Equipment financing allows businesses to acquire necessary tools and machinery without depleting cash reserves, preserving working capital and enabling operational growth. Flexible loan terms and competitive interest rates make it easier to manage expenses while upgrading or expanding your equipment fleet. Discover how equipment financing can transform your business by reading the rest of the article.

Table of Comparison

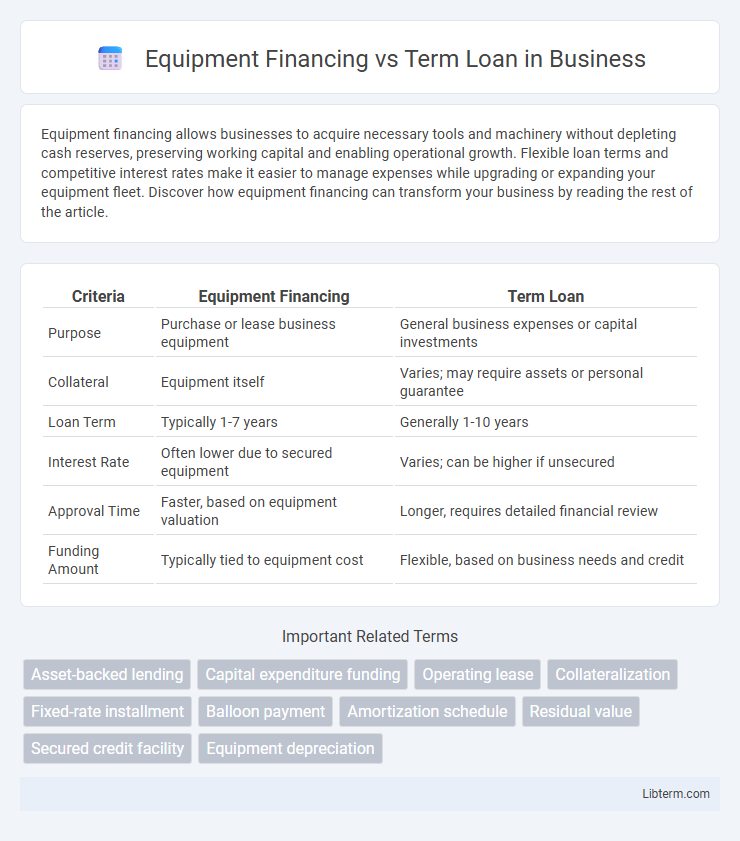

| Criteria | Equipment Financing | Term Loan |

|---|---|---|

| Purpose | Purchase or lease business equipment | General business expenses or capital investments |

| Collateral | Equipment itself | Varies; may require assets or personal guarantee |

| Loan Term | Typically 1-7 years | Generally 1-10 years |

| Interest Rate | Often lower due to secured equipment | Varies; can be higher if unsecured |

| Approval Time | Faster, based on equipment valuation | Longer, requires detailed financial review |

| Funding Amount | Typically tied to equipment cost | Flexible, based on business needs and credit |

Introduction to Equipment Financing and Term Loans

Equipment financing provides businesses with the capital needed to purchase or lease machinery and technology essential for operations, often secured by the equipment itself. Term loans offer a fixed amount of capital with a predefined repayment schedule and interest rate, typically used for a broad range of business investments beyond equipment. Both financing options enable companies to manage cash flow while acquiring necessary assets, but equipment financing is specifically tailored to asset procurement, whereas term loans offer versatile funding solutions.

Key Differences Between Equipment Financing and Term Loans

Equipment financing specifically funds the purchase of business equipment, using the equipment itself as collateral, which often results in lower interest rates and structured payments aligned with the equipment's useful life. Term loans provide a lump sum for a variety of business purposes, secured or unsecured, with fixed repayment terms and higher flexibility in usage but potentially higher interest rates. The key difference lies in the collateral and purpose, where equipment financing is asset-backed and purpose-specific, while term loans offer broader use with varied collateral options.

How Equipment Financing Works

Equipment financing allows businesses to acquire necessary machinery by using the purchased equipment itself as collateral, enabling easier access to capital without draining cash reserves. Payments are structured over a fixed term, aligning with the equipment's useful life, which often includes lower interest rates compared to unsecured loans. This financing method supports cash flow management by spreading out costs and can offer tax advantages through potential depreciation deductions.

How Term Loans Work

Term loans provide businesses with a fixed amount of capital repaid over a predetermined period through regular installments, typically involving fixed or variable interest rates. These loans are often used for significant expenses, including purchasing equipment, and allow borrowers to secure financing tailored to their cash flow by setting specific repayment terms. Unlike equipment financing, term loans are not tied directly to collateral, offering greater flexibility but often requiring stronger credit approval criteria.

Pros and Cons of Equipment Financing

Equipment financing allows businesses to acquire necessary machinery or technology without large upfront costs, enabling improved cash flow management. The main advantage lies in preserving working capital and gaining potential tax benefits through depreciation or interest deductions. However, equipment financing can result in higher overall costs due to interest rates and may require the equipment to serve as collateral, posing a risk if payments are missed.

Pros and Cons of Term Loans

Term loans offer fixed interest rates and predictable payment schedules, providing stability for budgeting and financial planning. However, these loans may have stricter qualification criteria and can involve collateral requirements, which might limit accessibility for some businesses. While term loans deliver lump-sum funding ideal for substantial investments, their inflexibility in repayment terms might pose challenges if cash flow fluctuates unexpectedly.

Eligibility Requirements for Each Option

Equipment financing typically requires businesses to have a solid credit history, proof of income, and a down payment or collateral related to the equipment being purchased. Term loans often demand stronger credit scores, detailed financial statements, and sometimes a longer operational history to prove repayment ability. Both options may require personal guarantees, but equipment financing is generally more accessible for startups or companies with less established credit.

Cost Comparison: Interest Rates and Fees

Equipment financing typically offers lower interest rates compared to term loans due to the secured nature of the asset, reducing lender risk. Term loans often involve higher fees and variable interest rates, increasing overall borrowing costs. Analyzing total repayment amounts, including origination fees and maintenance charges, provides a clearer cost comparison between the two financing options.

Choosing the Right Option for Your Business

Equipment financing allows businesses to acquire necessary machinery or technology with minimal upfront costs, preserving working capital and often providing tax advantages through depreciation. Term loans offer fixed repayment schedules and predictable interest rates, suitable for businesses seeking lump-sum financing for broader needs beyond equipment purchase. Evaluating cash flow stability, loan terms, and asset lifespan helps determine whether equipment financing or a term loan aligns best with your business's financial strategy and growth objectives.

Frequently Asked Questions about Equipment Financing vs Term Loans

Equipment financing typically involves using the equipment itself as collateral, making it easier to obtain for businesses needing specific assets, while term loans usually provide a lump sum with fixed repayment terms and can be used more flexibly. Common questions include eligibility criteria, interest rates, repayment periods, and the impact on cash flow for both financing options. Businesses often inquire about tax benefits, ownership status during repayment, and which option better supports long-term growth strategies.

Equipment Financing Infographic

libterm.com

libterm.com