Carbon offset projects counterbalance your greenhouse gas emissions by funding initiatives that reduce or absorb carbon dioxide, such as reforestation or renewable energy installations. These projects play a crucial role in mitigating climate change and achieving carbon neutrality goals. Discover how carbon offsets can contribute to your sustainability efforts in the rest of the article.

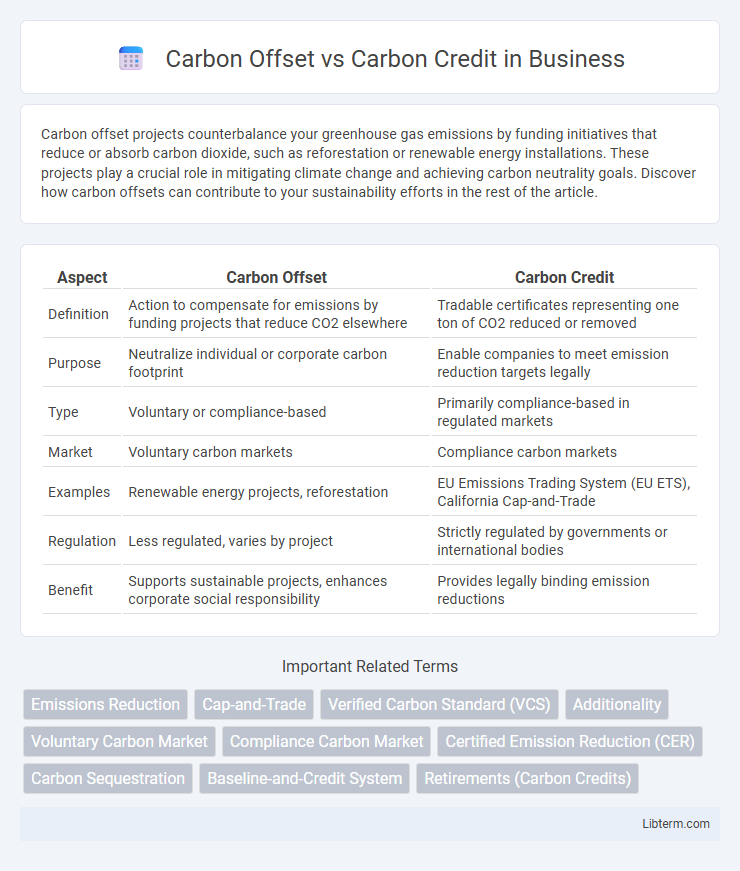

Table of Comparison

| Aspect | Carbon Offset | Carbon Credit |

|---|---|---|

| Definition | Action to compensate for emissions by funding projects that reduce CO2 elsewhere | Tradable certificates representing one ton of CO2 reduced or removed |

| Purpose | Neutralize individual or corporate carbon footprint | Enable companies to meet emission reduction targets legally |

| Type | Voluntary or compliance-based | Primarily compliance-based in regulated markets |

| Market | Voluntary carbon markets | Compliance carbon markets |

| Examples | Renewable energy projects, reforestation | EU Emissions Trading System (EU ETS), California Cap-and-Trade |

| Regulation | Less regulated, varies by project | Strictly regulated by governments or international bodies |

| Benefit | Supports sustainable projects, enhances corporate social responsibility | Provides legally binding emission reductions |

Understanding Carbon Offset and Carbon Credit

Carbon offsets represent measurable reductions in greenhouse gas emissions achieved through projects such as reforestation, renewable energy, or methane capture, which individuals or companies can purchase to compensate for their own emissions. Carbon credits are tradable certificates issued under regulatory or voluntary carbon markets, each typically equating to one metric ton of CO2 equivalent reduced or removed, facilitating compliance with emission caps. Understanding the distinction is crucial: carbon offsets are the actual environmental projects generating emission reductions, while carbon credits are the tradable instruments that monetize and distribute these reductions in the carbon market.

