Net Asset Value (NAV) represents the value per share of a mutual fund or an exchange-traded fund (ETF), calculated by dividing the total value of all assets minus liabilities by the number of outstanding shares. Understanding NAV helps You assess the fund's market value and determine the price at which shares can be bought or sold. Explore the rest of the article to learn how NAV impacts your investment decisions and portfolio management.

Table of Comparison

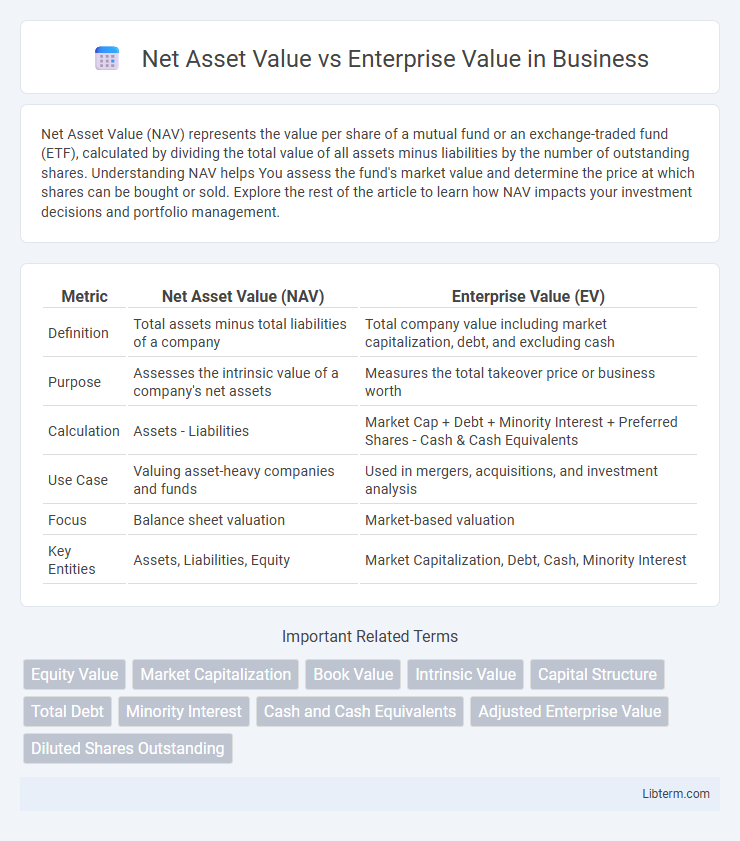

| Metric | Net Asset Value (NAV) | Enterprise Value (EV) |

|---|---|---|

| Definition | Total assets minus total liabilities of a company | Total company value including market capitalization, debt, and excluding cash |

| Purpose | Assesses the intrinsic value of a company's net assets | Measures the total takeover price or business worth |

| Calculation | Assets - Liabilities | Market Cap + Debt + Minority Interest + Preferred Shares - Cash & Cash Equivalents |

| Use Case | Valuing asset-heavy companies and funds | Used in mergers, acquisitions, and investment analysis |

| Focus | Balance sheet valuation | Market-based valuation |

| Key Entities | Assets, Liabilities, Equity | Market Capitalization, Debt, Cash, Minority Interest |

Introduction to Net Asset Value and Enterprise Value

Net Asset Value (NAV) represents a company's total assets minus its total liabilities, offering insight into the firm's intrinsic value from a balance sheet perspective. Enterprise Value (EV) reflects the total market value of a company, including equity, debt, and cash, providing a comprehensive measure of its overall worth for acquisition or investment purposes. Understanding both NAV and EV is essential for investors to evaluate a company's financial health and investment potential accurately.

Defining Net Asset Value (NAV)

Net Asset Value (NAV) represents the total value of a company's assets minus its liabilities, providing a snapshot of the company's intrinsic worth based on its balance sheet. NAV is often used in the valuation of investment funds, real estate, and companies with substantial tangible assets, reflecting the equity value available to shareholders. This contrasts with Enterprise Value (EV), which captures a company's total market value including debt and excluding cash, offering a broader measure of corporate valuation.

