A reverse merger is a strategic process where a private company acquires a publicly listed company to bypass the lengthy IPO process and become publicly traded quickly. This method offers a faster, cost-effective route to public markets, often enhancing liquidity and access to capital for Your business. Discover the key advantages and potential pitfalls of reverse mergers by reading the full article.

Table of Comparison

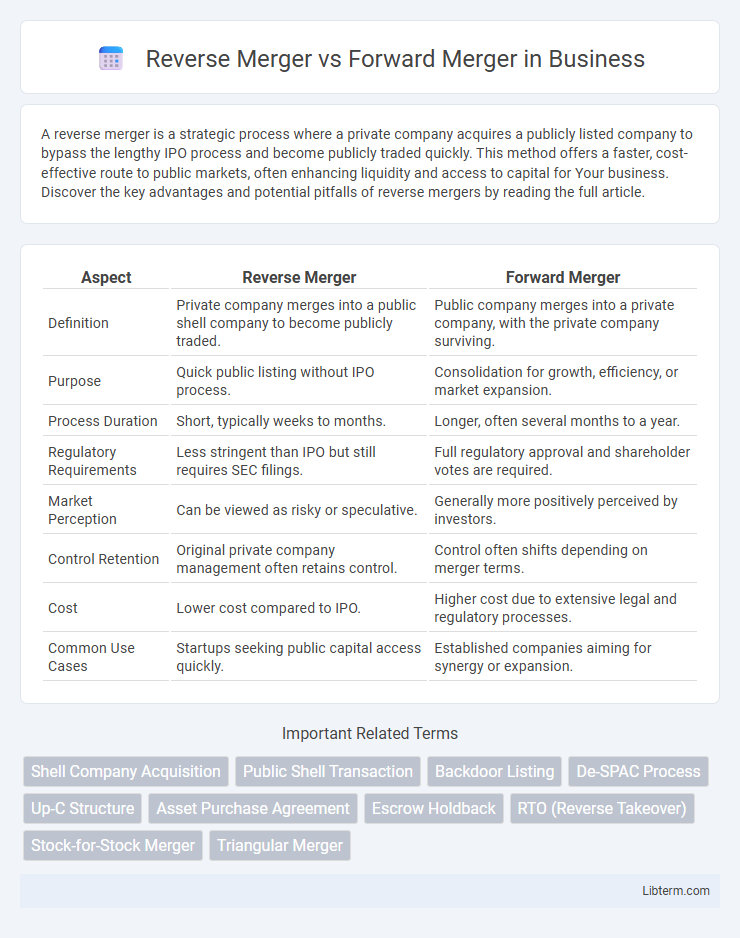

| Aspect | Reverse Merger | Forward Merger |

|---|---|---|

| Definition | Private company merges into a public shell company to become publicly traded. | Public company merges into a private company, with the private company surviving. |

| Purpose | Quick public listing without IPO process. | Consolidation for growth, efficiency, or market expansion. |

| Process Duration | Short, typically weeks to months. | Longer, often several months to a year. |

| Regulatory Requirements | Less stringent than IPO but still requires SEC filings. | Full regulatory approval and shareholder votes are required. |

| Market Perception | Can be viewed as risky or speculative. | Generally more positively perceived by investors. |

| Control Retention | Original private company management often retains control. | Control often shifts depending on merger terms. |

| Cost | Lower cost compared to IPO. | Higher cost due to extensive legal and regulatory processes. |

| Common Use Cases | Startups seeking public capital access quickly. | Established companies aiming for synergy or expansion. |

Introduction to Reverse and Forward Mergers

Reverse mergers allow private companies to become publicly traded by merging with an existing public shell company, offering a quicker and often less expensive alternative to traditional IPOs. Forward mergers involve a private company acquiring a public company or combining with it to form a new entity, typically used to achieve strategic expansion or market entry. Both methods provide distinct pathways for private firms to access public markets, with reverse mergers emphasizing speed and simplicity, while forward mergers focus on synergy and growth potential.

