A joint venture is a strategic partnership where two or more businesses combine resources to achieve specific goals while sharing profits and risks. This collaboration allows companies to leverage each other's strengths, enter new markets, and innovate efficiently. Discover how forming a joint venture can transform your business by reading the rest of the article.

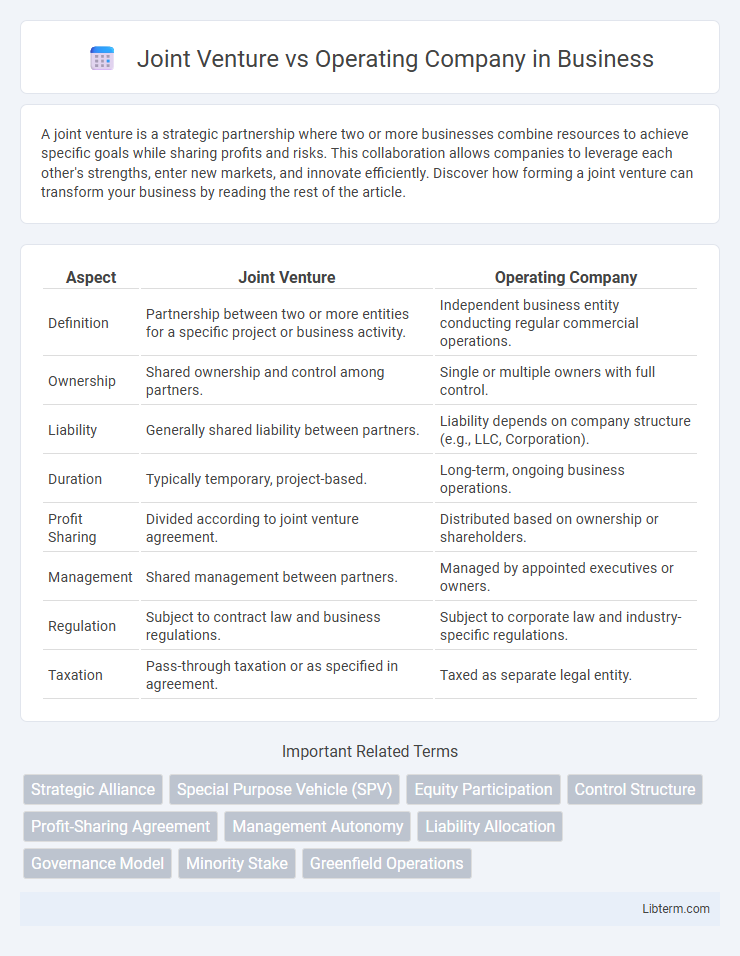

Table of Comparison

| Aspect | Joint Venture | Operating Company |

|---|---|---|

| Definition | Partnership between two or more entities for a specific project or business activity. | Independent business entity conducting regular commercial operations. |

| Ownership | Shared ownership and control among partners. | Single or multiple owners with full control. |

| Liability | Generally shared liability between partners. | Liability depends on company structure (e.g., LLC, Corporation). |

| Duration | Typically temporary, project-based. | Long-term, ongoing business operations. |

| Profit Sharing | Divided according to joint venture agreement. | Distributed based on ownership or shareholders. |

| Management | Shared management between partners. | Managed by appointed executives or owners. |

| Regulation | Subject to contract law and business regulations. | Subject to corporate law and industry-specific regulations. |

| Taxation | Pass-through taxation or as specified in agreement. | Taxed as separate legal entity. |

Understanding Joint Ventures: Definition and Key Features

A joint venture (JV) is a business arrangement where two or more parties collaborate by pooling resources to achieve a specific project or business activity, sharing profits, losses, and control. Key features of a joint venture include shared ownership, joint management, limited scope or duration, and separate legal entity formation in most cases. Unlike operating companies, JVs emphasize partnership synergy without full merger, allowing entities to maintain independent operations while pursuing common goals.