Defining Enterprise Value (EV)

Enterprise Value (EV) represents the total market value of a company's operating assets, calculated by adding market capitalization, total debt, and minority interest, then subtracting cash and cash equivalents. It provides a comprehensive measure of a firm's worth, reflecting both equity and debt holders' claims. EV is crucial for comparing companies with different capital structures, as it focuses on business value independent of financing methods.

Key Components of NAV

Net Asset Value (NAV) primarily consists of a company's total assets minus its total liabilities, reflecting the book value of equity available to shareholders. Key components of NAV include tangible assets such as property, plant, and equipment, current assets like cash and receivables, and intangible assets minus all outstanding debts and obligations. NAV serves as a fundamental measure to assess the intrinsic value of a company, contrasting with Enterprise Value (EV), which incorporates market capitalization, debt, minority interest, and excludes cash.

Key Components of EV

Enterprise Value (EV) incorporates key components such as market capitalization, total debt, preferred stock, and minority interest, minus cash and cash equivalents, providing a comprehensive measure of a company's total value. Unlike Net Asset Value (NAV), which focuses on the book value of assets minus liabilities, EV reflects the market's valuation and includes financial obligations that affect acquisition costs. This makes EV a crucial metric for investors evaluating a company's takeover price and overall financial health.

Calculation Methods for NAV and EV

Net Asset Value (NAV) is calculated by subtracting total liabilities from total assets, reflecting the intrinsic value of a company's equity. Enterprise Value (EV) is computed by adding market capitalization, total debt, and preferred shares, then subtracting cash and cash equivalents, representing the total firm value including debt. NAV focuses on the book value of assets minus liabilities, while EV accounts for market values and debt structure to assess overall company worth.

Main Differences Between NAV and EV

Net Asset Value (NAV) represents the total value of a company's assets minus its liabilities, primarily reflecting the book value of equity, whereas Enterprise Value (EV) measures a company's total market value, including equity, debt, and cash. NAV is used mainly for asset-heavy companies and investment funds to assess intrinsic value, while EV provides a comprehensive valuation used in mergers, acquisitions, and comparing companies regardless of capital structure. The main differences lie in NAV's focus on net assets at book value and EV's inclusion of market capitalization, debt, and cash to reflect true acquisition cost.

When to Use NAV vs Enterprise Value

Net Asset Value (NAV) is most appropriate for valuing asset-heavy companies like real estate or investment firms, where the focus is on the actual value of assets minus liabilities. Enterprise Value (EV) provides a comprehensive assessment of a company's total market value including debt and is ideal for operational businesses when assessing takeover price or overall valuation. Use NAV for asset liquidation scenarios and EV for evaluating ongoing business performance or acquisition decisions.

Advantages and Limitations of Each Metric

Net Asset Value (NAV) provides a clear snapshot of a company's intrinsic worth by calculating the difference between total assets and liabilities, making it advantageous for asset-heavy industries but limited by its lack of consideration for future earning potential. Enterprise Value (EV) offers a comprehensive measure by including market capitalization, debt, and cash, which gives investors insight into total company valuation beyond equity alone, though its reliance on fluctuating market prices can introduce volatility. NAV is most beneficial for valuation in liquidation scenarios, whereas EV is preferred for assessing ongoing business value and acquisition targets.

Conclusion: Choosing the Right Valuation Metric

Net Asset Value (NAV) accurately reflects a company's intrinsic asset worth, making it ideal for asset-heavy firms like real estate or investment companies. Enterprise Value (EV) offers a comprehensive measure of a company's total market value, incorporating debt and equity, and is preferred for operationally-driven businesses or those with complex capital structures. Selecting the appropriate metric depends on the industry context and the specific financial analysis goals.

Net Asset Value Infographic

libterm.com

libterm.com