Defining Reverse Merger

A reverse merger occurs when a private company acquires a publicly listed shell company to bypass the lengthy and expensive initial public offering (IPO) process, enabling faster access to public capital markets. In contrast, a forward merger involves a private company merging into a public company directly, often requiring more regulatory scrutiny and longer timelines. Reverse mergers offer a strategic advantage for private firms seeking rapid public listing with reduced disclosure requirements.

Defining Forward Merger

A forward merger occurs when a subsidiary company merges into its parent company, resulting in the subsidiary's dissolution and the parent company continuing to exist with combined assets and liabilities. This process streamlines organizational structure, consolidates operations, and often enhances financial reporting transparency. Unlike reverse mergers, forward mergers primarily facilitate consolidation within existing corporate hierarchies rather than enabling private companies to become publicly traded entities.

Key Differences Between Reverse and Forward Mergers

Reverse mergers involve a private company acquiring a publicly listed shell company to gain stock market access without an initial public offering (IPO), whereas forward mergers typically occur between two operating companies combining resources and operations. In reverse mergers, the private company's shareholders usually maintain control, while in forward mergers, ownership and management integration are negotiated between merging entities. Financial reporting requirements and regulatory scrutiny differ significantly, with reverse mergers often facing less rigorous initial disclosure obligations compared to the comprehensive due diligence in forward mergers.

Advantages of Reverse Mergers

Reverse mergers offer companies quicker access to public markets compared to traditional IPOs, significantly reducing time and costs associated with going public. They provide an opportunity for private firms to bypass the rigorous regulatory requirements and scrutiny involved in forward mergers or IPO processes. This method enables enhanced liquidity for shareholders and can facilitate easier capital raising while maintaining greater control over company operations.

Advantages of Forward Mergers

Forward mergers provide clearer regulatory approval paths, reducing compliance complexities compared to reverse mergers. They facilitate better integration of company cultures and operations, enhancing long-term business synergies. Investors generally perceive forward mergers as more transparent and stable, leading to improved market confidence and valuation.

Disadvantages and Risks of Reverse Mergers

Reverse mergers pose significant risks including limited due diligence due to the accelerated process, increasing the chance of inheriting undisclosed liabilities or financial irregularities from the private company. They often result in lower market credibility and reduced investor confidence compared to forward mergers, which can hinder future fundraising efforts. Regulatory scrutiny is heightened in reverse mergers, with potential legal challenges that can disrupt business operations and damage shareholder value.

Disadvantages and Risks of Forward Mergers

Forward mergers carry significant disadvantages including complex regulatory approvals which can delay the transaction and increase costs. They often face extensive scrutiny from shareholders and regulatory bodies, elevating the risk of deal rejection or legal challenges. Additionally, forward mergers may result in cultural clashes and integration difficulties, potentially undermining anticipated synergies and financial performance.

Strategic Considerations for Choosing a Merger Structure

Choosing between a reverse merger and a forward merger hinges on strategic considerations such as speed to market, regulatory scrutiny, and investor perception. Reverse mergers offer a faster path to public listing with reduced regulatory hurdles but may face skepticism from investors regarding legitimacy and transparency. Forward mergers, while typically more time-consuming due to extensive due diligence and approval processes, provide clearer integration strategies and stronger alignment with long-term corporate goals.

Conclusion: Selecting the Right Merger Approach

Choosing between a reverse merger and a forward merger depends on factors like the company's size, regulatory requirements, and speed of market access; reverse mergers offer faster public listings with potentially lower costs, while forward mergers provide more comprehensive integration and control. Evaluating financial goals, shareholder impact, and long-term strategic vision is essential to determine the optimal merger approach. Companies must balance risk tolerance and desired market positioning to ensure successful transaction outcomes.

Reverse Merger Infographic

libterm.com

libterm.com