A unitary board combines executive and non-executive directors to streamline decision-making and enhance corporate governance. This structure fosters better communication and accountability, ensuring Your company's strategic goals align with operational execution. Explore the rest of the article to understand how a unitary board can benefit Your organization.

Table of Comparison

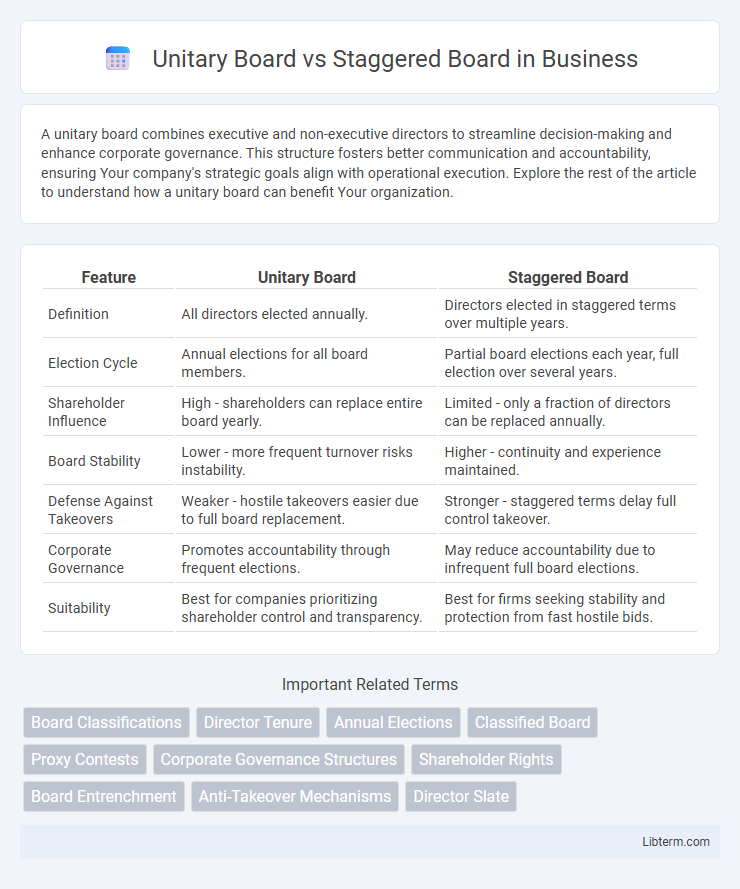

| Feature | Unitary Board | Staggered Board |

|---|---|---|

| Definition | All directors elected annually. | Directors elected in staggered terms over multiple years. |

| Election Cycle | Annual elections for all board members. | Partial board elections each year, full election over several years. |

| Shareholder Influence | High - shareholders can replace entire board yearly. | Limited - only a fraction of directors can be replaced annually. |

| Board Stability | Lower - more frequent turnover risks instability. | Higher - continuity and experience maintained. |

| Defense Against Takeovers | Weaker - hostile takeovers easier due to full board replacement. | Stronger - staggered terms delay full control takeover. |

| Corporate Governance | Promotes accountability through frequent elections. | May reduce accountability due to infrequent full board elections. |

| Suitability | Best for companies prioritizing shareholder control and transparency. | Best for firms seeking stability and protection from fast hostile bids. |

Introduction to Board Structures

A unitary board consists of a single group of directors responsible for both management oversight and strategic decision-making, commonly seen in many corporate governance models worldwide. In contrast, a staggered board divides directors into different classes with overlapping terms to ensure continuity by preventing a complete board turnover in a single election cycle. Understanding these board structures is essential for analyzing corporate control, shareholder influence, and board accountability mechanisms.

What is a Unitary Board?

A Unitary Board is a corporate governance structure where all directors, including executive and non-executive members, serve on a single board responsible for decision-making and oversight. This integrated approach promotes cohesive strategy implementation and streamlined communication among board members. Unitary Boards contrast with Staggered Boards, which have directors elected on a rotating schedule to enhance continuity and stability.

What is a Staggered Board?

A staggered board, also known as a classified board, divides a corporation's directors into separate classes with staggered terms, typically serving multi-year durations. Only a fraction of the board seats are up for election each year, which can enhance continuity and reduce the risk of hostile takeovers. This structure contrasts with a unitary board, where all directors are elected simultaneously, allowing for more frequent changes in board composition.

Key Differences Between Unitary and Staggered Boards

Unitary boards consist of all directors being elected annually, promoting greater accountability and quicker response to shareholder concerns. Staggered boards divide directors into classes with staggered election cycles, which can enhance board stability but reduce the speed of board turnover. These structural differences impact corporate governance, shareholder influence, and board continuity.

Governance Implications of Board Structures

Unitary boards consolidate executive and non-executive directors, promoting unified decision-making and streamlined governance, which may enhance accountability and agility. In contrast, staggered boards, where only a portion of directors are elected each year, can provide continuity and reduce the risk of hostile takeovers but may weaken shareholder influence and slow strategic shifts. Governance implications of these structures influence board independence, responsiveness to shareholders, and susceptibility to external control, impacting overall corporate performance and risk management.

Impact on Corporate Accountability

A unitary board structure centralizes decision-making by having all directors serve concurrent terms, which enhances corporate accountability through consistent oversight and unified strategic direction. In contrast, a staggered board, where directors serve overlapping multi-year terms, can weaken accountability by delaying board turnover and entrenching management, potentially reducing responsiveness to shareholder concerns. Empirical studies indicate that companies with unitary boards often experience higher transparency and stronger responses to shareholder activism than those with staggered boards.

Effects on Shareholder Influence

Unitary boards consolidate decision-making power, allowing shareholders more direct influence through a single election process and greater accountability of directors. Staggered boards divide director elections into classes, diluting shareholder influence by limiting the number of seats contested each year and making it harder to swiftly change board control. This structure often insulates management from shareholder pressure, potentially reducing responsiveness to shareholder interests.

Board Structure and Takeover Defenses

A unitary board consists of a single-tier structure where executive and non-executive directors collaborate, enhancing streamlined decision-making and transparency. A staggered board divides directors into classes with overlapping terms, making it difficult for potential acquirers to gain majority control quickly, serving as an effective takeover defense. The staggered board structure can entrench management by delaying board turnover, whereas the unitary board promotes accountability and shareholder influence.

Strategic Considerations for Companies

Unitary boards, featuring all directors elected annually, provide companies with flexibility in implementing swift strategic changes and enhancing accountability through regular shareholder input. Staggered boards, where only a fraction of directors face election each year, offer stability and protection against hostile takeovers, enabling long-term strategic planning without sudden shifts in leadership. Companies must balance the need for dynamic governance with risk management when choosing between these board structures.

Choosing the Right Board Structure

Choosing the right board structure involves evaluating the distinct governance and accountability features of unitary and staggered boards. A unitary board consolidates all directors into a single group, promoting streamlined decision-making and enhanced oversight, while a staggered board divides director terms into classes, providing continuity and protecting against hostile takeovers. Corporations aiming for dynamic governance and flexibility may prefer unitary boards, whereas those prioritizing stability and long-term strategy often opt for staggered boards.

Unitary Board Infographic

libterm.com

libterm.com