Mark to Market accounting reflects the current market value of assets and liabilities, providing a real-time assessment of financial positions. This method ensures transparency and accuracy in financial reporting by adjusting values according to market fluctuations. Discover how Mark to Market impacts your investment decisions and financial statements in the rest of this article.

Table of Comparison

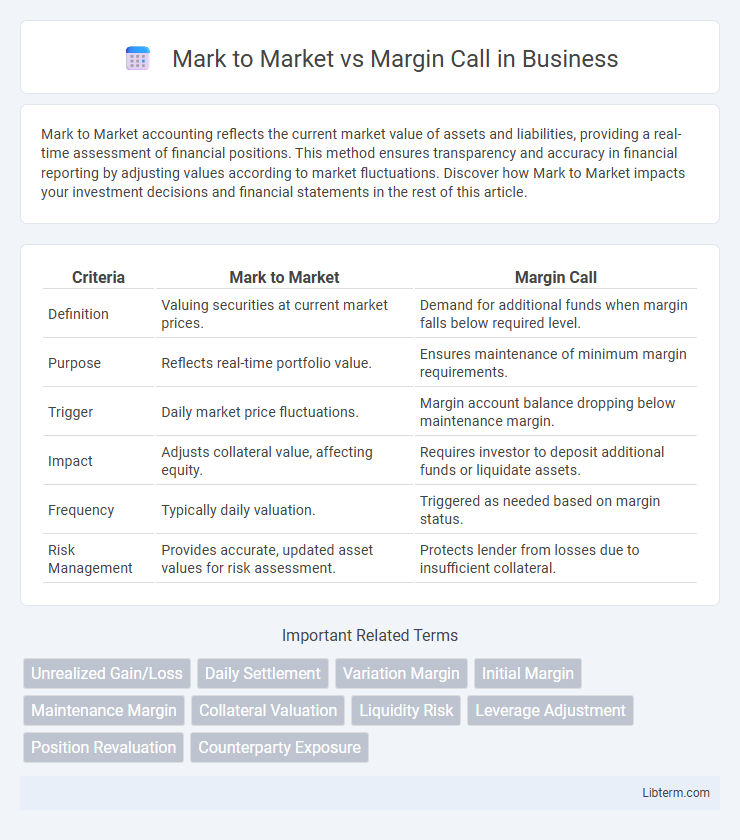

| Criteria | Mark to Market | Margin Call |

|---|---|---|

| Definition | Valuing securities at current market prices. | Demand for additional funds when margin falls below required level. |

| Purpose | Reflects real-time portfolio value. | Ensures maintenance of minimum margin requirements. |

| Trigger | Daily market price fluctuations. | Margin account balance dropping below maintenance margin. |

| Impact | Adjusts collateral value, affecting equity. | Requires investor to deposit additional funds or liquidate assets. |

| Frequency | Typically daily valuation. | Triggered as needed based on margin status. |

| Risk Management | Provides accurate, updated asset values for risk assessment. | Protects lender from losses due to insufficient collateral. |

Understanding Mark to Market: A Fundamental Overview

Mark to Market is the accounting method that adjusts the value of an asset or portfolio to reflect its current market price, ensuring accurate financial reporting. This process plays a critical role in derivatives and futures trading by calculating unrealized gains or losses daily. Understanding Mark to Market is essential to anticipate Margin Calls, which occur when the equity in a margin account falls below the required maintenance margin due to unfavorable market movements.

What is a Margin Call? Key Concepts Explained

A margin call occurs when an investor's account value falls below the broker's required minimum margin, prompting a demand for additional funds or securities to cover potential losses. It is triggered by the mark to market process, which continually assesses the current market value of assets against borrowed funds. Understanding margin calls is crucial for managing leveraged positions and avoiding forced liquidation of assets.

Mark to Market Accounting: How It Works

Mark to Market accounting involves valuing assets and liabilities based on current market prices rather than historical costs, providing a real-time snapshot of financial positions. This method adjusts the value of portfolios daily to reflect market fluctuations, impacting the reported profits and losses. Margin calls are triggered when the marked-to-market value of a trader's account falls below the maintenance margin, requiring additional funds to cover potential losses.

The Mechanics of Margin Calls in Trading

Margin calls occur when the equity in a trader's margin account falls below the broker's required maintenance margin due to adverse price movements reflected in mark-to-market valuations. The mark-to-market process updates the account balance daily based on current market prices, triggering a margin call if losses erode the account equity beneath the set threshold. Traders must promptly deposit additional funds or liquidate positions to restore the required margin and avoid forced position closures by the broker.

Mark to Market vs Margin Call: Core Differences

Mark to Market (MTM) is the daily valuation of a financial asset or portfolio at its current market price, reflecting real-time gains or losses, while a Margin Call is a demand by a broker for an investor to deposit additional funds or securities to maintain the minimum margin requirement. MTM adjustments directly affect the investor's account balance by updating unrealized profits or losses, whereas a Margin Call arises when MTM losses reduce equity below the maintenance margin, triggering the need for immediate capital infusion. The core difference lies in MTM being a valuation process, while a Margin Call is a consequence requiring corrective action to avoid forced liquidation.

Importance in Risk Management and Financial Stability

Mark to Market (MTM) provides real-time valuation of assets, essential for accurate risk assessment and transparency in financial markets. Margin Calls act as critical risk control mechanisms, requiring additional collateral when asset values drop, thereby preventing excessive leverage and potential default. Together, MTM and Margin Calls uphold financial stability by enabling timely risk management and protecting market participants from significant losses.

Real-World Examples: Mark to Market and Margin Calls

Mark to Market (MTM) adjustments reflect the real-time valuation of securities or portfolios, such as when Lehman Brothers' assets were marked down during the 2008 financial crisis, signaling deteriorating credit quality. Margin calls occur when account equity falls below maintenance margins, evidenced by the 2020 oil futures crash, where traders faced margin calls due to plummeting oil prices and rapidly declining contract values. Both mechanisms ensure risk is managed in volatile markets by forcing participants to cover losses or adjust positions promptly.

Impact on Traders and Investors

Mark to Market adjusts the daily value of traders' and investors' positions based on current market prices, directly affecting the evaluation of their assets and liabilities. Margin calls occur when account equity falls below the required maintenance margin, forcing traders to deposit additional funds or liquidate positions to cover losses. This dynamic intensifies risk management pressures, potentially leading to forced sell-offs and increased market volatility.

Regulatory Aspects: Compliance and Reporting

Mark to Market requires financial institutions to regularly update asset valuations to reflect current market prices, ensuring transparent and accurate financial reporting in line with regulatory mandates such as IFRS 13 and FASB ASC 820. Margin Call mechanisms enforce compliance with capital adequacy requirements by prompting traders to deposit additional collateral when asset values decline, thus maintaining market stability and risk management standards set by regulators like the SEC and CFTC. Both practices involve rigorous documentation and reporting obligations under frameworks such as Basel III, designed to enhance transparency and mitigate systemic financial risks.

Strategies to Manage Mark to Market and Margin Calls

Effective strategies to manage Mark to Market (MTM) and margin calls include maintaining a diversified portfolio to reduce volatility exposure and regularly monitoring positions to anticipate MTM fluctuations. Utilizing stop-loss orders and setting predetermined margin thresholds can prevent unexpected margin calls by limiting potential losses. Establishing clear communication with brokers and maintaining sufficient liquid reserves ensures prompt responses to margin calls, minimizing the risk of forced asset liquidation.

Mark to Market Infographic

libterm.com

libterm.com