Preferred stock offers investors a fixed dividend payment and priority over common stockholders in the event of company liquidation, making it a more secure investment option. Unlike common stock, preferred shares typically do not come with voting rights but provide a steady income stream that can appeal to risk-averse investors. Explore the rest of the article to understand how preferred stock can fit into Your investment portfolio and its potential advantages.

Table of Comparison

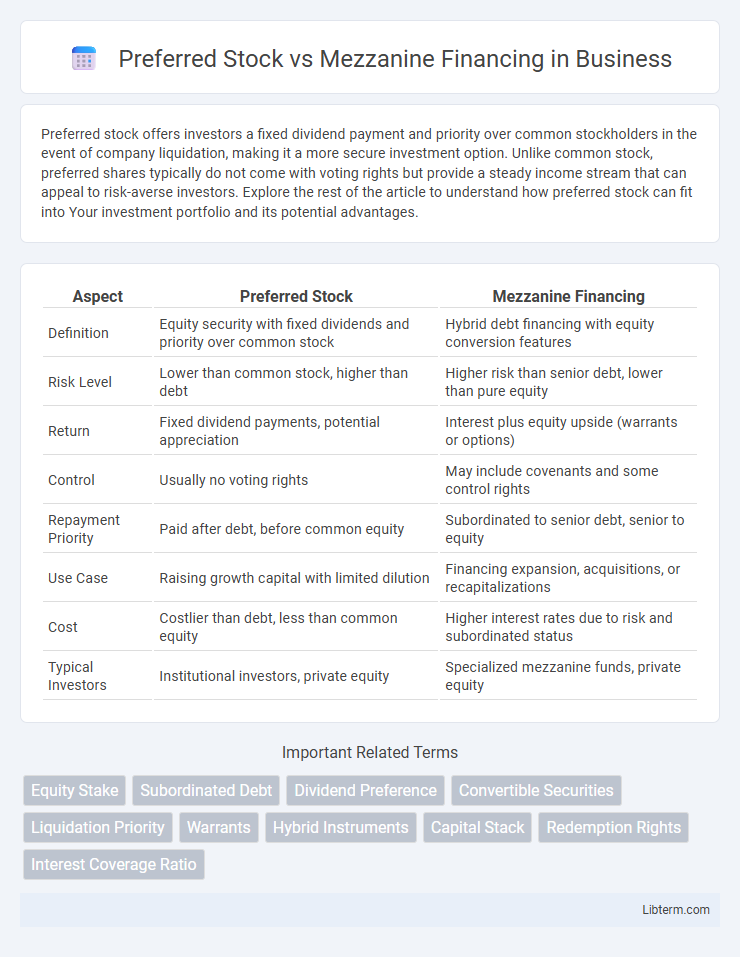

| Aspect | Preferred Stock | Mezzanine Financing |

|---|---|---|

| Definition | Equity security with fixed dividends and priority over common stock | Hybrid debt financing with equity conversion features |

| Risk Level | Lower than common stock, higher than debt | Higher risk than senior debt, lower than pure equity |

| Return | Fixed dividend payments, potential appreciation | Interest plus equity upside (warrants or options) |

| Control | Usually no voting rights | May include covenants and some control rights |

| Repayment Priority | Paid after debt, before common equity | Subordinated to senior debt, senior to equity |

| Use Case | Raising growth capital with limited dilution | Financing expansion, acquisitions, or recapitalizations |

| Cost | Costlier than debt, less than common equity | Higher interest rates due to risk and subordinated status |

| Typical Investors | Institutional investors, private equity | Specialized mezzanine funds, private equity |

Overview of Preferred Stock and Mezzanine Financing

Preferred stock represents an ownership stake with fixed dividends and priority over common stock in asset liquidation, combining characteristics of equity and debt. Mezzanine financing is a hybrid of debt and equity financing, typically used by companies to finance expansion, offering lenders equity conversion options or warrants alongside higher interest rates. Both instruments provide flexible capital solutions that balance investor risk and company growth needs.