What is an Operating Company? Core Characteristics

An operating company is a business entity actively engaged in producing goods or providing services to generate revenue, distinct from holding or investment companies. Core characteristics include direct control over daily business operations, ownership of assets, and responsibility for liabilities and compliance with regulatory requirements. Unlike joint ventures, operating companies maintain full management authority and operate independently without partnership structures.

Legal Structure: Joint Venture vs Operating Company

A joint venture (JV) is a distinct legal entity formed by two or more parties to undertake a specific business project, with shared ownership, control, and profits, while limiting liability to the venture's scope. An operating company is a standalone legal entity fully owning and controlling its assets and operations, responsible for all liabilities and regulatory compliance. The JV structure often involves contractual agreements outlining governance and profit-sharing, whereas operating companies follow corporate structures such as C-corporations or LLCs with comprehensive legal frameworks for ongoing business activities.

Ownership and Control Differences

Joint ventures involve shared ownership and control between two or more parties, with each partner contributing resources, equity, and decision-making authority based on agreed terms. Operating companies, on the other hand, are typically owned and controlled by a single entity or shareholders with centralized authority, allowing for unified strategic management and operational decisions. The key difference lies in the distribution of ownership stakes and governance, where joint ventures require collaborative control and operating companies function under consolidated ownership.

Financial Implications: Funding and Profit Sharing

Joint ventures require partners to contribute capital, spreading financial risk but often complicating funding arrangements due to shared control and decision-making. Operating companies typically secure funding through equity or debt, maintaining sole control over profit retention and reinvestment strategies. Profit sharing in joint ventures is proportionate to ownership stakes, impacting cash flow distributions, while operating companies allocate profits based on internal policies and shareholder agreements.

Risk Management in Joint Ventures vs Operating Companies

Risk management in joint ventures involves shared liabilities and coordinated risk strategies among partners, increasing complexity due to differing objectives and governance structures. Operating companies independently manage risks through centralized control, allowing for streamlined decision-making and direct accountability. Effective risk mitigation in joint ventures requires robust contractual agreements and continuous communication, whereas operating companies benefit from integrated risk management frameworks.

Decision-Making Processes Compared

Joint ventures involve shared decision-making authority between partnering entities, requiring consensus and coordinated collaboration, which can slow down the process but integrates diverse expertise. Operating companies have centralized decision-making systems, enabling quicker, streamlined choices driven by a clear hierarchy and unified leadership. This distinction impacts agility, with operating companies typically responding faster to market changes while joint ventures leverage pooled resources for strategic decisions.

Tax Considerations: JV vs Operating Company

A Joint Venture typically allows entities to share profits and losses directly, providing potential tax advantages through pass-through taxation, where income is only taxed once at the partner level. Operating Companies are taxed separately as distinct legal entities and may face double taxation on corporate income and dividends paid to shareholders. The choice between a Joint Venture and an Operating Company structure significantly impacts tax liabilities, deductions, and compliance obligations.

Suitability for Different Business Objectives

Joint ventures are ideal for businesses aiming to share resources, risks, and expertise in pursuing a specific project or market entry, offering flexibility without full integration. Operating companies suit organizations seeking long-term control, brand identity, and comprehensive management over business operations and decision-making. Selecting between a joint venture and an operating company depends on strategic goals, investment horizon, and desired level of operational control.

Pros and Cons: Joint Ventures vs Operating Companies

Joint ventures offer shared risk and resource pooling, enabling companies to leverage complementary strengths and enter new markets more easily; however, they can face challenges in decision-making due to differing partner goals and potential conflicts. Operating companies provide full control over operations and strategy execution, facilitating quicker decision-making and consistent brand management, but bear all financial risks and may face limitations in capital and expertise. Both structures present trade-offs between control, risk distribution, resource access, and operational complexity that companies must evaluate based on their strategic objectives.

Joint Venture Infographic

libterm.com

libterm.com