A trust account securely holds assets on behalf of beneficiaries, ensuring legal protection and proper management. It plays a crucial role in estate planning, safeguarding your investments and distributing funds according to specific terms. Explore the following article to understand how a trust account can benefit your financial strategy.

Table of Comparison

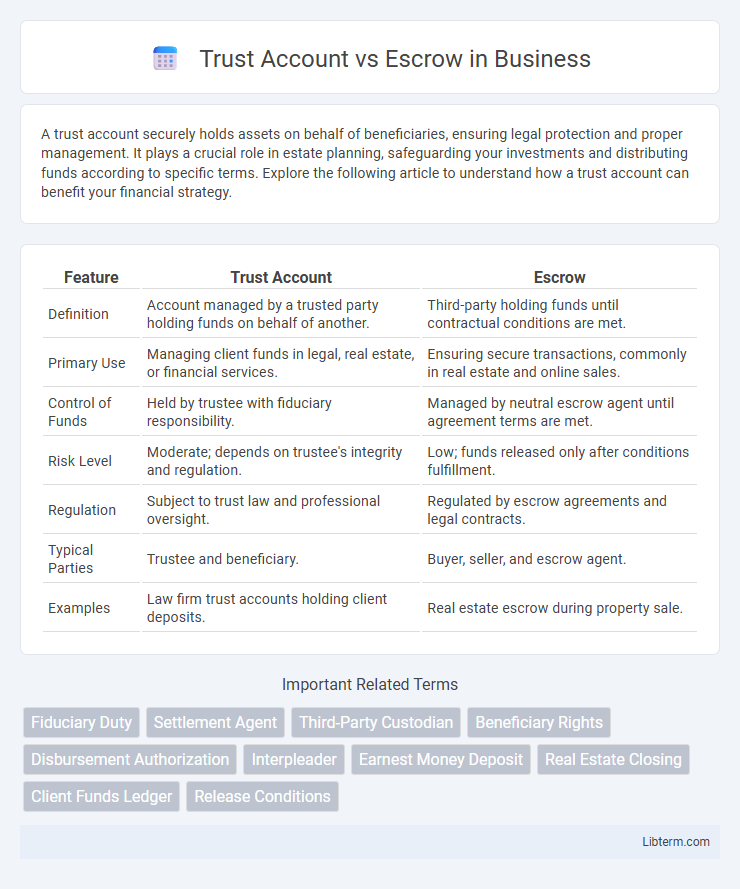

| Feature | Trust Account | Escrow |

|---|---|---|

| Definition | Account managed by a trusted party holding funds on behalf of another. | Third-party holding funds until contractual conditions are met. |

| Primary Use | Managing client funds in legal, real estate, or financial services. | Ensuring secure transactions, commonly in real estate and online sales. |

| Control of Funds | Held by trustee with fiduciary responsibility. | Managed by neutral escrow agent until agreement terms are met. |

| Risk Level | Moderate; depends on trustee's integrity and regulation. | Low; funds released only after conditions fulfillment. |

| Regulation | Subject to trust law and professional oversight. | Regulated by escrow agreements and legal contracts. |

| Typical Parties | Trustee and beneficiary. | Buyer, seller, and escrow agent. |

| Examples | Law firm trust accounts holding client deposits. | Real estate escrow during property sale. |

Introduction to Trust Accounts and Escrow

Trust accounts safeguard clients' funds by holding money on their behalf, typically managed by attorneys or financial institutions to ensure proper handling and compliance with legal standards. Escrow accounts act as neutral third-party holding accounts in real estate or business transactions, securing funds until contractual conditions are met and facilitating a safe exchange between buyers and sellers. Both trust and escrow accounts provide essential financial protection but serve distinct roles based on regulatory oversight and transactional purpose.

