Investing in real estate offers the potential for long-term wealth growth and passive income through rental properties. Understanding market trends, property valuation, and location significance is crucial for making informed decisions. Explore the rest of the article to discover how you can maximize your real estate investments effectively.

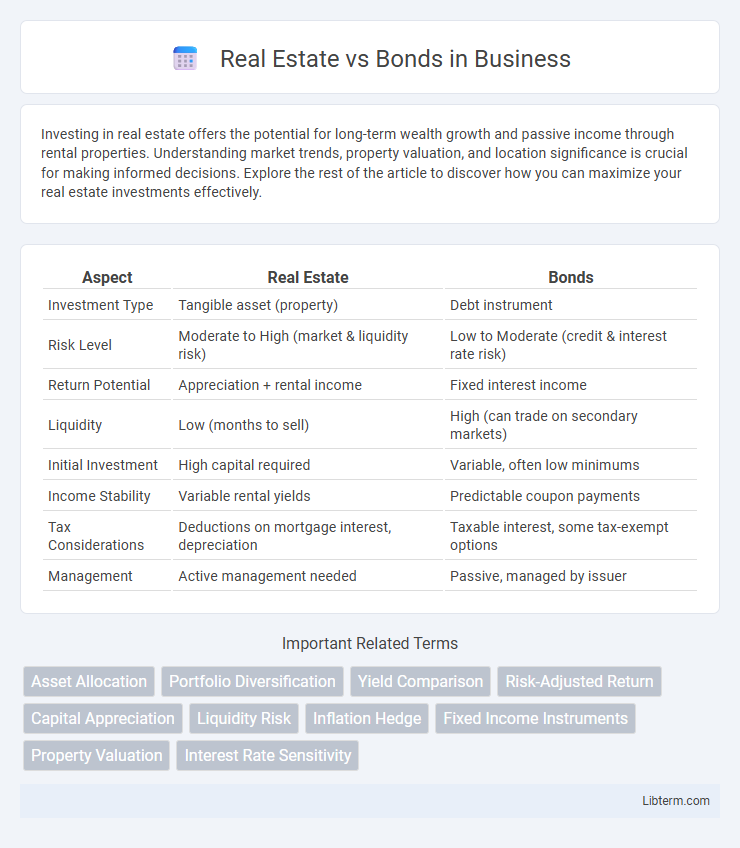

Table of Comparison

| Aspect | Real Estate | Bonds |

|---|---|---|

| Investment Type | Tangible asset (property) | Debt instrument |

| Risk Level | Moderate to High (market & liquidity risk) | Low to Moderate (credit & interest rate risk) |

| Return Potential | Appreciation + rental income | Fixed interest income |

| Liquidity | Low (months to sell) | High (can trade on secondary markets) |

| Initial Investment | High capital required | Variable, often low minimums |

| Income Stability | Variable rental yields | Predictable coupon payments |

| Tax Considerations | Deductions on mortgage interest, depreciation | Taxable interest, some tax-exempt options |

| Management | Active management needed | Passive, managed by issuer |

Introduction to Real Estate and Bonds

Real estate involves investing in physical properties such as residential, commercial, or industrial buildings, offering potential income through rent and capital appreciation. Bonds represent debt securities where investors lend money to governments or corporations in exchange for fixed interest payments over a predetermined period. Both asset classes provide diversification with real estate offering tangible assets and potential inflation hedges, while bonds deliver predictable income and lower risk exposure.

Key Differences Between Real Estate and Bonds

Real estate investments involve owning physical properties, offering potential for rental income and capital appreciation, while bonds are debt securities that provide fixed interest payments and return of principal at maturity. Real estate tends to have higher liquidity risk and requires active management, whereas bonds are generally more liquid and passive investments. Market volatility impacts bonds differently, often providing more stable returns compared to real estate, which is influenced by local market conditions and property demand.

Risk Factors: Real Estate vs Bonds

Real estate investments carry risks such as market volatility, property liquidity challenges, and exposure to location-specific economic downturns, whereas bonds face credit risk, interest rate fluctuations, and inflation risk impacting their fixed income returns. Real estate's value can be significantly affected by physical damage or regulatory changes, while bonds are more sensitive to changes in monetary policy and issuer solvency. Diversifying between both asset classes can mitigate risk by balancing real estate's tangible asset advantages against bonds' predictable income streams.

Potential Returns and Income Generation

Real estate investments typically offer higher potential returns through property appreciation and rental income, often outperforming bonds during periods of economic growth. Bonds provide more stable income generation with fixed interest payments, appealing to risk-averse investors seeking predictable cash flow. The choice between real estate and bonds depends on an investor's risk tolerance, income needs, and market conditions influencing yield and asset appreciation.

Liquidity Comparison: Selling Real Estate vs Bonds

Selling bonds typically offers higher liquidity compared to real estate, as bonds can be traded quickly on secondary markets with minimal transaction costs. Real estate transactions involve longer selling periods, often ranging from weeks to months, due to factors like property inspections, negotiations, and legal processes. This liquidity difference makes bonds more suitable for investors needing faster access to cash.

Tax Implications for Investors

Real estate investments offer tax benefits such as depreciation deductions, mortgage interest deductions, and potential property tax deductions, which can reduce taxable income for investors. Bonds generate interest income that is generally taxed as ordinary income, with municipal bonds often providing tax-free interest at the federal level and sometimes state level, making them attractive for tax-sensitive investors. Understanding the differential tax treatment of real estate and bonds is essential for optimizing after-tax returns and aligning investment strategies with individual tax situations.

Inflation Protection: Which Asset Performs Better?

Real estate typically offers superior inflation protection compared to bonds due to its tangible nature and ability to generate rental income that adjusts with inflation. Unlike fixed-coupon bonds, which lose purchasing power when inflation rises, real estate values and rents often increase, preserving investor returns. Historical data shows real estate assets tend to outperform nominal bonds during periods of high inflation, making them a more effective hedge.

Diversification Benefits in a Portfolio

Real estate investments provide unique diversification benefits in a portfolio by offering low correlation with traditional bond markets, enhancing overall risk-adjusted returns. Physical assets like commercial and residential properties generate steady income streams through rents, which are less sensitive to interest rate fluctuations compared to bond yields. Incorporating real estate alongside bonds reduces portfolio volatility and improves capital preservation during market downturns.

Suitability for Different Investor Profiles

Real estate investments suit risk-tolerant investors seeking tangible assets with potential for rental income and capital appreciation, often requiring longer time horizons and active management. Bonds appeal to conservative investors prioritizing capital preservation and steady income through fixed interest payments, ideal for those needing predictable cash flow and lower volatility. Portfolio diversification benefits from balancing these asset classes to align with individual risk tolerance, investment goals, and liquidity needs.

Conclusion: Choosing Between Real Estate and Bonds

Choosing between real estate and bonds depends on individual financial goals, risk tolerance, and investment horizon. Real estate offers potential for capital appreciation and passive income through rental yields, while bonds provide more stable, predictable returns with lower risk. Investors seeking diversification may benefit from allocating assets across both to balance growth opportunities and income stability.

Real Estate Infographic

libterm.com

libterm.com