Net profit represents the remaining income after all expenses, taxes, and costs have been deducted from total revenue, reflecting the true profitability of a business. It is a critical indicator for assessing financial health, guiding investment decisions, and measuring operational efficiency. Explore the full article to understand how optimizing your net profit can enhance your business success.

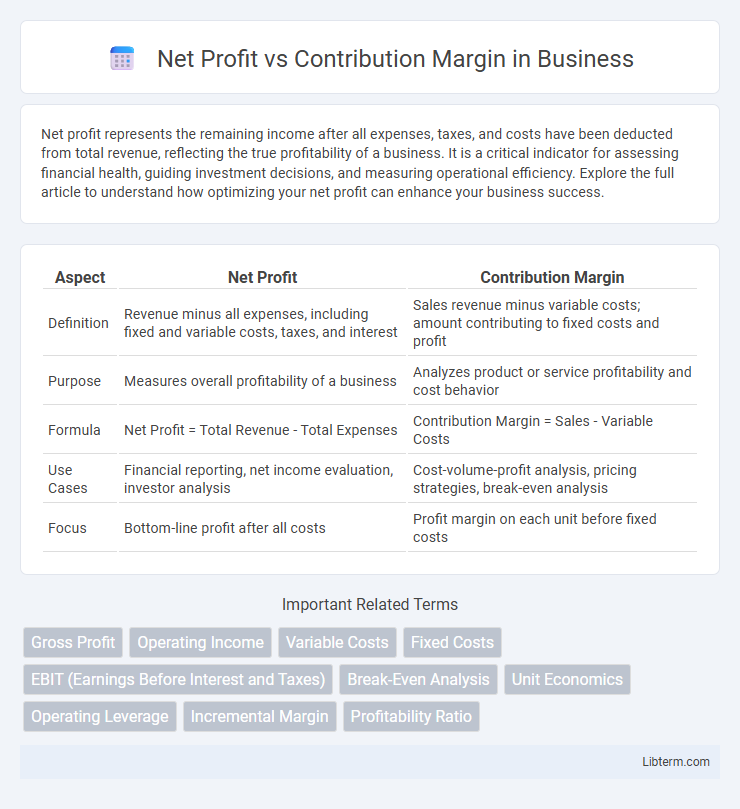

Table of Comparison

| Aspect | Net Profit | Contribution Margin |

|---|---|---|

| Definition | Revenue minus all expenses, including fixed and variable costs, taxes, and interest | Sales revenue minus variable costs; amount contributing to fixed costs and profit |

| Purpose | Measures overall profitability of a business | Analyzes product or service profitability and cost behavior |

| Formula | Net Profit = Total Revenue - Total Expenses | Contribution Margin = Sales - Variable Costs |

| Use Cases | Financial reporting, net income evaluation, investor analysis | Cost-volume-profit analysis, pricing strategies, break-even analysis |

| Focus | Bottom-line profit after all costs | Profit margin on each unit before fixed costs |

Understanding Net Profit

Net profit represents the actual earnings of a business after subtracting all expenses, including operating costs, taxes, interest, and depreciation, from total revenue. It reflects the overall profitability and financial health of a company, providing insight into sustainable business performance. Understanding net profit is crucial for evaluating long-term viability and making informed decisions regarding investment, cost management, and growth strategies.

Defining Contribution Margin

Contribution margin represents the amount remaining from sales revenue after variable costs are deducted, serving as a key indicator of how much revenue contributes to fixed costs and profit generation. Unlike net profit, which accounts for all expenses including fixed costs, taxes, and interest, contribution margin focuses solely on variable costs directly tied to production or sales volume. This metric is essential for assessing product profitability, pricing decisions, and break-even analysis within managerial accounting.

Key Differences Between Net Profit and Contribution Margin

Net profit represents the total earnings after deducting all expenses, including fixed and variable costs, taxes, and interest, while contribution margin reflects the revenue remaining after variable costs are subtracted, indicating the amount available to cover fixed costs and generate profit. Contribution margin is essential for understanding the profitability of individual products or services, whereas net profit provides a comprehensive view of overall business profitability. Key differences include their scope, with contribution margin focusing on variable costs and product-level analysis, and net profit encompassing all financial aspects for full business evaluation.

Importance of Net Profit in Financial Analysis

Net profit represents the actual profitability of a business after all expenses, including fixed and variable costs, taxes, and interest, have been deducted from total revenue, providing a comprehensive measure of financial health. Contribution margin, on the other hand, highlights the profitability of individual products or services by showing the excess of sales over variable costs, aiding in pricing and product mix decisions. Net profit is crucial in financial analysis as it reflects the company's ability to generate sustainable earnings, attract investors, and support long-term growth strategies.

Role of Contribution Margin in Decision Making

Contribution margin plays a crucial role in decision making by highlighting the profitability of individual products or services before fixed costs are deducted, enabling businesses to identify the most profitable items to prioritize. Unlike net profit, which reflects overall profitability after all expenses, contribution margin allows managers to better assess variable costs and make informed choices regarding pricing, product lines, and cost control. This metric supports break-even analysis and short-term financial planning by clearly showing how sales impact profitability.

Calculating Net Profit: Step-by-Step

Calculating net profit starts by subtracting total expenses, including fixed and variable costs, from total revenue. Contribution margin, which is sales revenue minus variable costs, helps identify the portion of sales contributing to fixed costs and profit. Net profit reflects the remaining income after all operational expenses, taxes, and interest are deducted, providing a comprehensive measure of profitability beyond contribution margin analysis.

How to Determine Contribution Margin

Contribution margin is determined by subtracting variable costs from sales revenue, highlighting the amount available to cover fixed costs and generate profit. It is often expressed as a percentage by dividing the contribution margin by sales revenue, providing insight into product profitability and operational efficiency. Calculating contribution margin accurately enables businesses to make informed decisions on pricing, budgeting, and sales strategies.

Impact on Business Strategy: Net Profit vs Contribution Margin

Net profit measures overall profitability by subtracting all expenses from total revenue, directly influencing long-term business strategy and investment decisions. Contribution margin highlights the profitability of individual products or services by calculating sales revenue minus variable costs, guiding decisions on pricing, product focus, and cost control. Understanding the impact of net profit and contribution margin helps businesses optimize resource allocation and prioritize growth initiatives effectively.

Common Misconceptions: Net Profit and Contribution Margin

Net Profit and Contribution Margin are often confused, but they represent different financial metrics critical for business analysis. Net Profit reflects the total earnings after all expenses, taxes, and costs are deducted, whereas Contribution Margin indicates the amount remaining from sales revenue after variable costs, highlighting the portion available to cover fixed costs and generate profit. Misunderstanding this distinction can lead to flawed decision-making, as Contribution Margin is used to assess product-level profitability and break-even points, while Net Profit provides an overall measure of company performance.

Choosing the Right Metric for Your Business Goals

Net profit reflects overall profitability after all expenses, taxes, and interest, making it ideal for assessing long-term business sustainability and shareholder value. Contribution margin highlights the profitability of individual products or services by measuring revenue minus variable costs, helping businesses optimize pricing and operational decisions. Selecting the right metric hinges on your business goals: use net profit for financial health monitoring and strategic planning, while contribution margin is key for product-level analysis and cost control.

Net Profit Infographic

libterm.com

libterm.com