The debt market plays a crucial role in the global economy by enabling governments, corporations, and other entities to raise capital through the issuance of bonds and other fixed-income securities. Understanding how interest rates, credit ratings, and market demand influence bond prices can help you make more informed investment decisions. Dive deeper into this article to explore the key features and benefits of the debt market.

Table of Comparison

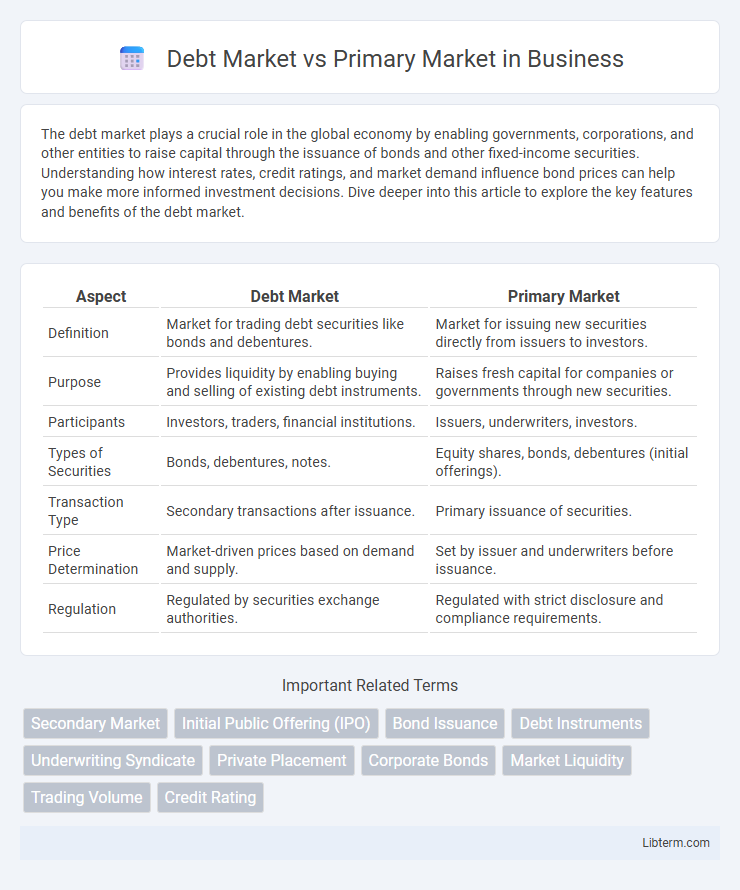

| Aspect | Debt Market | Primary Market |

|---|---|---|

| Definition | Market for trading debt securities like bonds and debentures. | Market for issuing new securities directly from issuers to investors. |

| Purpose | Provides liquidity by enabling buying and selling of existing debt instruments. | Raises fresh capital for companies or governments through new securities. |

| Participants | Investors, traders, financial institutions. | Issuers, underwriters, investors. |

| Types of Securities | Bonds, debentures, notes. | Equity shares, bonds, debentures (initial offerings). |

| Transaction Type | Secondary transactions after issuance. | Primary issuance of securities. |

| Price Determination | Market-driven prices based on demand and supply. | Set by issuer and underwriters before issuance. |

| Regulation | Regulated by securities exchange authorities. | Regulated with strict disclosure and compliance requirements. |

Introduction to Debt Market and Primary Market

The debt market, also known as the bond market, involves the issuance and trading of debt securities such as bonds and debentures, enabling governments and corporations to raise capital by borrowing from investors. The primary market, on the other hand, is the platform where new securities, including stocks and bonds, are issued for the first time directly from the issuer to investors, facilitating capital formation. Understanding the primary market's role in introducing new debt securities is essential for grasping the overall functioning of the debt market.

Key Differences Between Debt Market and Primary Market

The Debt Market primarily involves the buying and selling of debt securities such as bonds and debentures, enabling investors to earn fixed returns, whereas the Primary Market deals with the issuance of new securities directly from issuers, facilitating capital raising for companies and governments. Debt Market transactions occur in the secondary market where existing debt instruments are traded among investors, while the Primary Market is the initial offering stage where securities are sold for the first time. Key differences highlight that the Debt Market focuses on debt instruments and their liquidity, while the Primary Market emphasizes new equity and debt issuance for funding purposes.

