Index investing offers a low-cost, diversified approach to building wealth by tracking the performance of entire market segments rather than individual stocks. This strategy reduces risk and requires less active management, making it ideal for long-term financial goals. Discover how index investing can simplify your portfolio and boost your returns in the rest of this article.

Table of Comparison

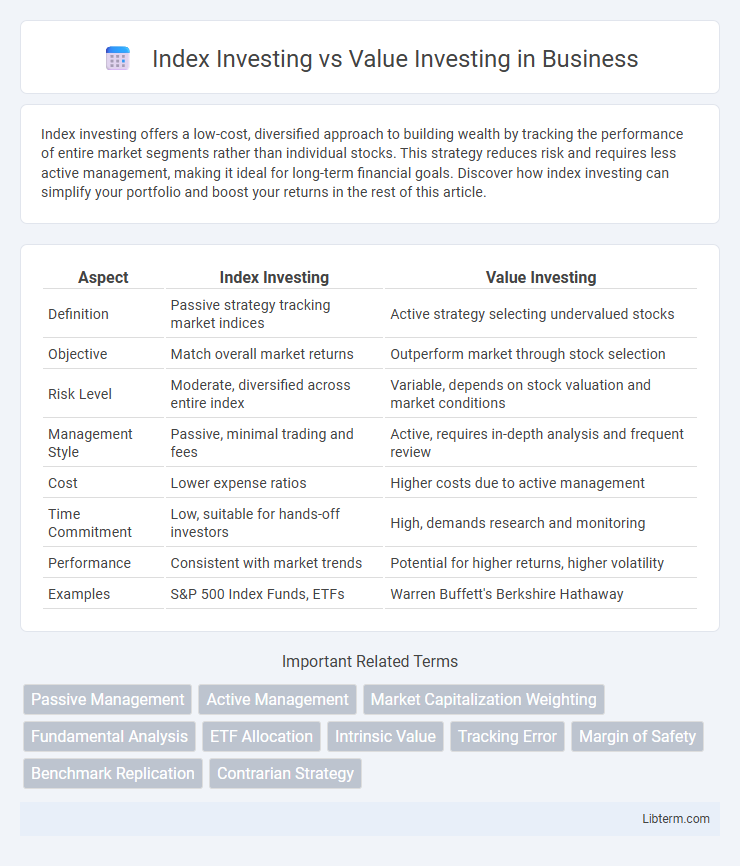

| Aspect | Index Investing | Value Investing |

|---|---|---|

| Definition | Passive strategy tracking market indices | Active strategy selecting undervalued stocks |

| Objective | Match overall market returns | Outperform market through stock selection |

| Risk Level | Moderate, diversified across entire index | Variable, depends on stock valuation and market conditions |

| Management Style | Passive, minimal trading and fees | Active, requires in-depth analysis and frequent review |

| Cost | Lower expense ratios | Higher costs due to active management |

| Time Commitment | Low, suitable for hands-off investors | High, demands research and monitoring |

| Performance | Consistent with market trends | Potential for higher returns, higher volatility |

| Examples | S&P 500 Index Funds, ETFs | Warren Buffett's Berkshire Hathaway |

Introduction to Index Investing and Value Investing

Index investing involves purchasing a broad market index fund that mimics the performance of a specific market index like the S&P 500, offering diversification and low management fees. Value investing focuses on identifying undervalued stocks with strong fundamentals, aiming to buy them at a price lower than their intrinsic value to achieve long-term capital appreciation. Both strategies appeal to investors seeking growth, but index investing emphasizes market-wide exposure while value investing requires detailed stock analysis.

Core Principles of Index Investing

Index investing emphasizes broad market exposure by tracking a specific index, offering diversification and reduced risk. It relies on passive management to minimize costs and aims to replicate market returns rather than outperform them. The core principle is maintaining a portfolio that mirrors the chosen index's composition, ensuring consistent, long-term growth aligned with overall market performance.

Key Concepts of Value Investing

Value investing emphasizes purchasing stocks undervalued relative to their intrinsic worth, relying on fundamental analysis such as price-to-earnings ratio, book value, and dividend yield. It involves identifying companies with strong financial health, consistent earnings, and competitive advantages that are temporarily out of favor in the market. Key concepts include margin of safety, long-term horizon, and disciplined evaluation to exploit market inefficiencies.

Historical Performance Comparison

Index investing has historically provided consistent, broad market returns with lower fees and diversification benefits, often outperforming many actively managed strategies over long periods. Value investing, focusing on undervalued stocks with potential for price appreciation, has delivered periods of substantial outperformance, especially during market recoveries and economic rebounds. Studies show that while value investing can outperform in certain cycles, index investing typically offers more stable returns with less risk and volatility across decades.

Risk and Volatility Assessment

Index investing offers broad market exposure with lower risk and volatility due to diversification across numerous stocks mirroring market indices such as the S&P 500. Value investing concentrates on undervalued stocks with strong fundamentals, which may introduce higher volatility and company-specific risk but aims for long-term capital appreciation through market corrections. Assessing risk involves examining beta coefficients and historical price fluctuations, with index funds generally exhibiting lower beta compared to the often higher beta associated with individual value stocks.

Investment Strategies and Approaches

Index investing involves purchasing a diversified portfolio designed to replicate the performance of a market index, minimizing costs and emphasizing broad market exposure. Value investing focuses on identifying undervalued stocks through fundamental analysis, seeking long-term gains by purchasing securities trading below their intrinsic value. Both strategies prioritize disciplined investment approaches, with index investing using passive management and value investing relying on active stock selection.

Costs and Fees Analysis

Index investing typically involves lower costs and fees due to its passive management style, with expense ratios often below 0.1%, making it cost-effective for long-term investors. Value investing, often involving active stock selection by fund managers, usually incurs higher management fees, typically ranging from 0.5% to 1.5%, reflecting the research and expertise required. These fee differences significantly impact net returns over time, with index funds favoring investors prioritizing cost efficiency and value funds appealing to those seeking potential alpha despite higher expenses.

Suitability for Different Investor Profiles

Index investing offers broad market exposure with low fees, making it suitable for passive investors seeking long-term, diversified growth without frequent trading. Value investing requires in-depth analysis to identify undervalued stocks, appealing to active investors willing to perform research and tolerate higher risk for potential above-average returns. Conservative investors or those with limited time may prefer index funds, while experienced investors with a strong risk tolerance might find value investing more rewarding.

Common Myths and Misconceptions

Index investing is often misunderstood as a passive, low-return strategy, but it provides broad market exposure and typically outperforms many active managers over time. Value investing is mistaken for simply buying cheap stocks, yet it involves rigorous analysis of company fundamentals to identify undervalued assets with strong growth potential. Both strategies face myths about risk and performance, but understanding their distinct principles helps investors create diversified portfolios aligned with long-term financial goals.

Final Thoughts: Choosing the Right Approach

Index investing offers broad market exposure with low fees and consistent returns aligned with overall market performance. Value investing targets undervalued stocks seeking long-term capital appreciation through detailed fundamental analysis. Selecting the right approach depends on individual risk tolerance, investment goals, and willingness to engage in active management or embrace passive strategies.

Index Investing Infographic

libterm.com

libterm.com