Standards

Fiserv and Black Knight both prioritize robust security protocols, with Fiserv adhering to ISO/IEC 27001 standards and implementing advanced encryption methods to protect financial data. Black Knight emphasizes compliance with industry regulations such as GDPR, HIPAA, and SOC 2, ensuring comprehensive risk management and data privacy. Their platforms integrate continuous monitoring and multi-factor authentication to safeguard against cyber threats and maintain regulatory compliance.

User Experience and Interface Design

Fiserv and Black Knight both emphasize user experience and interface design, but Fiserv prioritizes intuitive navigation and customizable dashboards to enhance client interaction with financial services. Black Knight offers robust data visualization tools and streamlined workflows tailored for mortgage and real estate professionals, improving operational efficiency. Their interfaces integrate advanced analytics and automation features, ensuring users access real-time insights with minimal learning curve.

Choosing Between Fiserv and Black Knight: Which Is Right for You?

Choosing between Fiserv and Black Knight depends largely on your specific financial technology needs; Fiserv excels in comprehensive payment processing and digital banking solutions, while Black Knight specializes in mortgage origination and servicing software. Evaluate your business's core focus--if you prioritize scalable payment systems and omnichannel banking, Fiserv offers robust platforms like Clover and DNA. For mortgage lenders and servicers, Black Knight's Empower and LoanSphere products provide advanced data analytics and workflow automation tailored to enhance loan lifecycle management.

Fiserv Infographic

libterm.com

libterm.com