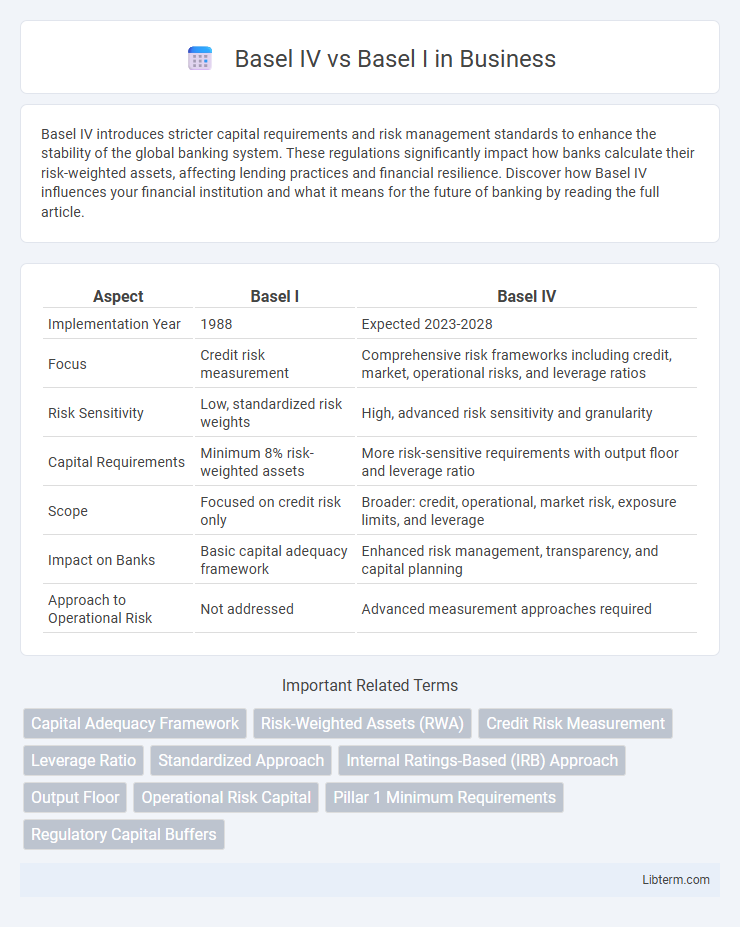

Basel IV introduces stricter capital requirements and risk management standards to enhance the stability of the global banking system. These regulations significantly impact how banks calculate their risk-weighted assets, affecting lending practices and financial resilience. Discover how Basel IV influences your financial institution and what it means for the future of banking by reading the full article.

Table of Comparison

| Aspect | Basel I | Basel IV |

|---|---|---|

| Implementation Year | 1988 | Expected 2023-2028 |

| Focus | Credit risk measurement | Comprehensive risk frameworks including credit, market, operational risks, and leverage ratios |

| Risk Sensitivity | Low, standardized risk weights | High, advanced risk sensitivity and granularity |

| Capital Requirements | Minimum 8% risk-weighted assets | More risk-sensitive requirements with output floor and leverage ratio |

| Scope | Focused on credit risk only | Broader: credit, operational, market risk, exposure limits, and leverage |

| Impact on Banks | Basic capital adequacy framework | Enhanced risk management, transparency, and capital planning |

| Approach to Operational Risk | Not addressed | Advanced measurement approaches required |

Overview of Basel I and Basel IV

Basel I, introduced in 1988, established the first international framework for banking regulation, focusing primarily on credit risk with minimum capital requirements set at 8% of risk-weighted assets. Basel IV, finalized in 2017, significantly enhances risk sensitivity by revising standardized approaches for credit, market, and operational risks while introducing output floor measures to limit the benefit banks gain from internal models. The evolution from Basel I to Basel IV reflects a shift towards more comprehensive risk assessment and stronger capital adequacy standards.

Historical Context of Basel Accords

Basel I, introduced in 1988 by the Basel Committee on Banking Supervision, established the first global minimum capital requirements for banks, primarily focusing on credit risk and creating a standardized measure to ensure financial stability. Basel IV, an evolution of Basel III reforms finalized around 2017-2019, refines risk sensitivity by addressing weaknesses in risk-weighted asset calculations, enhancing capital adequacy frameworks, and improving market discipline through more stringent operational risk and leverage ratio standards. The historical context reflects a trajectory from basic regulatory frameworks to more sophisticated, risk-sensitive regulations designed to prevent financial crises and promote resilience in the global banking system.