Key Differences Between Preferred Stock and Mezzanine Financing

Preferred stock represents an equity investment with fixed dividends and priority over common stock in asset liquidation, while mezzanine financing is a hybrid debt-equity instrument often structured as subordinated debt with attached warrants or conversion options. Preferred stockholders have ownership rights and potential appreciation, whereas mezzanine lenders primarily seek higher interest returns and possible equity upside without direct control. Mezzanine financing typically carries higher risk and cost than secured debt but offers more flexibility and less dilution compared to issuing new preferred equity.

Advantages of Preferred Stock for Investors

Preferred stock offers investors priority over common stockholders in dividend payments and asset liquidation, enhancing income stability and reducing investment risk. It often includes fixed dividend rates, providing predictable cash flow and potential tax advantages compared to mezzanine debt interest payments. Investors benefit from potential appreciation through convertible features and a stronger claim in the capital structure relative to mezzanine financing.

Benefits of Mezzanine Financing for Companies

Mezzanine financing offers companies flexible capital that bridges the gap between equity and senior debt, enabling growth without significant ownership dilution. It typically provides subordinated debt with equity participation options, aligning investor interests with company performance and increasing access to larger funding amounts. This financing structure enhances balance sheet leverage while preserving control, making it advantageous for businesses seeking expansion and strategic acquisitions.

Risk Profiles: Preferred Stock vs. Mezzanine Financing

Preferred stock carries lower risk than mezzanine financing due to its equity-like characteristics, offering fixed dividends and priority over common stock in liquidation but lacking voting rights. Mezzanine financing involves higher risk, combining debt and equity features, with subordinated debt status and potential equity warrants, leading to higher returns but increased default risk. Investors choose preferred stock for stable income and mezzanine financing for aggressive growth with greater risk tolerance.

Typical Structures and Terms

Preferred stock typically features fixed dividend payments, liquidation preferences, and convertible options, providing investors with downside protection and potential equity upside. Mezzanine financing combines debt and equity elements, often structured as subordinated loans with warrants or options to convert into common equity, featuring higher interest rates and flexible repayment terms. Preferred stock prioritizes dividends and liquidity preferences, while mezzanine financing emphasizes cash flow through interest payments alongside equity participation.

Impact on Company Ownership and Control

Preferred stock typically grants investors ownership stakes with dividend preferences but limited control rights, thereby diluting existing shareholders' equity without significantly affecting company management decisions. Mezzanine financing, often structured as subordinated debt with equity warrants, imposes fewer ownership dilution effects but may include covenants that influence strategic decisions and financial policies. Companies seeking to maintain control usually prefer mezzanine financing to preserve decision-making authority while balancing capital needs.

Use Cases: When to Choose Each Option

Preferred stock is ideal for companies seeking long-term equity financing without diluting control, often used by firms in growth stages needing capital to expand operations or enter new markets. Mezzanine financing suits businesses aiming for short-to-medium term funding with flexible repayment terms, typically employed during acquisitions, buyouts, or major capital projects requiring debt that converts into equity if unpaid. Firms prioritize preferred stock when maintaining shareholder equity is crucial, whereas mezzanine financing is chosen to balance debt and equity costs while preserving ownership structure.

Tax Considerations and Implications

Preferred stock dividends are generally paid from after-tax earnings and do not provide the issuer with a tax deduction, making them less tax-efficient compared to mezzanine financing, where interest payments are tax-deductible and reduce taxable income. Mezzanine financing often involves subordinated debt with equity kickers, allowing companies to benefit from interest expense deductions while managing dilution risk. Careful structuring of mezzanine instruments can optimize tax benefits and balance leverage with shareholder equity, impacting corporate tax liabilities and cash flow management.

Summary: Choosing the Right Capital Solution

Preferred stock offers fixed dividends and equity-like features, appealing to investors seeking steady income and ownership potential without immediate debt obligations. Mezzanine financing combines debt and equity elements, providing flexible capital with higher risk and return profiles suited for growth-stage companies needing substantial funding. Evaluating company goals, risk tolerance, and capital structure requirements is critical in selecting the right solution between preferred stock and mezzanine financing.

Preferred Stock Infographic

libterm.com

libterm.com