A subsidiary is a company controlled by another, usually larger, parent company, enabling strategic expansion and market presence. It operates independently but aligns with the parent company's financial and operational objectives. Discover how subsidiaries impact business growth and corporate structure throughout this article.

Table of Comparison

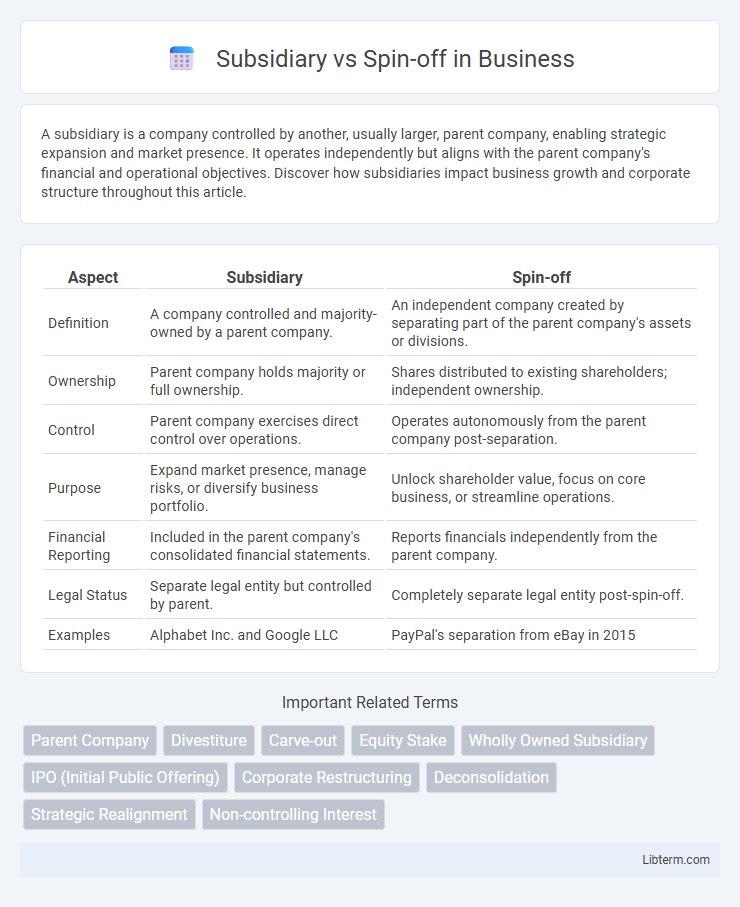

| Aspect | Subsidiary | Spin-off |

|---|---|---|

| Definition | A company controlled and majority-owned by a parent company. | An independent company created by separating part of the parent company's assets or divisions. |

| Ownership | Parent company holds majority or full ownership. | Shares distributed to existing shareholders; independent ownership. |

| Control | Parent company exercises direct control over operations. | Operates autonomously from the parent company post-separation. |

| Purpose | Expand market presence, manage risks, or diversify business portfolio. | Unlock shareholder value, focus on core business, or streamline operations. |

| Financial Reporting | Included in the parent company's consolidated financial statements. | Reports financials independently from the parent company. |

| Legal Status | Separate legal entity but controlled by parent. | Completely separate legal entity post-spin-off. |

| Examples | Alphabet Inc. and Google LLC | PayPal's separation from eBay in 2015 |

Introduction to Subsidiaries and Spin-offs

Subsidiaries are companies controlled by a parent firm, where the parent holds a majority stake, enabling centralized management and strategic direction. Spin-offs occur when a parent company creates an independent entity by distributing shares of a division or business unit to existing shareholders. These corporate structures differ in ownership, control, and post-transaction autonomy, influencing financial performance and market positioning.

Defining Subsidiary: Meaning and Key Features

A subsidiary is a company controlled by a parent organization, typically owning more than 50% of its voting shares, enabling direct management and operational influence. Key features include legal independence, separate financial statements, and distinct branding, while remaining strategically aligned with the parent company's objectives. Subsidiaries allow corporations to diversify markets, mitigate risks, and streamline business operations within varied industries or regions.