Key Objectives: Basel I vs Basel IV

Basel I primarily focused on establishing minimum capital requirements to mitigate credit risk by categorizing assets into broad risk buckets, while Basel IV enhances risk sensitivity through refined risk-weighted asset calculations and incorporates operational and market risks more comprehensively. Basel IV aims to improve the accuracy and comparability of capital adequacy by introducing standardized approaches and internal model constraints to prevent underestimation of risks. The key objective shift reflects Basel IV's emphasis on stronger, more risk-sensitive regulatory capital frameworks to bolster global financial stability.

Capital Requirements: Then and Now

Basel IV significantly tightens capital requirements compared to Basel I by introducing more risk-sensitive measures and higher capital buffers to address modern financial system complexities. Basel I primarily relied on fixed risk weights for broad asset categories, whereas Basel IV incorporates advanced risk modeling techniques and adjustments for operational and credit risk, enhancing banks' resilience. These updates ensure that capital adequacy reflects the current risk profiles more accurately, promoting greater stability in the global banking sector.

Risk Assessment Approaches

Basel IV significantly refines risk assessment approaches compared to Basel I by introducing more risk-sensitive capital requirements and enhanced methodologies for measuring credit, market, and operational risks. It replaces Basel I's simplistic standardized risk weights with advanced Internal Ratings-Based (IRB) models and output floor mechanisms to ensure consistency and risk sensitivity across banks. The framework promotes more granular risk differentiation, aiming to improve the resilience of financial institutions against economic shocks.

Credit Risk Evaluation Differences

Basel IV introduces more stringent credit risk evaluation frameworks compared to Basel I, emphasizing risk sensitivity and enhancing the granularity of risk assessment. Unlike Basel I's standardized approach using fixed risk weights, Basel IV incorporates advanced internal ratings-based (IRB) models and revised risk weight formulas that better capture borrower creditworthiness and exposure characteristics. This evolution enhances capital adequacy measures by aligning regulatory capital requirements more closely with actual credit risk profiles.

Market Risk and Operational Risk Changes

Basel IV introduces significant enhancements over Basel I by implementing more advanced market risk measurement approaches, such as the Fundamental Review of the Trading Book (FRTB), which replaces the simplistic standardized and internal models used in Basel I, improving risk sensitivity and capital adequacy. Operational risk treatment transitions from the basic standardized approach in Basel I to a more risk-sensitive standardized approach under Basel IV, eliminating the Advanced Measurement Approaches (AMA) and incorporating business indicator components and internal loss data to better capture operational risk exposure. These changes aim to increase the robustness and comparability of capital requirements, reducing model risk and enhancing the resilience of banks to market and operational shocks.

Impact on Global Banking Practices

Basel IV introduces stricter capital requirements and enhanced risk sensitivity compared to Basel I, significantly influencing global banking risk management frameworks. It enforces more granular calculations for credit, market, and operational risks, driving banks worldwide to bolster their capital reserves and improve transparency. The shift from Basel I's simpler measures to Basel IV's detailed standards compels banks to adopt advanced data analytics and reporting systems, enhancing overall financial stability in the international banking sector.

Implementation Challenges and Timelines

Basel IV introduces significantly more complex risk-based capital requirements than Basel I, creating substantial implementation challenges for banks, including updating risk models and IT systems. The timeline for Basel IV implementation has been extended several times, with full compliance expected by January 2028, compared to Basel I's simpler standards established in the late 1980s. Banks face increased regulatory scrutiny and higher operational costs due to detailed data demands and stricter credit risk, market risk, and operational risk frameworks under Basel IV.

Future Outlook for Basel Regulatory Frameworks

The Basel IV regulatory framework introduces stricter capital requirements and enhanced risk sensitivity compared to the simpler Basel I standards, aiming to improve banking sector resilience and financial stability. Future outlooks emphasize ongoing refinement of stress testing, leverage ratios, and credit risk models to address emerging risks and economic complexities. Digital transformation and climate-related financial risks are expected to drive further evolution in Basel regulations, promoting transparency and sustainability in global banking practices.

Basel IV Infographic

libterm.com

libterm.com