Definition of Trust Accounts

Trust accounts are fiduciary accounts held by a third party, such as attorneys or real estate agents, to manage funds on behalf of clients with strict regulatory oversight ensuring the protection and proper use of the money. These accounts are legally segregated from the operating funds of the holder to prevent commingling and maintain transparency in financial transactions. Trust accounts often serve purposes like holding client deposits, settlement funds, or escrow payments until contractual obligations are fulfilled.

Definition of Escrow Accounts

Escrow accounts are specialized financial arrangements where a third party temporarily holds funds or assets on behalf of transacting parties until contract conditions are fully met. They provide a secure mechanism to ensure obligations like property purchases or service deliveries are fulfilled before funds are released. Unlike trust accounts that may serve broader fiduciary purposes, escrow accounts are specifically designed to protect interests in distinct transactions.

Key Differences Between Trust Accounts and Escrow

Trust accounts are typically managed by attorneys or fiduciaries to hold client funds securely for various purposes, while escrow accounts involve a neutral third party holding funds during a transaction until specific conditions are met. Trust accounts provide ongoing management and may allow for withdrawals or payments on behalf of the client, whereas escrow accounts are strictly transactional with funds released only upon fulfillment of contractual obligations. The key difference lies in control and purpose: trust accounts support fiduciary duties over time, while escrow accounts ensure conditional payment security within a specific transaction.

Use Cases for Trust Accounts

Trust accounts primarily serve real estate agents, lawyers, and financial advisors who manage client funds with fiduciary responsibility, ensuring legal compliance and ethical handling of deposits. These accounts are ideal for holding earnest money, settlement funds, or retainers, providing transparency and safeguarding clients' assets until transaction completion. Unlike escrow accounts, trust accounts offer enhanced control and reporting tailored for ongoing fiduciary relationships rather than temporary transactional purposes.

Use Cases for Escrow Accounts

Escrow accounts are commonly used in real estate transactions to securely hold funds such as deposits, down payments, and closing costs until all contractual conditions are met, ensuring a safe exchange between buyers and sellers. They are also utilized in online marketplaces and large business deals to manage payments, reduce fraud risk, and provide assurance that both parties fulfill their obligations. Unlike trust accounts, escrow accounts offer a neutral third-party holding mechanism specifically designed to protect transaction integrity and facilitate smoother financial exchanges.

Legal and Regulatory Considerations

Trust accounts and escrow accounts are governed by distinct legal frameworks, with trust accounts typically subject to state trust laws and fiduciary duties, while escrow accounts fall under escrow laws and contractual agreements. Regulatory oversight often mandates strict compliance with record-keeping, client fund segregation, and dispute resolution protocols to protect parties involved in real estate, legal, or financial transactions. Understanding these legal and regulatory considerations ensures proper fund management and minimizes liability risks for fiduciaries and escrow agents.

Advantages and Disadvantages of Trust Accounts

Trust accounts offer enhanced control and transparency for clients, ensuring funds are held securely by a fiduciary until specific conditions are met, which reduces the risk of misappropriation. They provide flexibility in managing funds, allowing interest to accrue for beneficiaries and easier traceability of transactions. However, trust accounts can involve higher administrative costs and complexity due to stringent regulatory requirements and the need for detailed record-keeping.

Advantages and Disadvantages of Escrow Accounts

Escrow accounts provide a secure way to hold funds during transactions, reducing the risk of fraud by ensuring money is only released when contractual conditions are met. They offer impartiality by involving a neutral third party, benefiting both buyers and sellers in real estate, mergers, and online sales. However, escrow accounts can incur fees and delays, and limited flexibility may hinder quick access to funds in urgent situations.

Choosing the Right Solution: Trust Account vs Escrow

Choosing between a trust account and escrow hinges on the specific financial transaction and legal requirements involved. Trust accounts managed by lawyers or fiduciaries offer ongoing asset management and flexibility, ideal for long-term arrangements like estate planning or client funds. Escrow services provide a neutral, time-bound holding mechanism for transactional purposes, commonly used in real estate or mergers, ensuring secure payment release upon contract fulfillment.

Trust Account Infographic

libterm.com

libterm.com