Understanding Spin-off: Concept and Characteristics

A spin-off refers to the creation of an independent company through the separation of a division or business unit from a parent company, allowing the new entity to operate autonomously. Key characteristics of a spin-off include distribution of shares to existing shareholders, retention of original ownership structure, and the ability to focus on specific market niches or innovation without the constraints of the parent corporation. This strategic move often aims to unlock shareholder value by enabling focused management, tailored business strategies, and improved operational efficiency for both the parent and the spun-off company.

Structural Differences Between Subsidiaries and Spin-offs

Subsidiaries operate as separate legal entities fully or majority-owned by the parent company, maintaining direct control and consolidated financial reporting. Spin-offs occur when a parent company distributes shares of a division to existing shareholders, creating an independent company with separate management and financial autonomy. The structural difference hinges on ownership and control, with subsidiaries integrated into the parent company's hierarchy and spin-offs functioning as distinct, standalone organizations.

Legal and Regulatory Considerations

Subsidiaries are separate legal entities controlled by a parent company, requiring compliance with corporate governance, tax regulations, and reporting standards specific to each jurisdiction. Spin-offs involve distributing shares of a newly independent company to existing shareholders, triggering regulatory scrutiny from securities authorities like the SEC to ensure transparency and investor protection. Both structures demand adherence to antitrust laws, intellectual property rights, and contractual obligations to maintain legal integrity throughout the transition.

Financial Implications for Parent Companies

Subsidiaries often require significant capital investment and ongoing financial support from the parent company, impacting its balance sheet with consolidated assets and liabilities. Spin-offs can improve the parent company's financial health by unlocking shareholder value and reducing debt, as the new entity operates independently with its own capital structure. Tax implications differ; subsidiaries may offer tax consolidation benefits, while spin-offs usually aim for tax-free distribution under specific regulatory conditions.

Impact on Shareholders and Stakeholders

A subsidiary is a company controlled by a parent corporation, often leading to consolidated financial reporting and potential dilution of shareholder control but offering diversified risk and strategic oversight. In contrast, a spin-off creates an independent company by distributing shares to existing shareholders, enhancing shareholder value through focused management and direct ownership of the new entity, often increasing market valuation. Stakeholders in spin-offs benefit from clearer accountability and operational focus, while subsidiaries may provide stability through integrated resources and aligned corporate governance.

Strategic Advantages of Subsidiaries vs Spin-offs

Subsidiaries offer strategic advantages such as enhanced operational control, focused management, and the ability to leverage parent company resources for scaling and risk mitigation. Spin-offs enable dedicated autonomy, allowing newly independent entities to pursue specialized market opportunities and unlock shareholder value through tailored strategic direction. Choosing subsidiaries over spin-offs often benefits companies aiming for integrated growth, centralized governance, and sustained financial synergies within a unified corporate structure.

Real-World Examples: Subsidiary and Spin-off Case Studies

Coca-Cola's acquisition of Costa Coffee illustrates a subsidiary model where the brand operates under the parent company's control, maintaining strategic alignment. In contrast, PayPal's spin-off from eBay exemplifies a spin-off, creating an independent publicly traded company to unlock shareholder value and focus on its core business. These examples highlight how subsidiaries remain integrated within parent firms, while spin-offs pursue autonomy to enhance growth and market responsiveness.

Choosing Between a Subsidiary and a Spin-off: Key Factors

Choosing between a subsidiary and a spin-off requires evaluating control, financial objectives, and strategic alignment. Subsidiaries offer greater control and integration within the parent company's operations, beneficial for maintaining unified branding and centralized management. Spin-offs, by contrast, allow the new entity to operate independently, often enhancing shareholder value by unlocking business focus and enabling distinct growth opportunities.

Subsidiary Infographic

libterm.com

libterm.com