Structure and Functioning of the Debt Market

The debt market, also known as the bond market, facilitates the issuance and trading of debt securities, enabling governments, corporations, and institutions to raise capital by borrowing from investors. Its structure includes various segments such as government bonds, corporate bonds, municipal bonds, and asset-backed securities, each with distinct risk profiles and maturities. Functioning through primary issuance and secondary trading platforms, the debt market provides liquidity, price discovery, and risk management tools, distinguishing it from the primary market, which strictly involves the initial issuance of new securities directly from issuers to investors.

Structure and Functioning of the Primary Market

The primary market serves as the initial platform where securities such as stocks and bonds are issued directly by corporations or governments to investors, facilitating capital formation. It features structures like initial public offerings (IPOs), private placements, and rights issues, enabling entities to raise funds by selling new securities. The debt market, a subset of the primary market, specializes in the issuance of fixed-income instruments, providing issuers with organized mechanisms for borrowing through bonds and notes, targeting investors seeking regular interest income.

Types of Instruments in Debt Market vs Primary Market

The debt market primarily features fixed-income instruments such as bonds, debentures, and treasury bills, which represent loans made by investors to issuers. In contrast, the primary market involves the issuance of new securities, including equity shares, preference shares, and fresh debt instruments like initial public offerings (IPOs) and new bond issuances. While debt instruments dominate the debt market, the primary market encompasses both debt and equity instruments, facilitating capital raising for companies and governments.

Participation and Key Players in Each Market

The debt market primarily involves institutional investors such as pension funds, insurance companies, and mutual funds, along with corporations and governments issuing bonds and other debt securities. The primary market includes issuers like corporations, government entities, and financial institutions directly selling new securities to investors, who range from individual retail investors to large institutional buyers. Key players in the primary market are underwriters and investment banks facilitating initial offerings, while the debt market hinges on bondholders and institutional investors managing long-term debt portfolios.

Risk and Return Profiles: Debt Market vs Primary Market

The Debt Market primarily involves trading fixed-income securities like bonds, offering lower risk and stable returns due to predictable interest payments. The Primary Market focuses on new security issuance, presenting higher risk and potential for greater returns as investors buy at initial offering prices with uncertainty about future market performance. Understanding the contrasting risk and return profiles between the Debt Market's stability and the Primary Market's initial pricing volatility is crucial for investment strategy.

Regulatory Framework Governing Both Markets

The Debt Market is primarily regulated by securities commissions like the SEC in the U.S., focusing on transparency, issuer creditworthiness, and mandatory disclosures to protect investors. The Primary Market operates under stringent regulatory frameworks that oversee the issuance process, including registration requirements, prospectus approvals, and compliance with securities laws to ensure fair capital raising. Both markets require adherence to anti-fraud provisions and ongoing reporting standards to maintain market integrity and investor confidence.

Advantages and Disadvantages of Debt and Primary Markets

Debt markets offer investors fixed income securities with predictable returns and lower risk compared to equity, but they can expose issuers to interest rate fluctuations and repayment obligations. Primary markets enable companies to raise capital directly from investors through new securities issuance, fostering business growth, though they often involve higher regulatory costs and market timing risks. Investors in primary markets face potential dilution and price volatility, whereas debt market participants benefit from priority claims in bankruptcy but bear credit risk.

Impact on Economic Growth and Capital Formation

The debt market facilitates economic growth by providing companies and governments with access to capital through bonds and other debt instruments, enabling large-scale investments and infrastructure development without immediate equity dilution. In contrast, the primary market directly impacts capital formation by allowing firms to issue new stocks and bonds, raising fresh funds that increase the capital base and support expansion activities. Together, these markets enhance financial stability and liquidity, promoting sustainable economic development and efficient allocation of resources.

Debt Market Infographic

libterm.com

libterm.com