A salary increase reflects your growing value and contributions within a company, often correlating with enhanced skills and expanded responsibilities. Understanding the factors that influence pay raises can empower you to negotiate effectively and plan your career growth strategically. Explore the rest of this article to uncover actionable tips for securing a well-deserved salary increase.

Table of Comparison

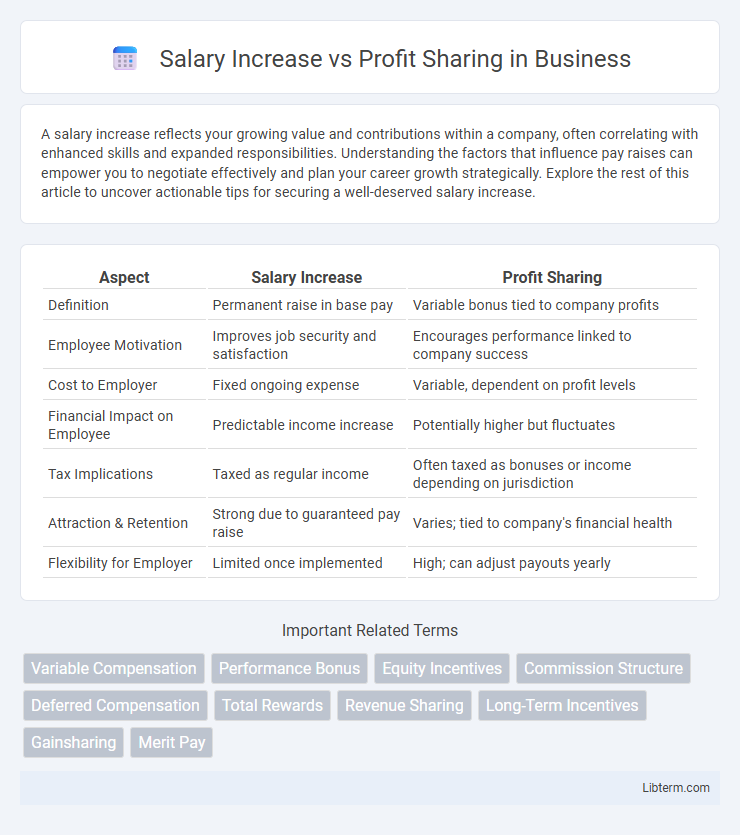

| Aspect | Salary Increase | Profit Sharing |

|---|---|---|

| Definition | Permanent raise in base pay | Variable bonus tied to company profits |

| Employee Motivation | Improves job security and satisfaction | Encourages performance linked to company success |

| Cost to Employer | Fixed ongoing expense | Variable, dependent on profit levels |

| Financial Impact on Employee | Predictable income increase | Potentially higher but fluctuates |

| Tax Implications | Taxed as regular income | Often taxed as bonuses or income depending on jurisdiction |

| Attraction & Retention | Strong due to guaranteed pay raise | Varies; tied to company's financial health |

| Flexibility for Employer | Limited once implemented | High; can adjust payouts yearly |

Understanding Salary Increases

Salary increases provide employees with a fixed, predictable boost to their base pay, reflecting individual performance, market trends, or company policies. This type of compensation adjustment enhances financial stability by directly impacting monthly income and long-term benefits like retirement contributions. Understanding salary increases helps employees negotiate effectively and align expectations with organizational compensation strategies.

What Is Profit Sharing?

Profit sharing is a compensation strategy where employees receive a portion of the company's profits, aligning their interests with business performance and fostering motivation. Unlike salary increases, which provide a fixed pay raise regardless of company outcomes, profit sharing varies based on profitability, often distributed as bonuses or stock options. This approach enhances employee engagement by directly linking rewards to the company's financial success, promoting a sense of ownership and collaboration.

Key Differences: Salary Increase vs Profit Sharing

Salary increase involves a fixed, predictable boost to an employee's base pay, enhancing financial stability and straightforward budget planning for employers. Profit sharing ties compensation to company performance, creating variable rewards that incentivize employees to contribute to business success and align their interests with shareholders. Unlike salary increases, profit sharing depends on profitability metrics and can fluctuate, fostering a performance-driven culture rather than guaranteed income growth.

Financial Impact on Employees

Salary increases provide employees with a predictable and consistent boost to their income, directly enhancing financial stability and long-term planning. Profit sharing offers variable compensation tied to company performance, potentially leading to higher earnings during profitable periods but less income certainty. The financial impact on employees depends on personal risk tolerance, with salary increases delivering guaranteed growth and profit sharing aligning rewards with business success.

Employer Perspective: Cost and Benefits

Employers weigh salary increases against profit sharing by analyzing direct labor cost impacts versus performance-linked expense variability. Salary increases create fixed, predictable costs that boost employee retention and satisfaction, while profit sharing aligns compensation with company profitability, fostering employee motivation without guaranteed fixed expenses. Balancing these options requires evaluating budget stability, incentive effectiveness, and long-term workforce engagement strategies.

Motivation and Productivity Effects

Salary increases provide employees with immediate financial recognition, enhancing motivation and job satisfaction through predictable income growth. Profit sharing aligns employee interests with company performance, boosting engagement by creating a sense of ownership and incentivizing productivity improvements. Combining both strategies can optimize motivation by balancing short-term rewards with long-term organizational commitment.

Tax Implications for Each Option

Salary increases are subject to regular income tax withholding and payroll taxes such as Social Security and Medicare, directly impacting the employee's take-home pay. Profit sharing, typically distributed as a bonus or retirement plan contribution, may offer tax advantages by deferring income and potentially reducing current taxable income. Employers must consider the differing tax treatments and reporting requirements for salary increases and profit-sharing plans to optimize compensation strategies and employee benefits.

Long-Term Career Advancement

Salary increases provide predictable and steady growth in income, promoting financial stability essential for long-term career planning and personal development. Profit sharing aligns employees' interests with company performance, fostering a sense of ownership that can motivate higher productivity and skill advancement over time. Evaluating both options, professionals aiming for sustained career growth benefit from balancing guaranteed salary increments with performance-based incentives like profit sharing.

Industry Trends and Case Studies

Industry trends reveal a growing preference for profit sharing as companies seek to align employee incentives with organizational performance, enhancing motivation and retention. Case studies from technology and manufacturing sectors demonstrate that profit sharing can lead to improved productivity and higher employee satisfaction compared to traditional salary increases. Data indicates that firms implementing profit sharing report a 15-20% increase in overall profitability while reducing turnover rates by up to 30%.

Choosing the Best Approach for Your Business

Salary increases provide employees with guaranteed, predictable income growth, improving job satisfaction and retention while directly impacting payroll expenses. Profit sharing aligns employee incentives with company performance, fostering a sense of ownership and motivating higher productivity without immediate fixed costs. Choosing the best approach depends on business cash flow stability, long-term growth goals, and the desired balance between fixed compensation and performance-based rewards.

Salary Increase Infographic

libterm.com

libterm.com