An unclassified board operates without categorizing its members into specific classes or terms, promoting seamless continuity in governance. This structure often results in more flexible decision-making and swift responses to emerging challenges. Explore the rest of the article to understand how an unclassified board can benefit your organization's leadership.

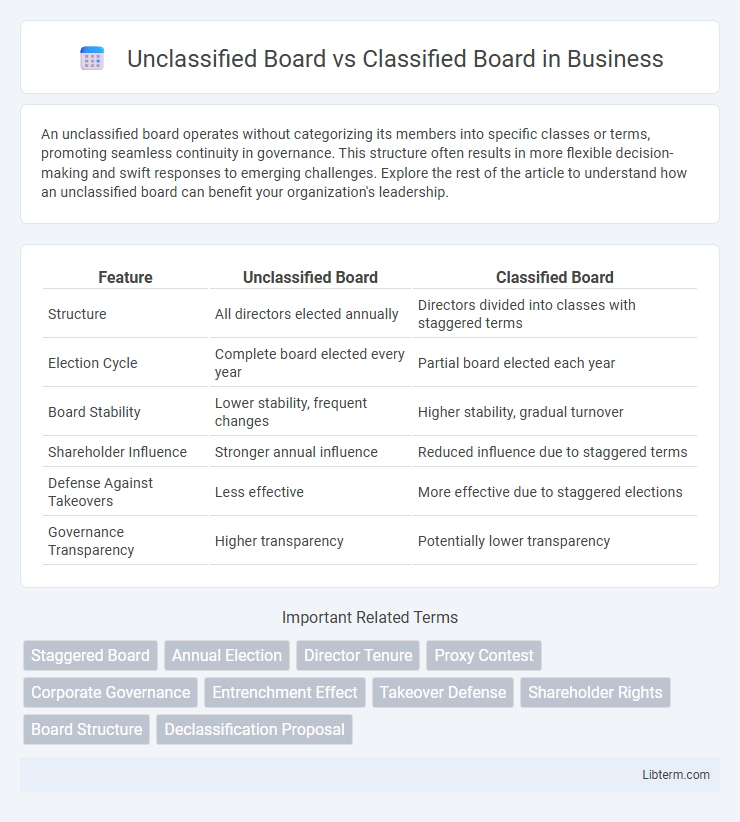

Table of Comparison

| Feature | Unclassified Board | Classified Board |

|---|---|---|

| Structure | All directors elected annually | Directors divided into classes with staggered terms |

| Election Cycle | Complete board elected every year | Partial board elected each year |

| Board Stability | Lower stability, frequent changes | Higher stability, gradual turnover |

| Shareholder Influence | Stronger annual influence | Reduced influence due to staggered terms |

| Defense Against Takeovers | Less effective | More effective due to staggered elections |

| Governance Transparency | Higher transparency | Potentially lower transparency |

Introduction to Board Structures

Unclassified boards consist of directors elected annually, promoting regular accountability and responsiveness to shareholders. Classified boards divide directors into separate classes with staggered terms, typically lasting three years, which can enhance board stability and continuity. This structural distinction impacts corporate governance dynamics, influencing board turnover and shareholder influence.

What is an Unclassified Board?

An unclassified board, also known as a non-staggered board, consists of directors elected annually by shareholders, allowing for complete board turnover in a single election cycle. This structure enhances accountability and responsiveness to shareholders by enabling them to voice approval or disapproval each year. Unclassified boards contrast with classified boards, where directors serve staggered multi-year terms, limiting the frequency of full board elections.

What is a Classified Board?

A classified board, also known as a staggered board, divides directors into separate classes with staggered terms typically lasting three years, preventing all members from being elected simultaneously. This structure enhances continuity and stability by reducing the risk of sudden board takeovers and discouraging hostile takeovers. Classified boards are common in publicly traded companies aiming to maintain long-term strategic direction and protect against rapid shifts in governance.

Key Differences Between Unclassified and Classified Boards

Unclassified boards consist of directors who are all elected annually, allowing shareholders to vote for the entire board each year, enhancing accountability and responsiveness. Classified boards divide directors into staggered terms, typically serving three-year cycles, which can provide continuity and stability but may reduce immediate shareholder influence. Governance structures vary significantly as unclassified boards facilitate quicker strategic changes, whereas classified boards often protect management from hostile takeovers by limiting the frequency of board elections.

Advantages of Unclassified Boards

Unclassified boards, composed entirely of directors elected annually, offer enhanced accountability by allowing shareholders to regularly vote on every director, ensuring responsiveness to investor interests. This structure fosters greater board dynamism and adaptability, facilitating swift changes in leadership that align with evolving corporate strategies. Transparency and shareholder engagement increase under unclassified boards, promoting governance practices that are closely monitored and aligned with shareholder value creation.

Advantages of Classified Boards

Classified boards enhance corporate stability by staggering director terms, reducing the risk of complete board turnover in a single election cycle. This structure supports long-term strategic planning and protects against hostile takeovers by making abrupt changes in board composition more difficult. Stability and continuity in governance often lead to more consistent decision-making and improved shareholder value.

Disadvantages of Each Board Structure

Unclassified boards face disadvantages such as increased risk of sudden leadership changes, which can disrupt long-term strategic planning and reduce stability in corporate governance. Classified boards, on the other hand, may slow down the process of removing underperforming directors, leading to potential entrenchment and reduced accountability to shareholders. Both structures have inherent challenges affecting board responsiveness and shareholder influence.

Impact on Corporate Governance

Unclassified boards, with all directors elected annually, enhance accountability by enabling shareholders to promptly address performance issues and influence board composition. Classified boards, staggered with directors serving multi-year terms, promote stability and long-term strategic planning but may reduce shareholder influence and delay board turnover. The choice between unclassified and classified structures fundamentally shapes corporate governance by balancing responsiveness to shareholders against continuity in leadership.

Board Structure and Shareholder Influence

Unclassified boards consist of all directors elected annually, promoting greater shareholder influence through regular voting opportunities and responsiveness to shareholder preferences. Classified boards divide directors into staggered terms, typically serving three-year periods, which can insulate management and reduce immediate shareholder control by limiting annual seat turnover. This structural difference affects corporate governance by balancing board stability and continuity against shareholder power to enact rapid leadership changes.

Trends and Future Outlook for Board Classification

Unclassified boards are increasingly favored in dynamic, high-growth industries due to their flexibility in responding to market changes and shareholder demands, driving a trend toward annual director elections. Classified boards, which stagger director terms to promote continuity and defense against hostile takeovers, face scrutiny as investors prioritize accountability and transparency. The future outlook indicates a gradual shift toward unclassified boards, supported by evolving corporate governance standards and regulatory pressures emphasizing shareholder rights and board responsiveness.

Unclassified Board Infographic

libterm.com

libterm.com