Key Differences Between Carbon Offsets and Carbon Credits

Carbon offsets represent verified emission reductions generated by projects like reforestation or renewable energy, which individuals or companies can purchase to compensate for their own carbon footprint. Carbon credits are tradable certificates issued under regulatory or voluntary carbon markets, granting the holder the right to emit one metric ton of CO2 or equivalent greenhouse gases. The key difference lies in carbon credits being market-based compliance tools, while carbon offsets are often voluntary actions aimed at neutralizing emissions through specific environmental projects.

How Carbon Offsets Work

Carbon offsets represent measurable reductions in greenhouse gas emissions generated by projects such as reforestation or renewable energy installation, which individuals or companies purchase to compensate for their own emissions. These offsets are quantified in metric tons of CO2 equivalent and are verified by third-party standards like the Verified Carbon Standard (VCS) to ensure their credibility and impact. The primary function of carbon offsets is to balance out carbon footprints by funding activities that either reduce existing emissions or enhance carbon sequestration in the atmosphere.

The Mechanisms Behind Carbon Credits

Carbon credits operate through a certified system where one credit represents the removal or reduction of one metric ton of CO2 emissions, facilitating a market for companies to buy and sell these credits to meet regulatory or voluntary emission targets. These credits are generated by verified projects such as reforestation, renewable energy, or methane capture, which directly lower atmospheric carbon levels or prevent future emissions. The mechanisms behind carbon credits ensure environmental integrity by requiring rigorous third-party verification, monitoring, and reporting to confirm that each credit corresponds to a real, measurable, and additional emission reduction.

Environmental Impact: Offsets vs Credits

Carbon offsets represent measurable reductions in greenhouse gas emissions achieved through specific environmental projects such as reforestation or renewable energy installations. Carbon credits function as tradable certificates allowing organizations to meet regulatory or voluntary emission caps by purchasing verified emission reductions. While offsets directly contribute to environmental improvement through concrete actions, credits primarily serve as market instruments that can both incentivize emission reductions and risk enabling continued pollution if not rigorously monitored.

Benefits of Carbon Offsetting

Carbon offsetting directly reduces greenhouse gas emissions by funding projects such as renewable energy, reforestation, or methane capture, which contribute to environmental sustainability and biodiversity conservation. This proactive approach helps organizations and individuals achieve carbon neutrality, improve corporate social responsibility profiles, and comply with regulatory standards. Unlike carbon credits that represent a tradable emission allowance, carbon offsets generate tangible environmental benefits by actively removing or preventing emissions.

Advantages of Using Carbon Credits

Carbon credits offer a flexible and market-driven approach for companies to meet regulatory emissions targets by allowing the purchase and trade of verified emission reductions. These credits incentivize sustainable projects worldwide, promoting renewable energy, reforestation, and clean technology investments. Utilizing carbon credits can enhance corporate social responsibility profiles and support global carbon reduction goals efficiently.

Common Misconceptions About Offsets and Credits

Carbon offsets and carbon credits are often mistakenly used interchangeably, despite representing different mechanisms for reducing greenhouse gas emissions. Carbon offsets refer to projects that reduce or remove emissions to compensate for emissions produced elsewhere, while carbon credits are tradable certificates representing the right to emit a specific amount of CO2. A common misconception is that purchasing carbon credits directly neutralizes emissions, whereas true decarbonization requires the additional implementation of carbon offset projects.

Choosing Between Carbon Offset and Carbon Credit

Choosing between carbon offset and carbon credit depends on your sustainability goals and regulatory requirements. Carbon offsets involve projects that reduce or remove greenhouse gas emissions, such as reforestation or renewable energy initiatives, while carbon credits represent a tradable permit that allows the holder to emit a specific amount of CO2. Companies seeking compliance with emissions cap-and-trade programs typically opt for carbon credits, whereas individuals and organizations aiming to neutralize their carbon footprint often invest in carbon offsets.

Future Trends in Carbon Offset and Credit Markets

Future trends in carbon offset and credit markets emphasize increased regulatory oversight and the adoption of blockchain technology to enhance transparency and traceability. Market expansion is driven by growing corporate commitments to net-zero targets and emerging international carbon trading platforms fostering cross-border credit exchanges. Advances in verification methodologies and integration of AI analytics improve project accountability, boosting investor confidence and market liquidity.

Carbon Offset Infographic

libterm.com

libterm.com