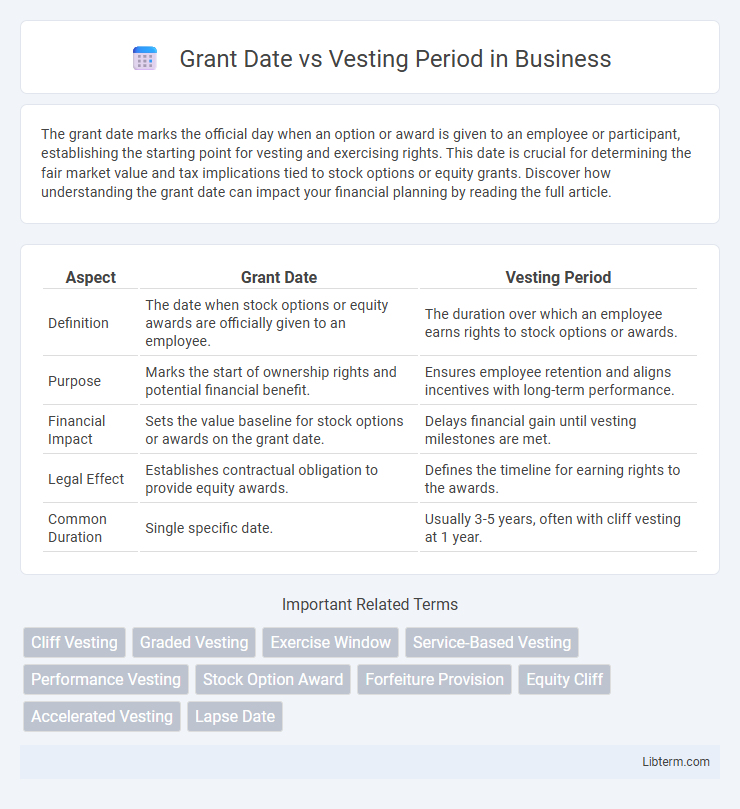

The grant date marks the official day when an option or award is given to an employee or participant, establishing the starting point for vesting and exercising rights. This date is crucial for determining the fair market value and tax implications tied to stock options or equity grants. Discover how understanding the grant date can impact your financial planning by reading the full article.

Table of Comparison

| Aspect | Grant Date | Vesting Period |

|---|---|---|

| Definition | The date when stock options or equity awards are officially given to an employee. | The duration over which an employee earns rights to stock options or awards. |

| Purpose | Marks the start of ownership rights and potential financial benefit. | Ensures employee retention and aligns incentives with long-term performance. |

| Financial Impact | Sets the value baseline for stock options or awards on the grant date. | Delays financial gain until vesting milestones are met. |

| Legal Effect | Establishes contractual obligation to provide equity awards. | Defines the timeline for earning rights to the awards. |

| Common Duration | Single specific date. | Usually 3-5 years, often with cliff vesting at 1 year. |

Understanding Grant Date in Equity Compensation

The grant date in equity compensation marks the official day when an employee is awarded stock options or shares, establishing the fair market value used to determine tax implications and accounting purposes. This date is crucial as it triggers the start of the vesting period, which defines when employees gain ownership rights to their equity. Understanding the grant date allows employees and employers to accurately track the timeline for exercising options and recognizing compensation expenses.

Defining the Vesting Period

The vesting period is the timeframe during which an employee must wait before gaining full ownership of granted stock options or equity awards. This period typically begins on the grant date and can span several years, with vesting schedules often structured in increments such as monthly or annually. Understanding the vesting period is crucial for employees to realize when they can exercise their rights to the shares and benefit fully from equity compensation plans.

Key Differences Between Grant Date and Vesting Period

The grant date is the specific day an employee is awarded stock options or equity, establishing the official start of their ownership rights, while the vesting period is the duration over which the employee earns full ownership of those options incrementally. Unlike the grant date, which is a fixed point in time, the vesting period spans months or years and determines when the employee can exercise or sell their shares. Understanding the distinction between the grant date and vesting schedule is crucial for optimizing equity compensation benefits and managing tax implications effectively.

Importance of Grant Date in Stock Options

The grant date in stock options is crucial because it marks the official point when the company awards the options to an employee, establishing the option's strike price based on the market value of the stock at that time. This date directly influences the potential financial gain, as the option's profitability depends on the stock price appreciation from the grant date forward. Understanding the grant date helps employees assess the timing and value of their stock options relative to the vesting period, which dictates when they can exercise those options.

The Role of Vesting Period in Employee Retention

The vesting period plays a crucial role in employee retention by incentivizing employees to remain with the company until their stock options or awards become fully vested, typically over several years. Unlike the grant date, which marks when the options are awarded, the vesting period ensures gradual ownership, aligning employee interests with long-term company performance. This structured timeline motivates sustained commitment, reducing turnover and promoting loyalty through financial rewards tied to tenure.

How Grant Date Affects Fair Value Calculation

The grant date in equity compensation establishes the fair value baseline for stock options or awards, as it marks the moment when both the employer and employee commit to the terms of the contract. This date directly influences the fair value calculation by locking in the share price, volatility, and other relevant financial metrics used in pricing models such as Black-Scholes or binomial trees. The vesting period follows the grant date but does not impact the initial fair value; instead, it affects the timing and recognition of compensation expense over the service period.

Types of Vesting Schedules Explained

Grant date marks the point when stock options or equity awards are officially given to an employee, while the vesting period defines the timeline over which these rights become exercisable or owned. Common types of vesting schedules include cliff vesting, where employees gain full rights after a single period (e.g., one year), and graded vesting, which allows gradual ownership buildup typically on an annual or monthly basis over several years. Understanding these vesting schedules is crucial for employees to maximize benefits from stock incentives and align with company retention strategies.

Tax Implications: Grant Date vs Vesting Period

The tax implications of stock options hinge on the distinction between the grant date and the vesting period, with the grant date marking when options are awarded but typically not taxed. Taxable events usually occur during the vesting period or upon exercise, with income recognized based on the fair market value at vesting or exercise, depending on jurisdiction and plan type. Understanding the timing of these events is critical for accurate tax reporting and optimizing tax strategies related to employee equity compensation.

Impact on Employee Motivation and Performance

The grant date marks when employees receive stock options or equity awards, creating immediate psychological ownership that can boost motivation. The vesting period determines when employees gain full rights to these assets, encouraging sustained performance and long-term commitment to company goals. A well-structured vesting schedule aligns employee incentives with organizational success, driving productivity and reducing turnover.

Best Practices for Managing Grant Dates and Vesting Periods

Effective management of grant dates and vesting periods ensures accurate tracking of employee equity compensation and compliance with accounting standards like ASC 718. Organizations should establish clear documentation and communication protocols for grant dates to prevent discrepancies in valuation and taxation. Monitoring vesting schedules closely through automated systems helps maintain transparency and supports strategic talent retention efforts.

Grant Date Infographic

libterm.com

libterm.com