Carried interest is a share of profits that investment managers receive as compensation, typically in private equity and hedge funds, aligning their incentives with investors' success. This form of earnings is often taxed at capital gains rates, creating ongoing debates about fairness and tax policy. Discover how carried interest impacts your investments and the financial landscape in the rest of this article.

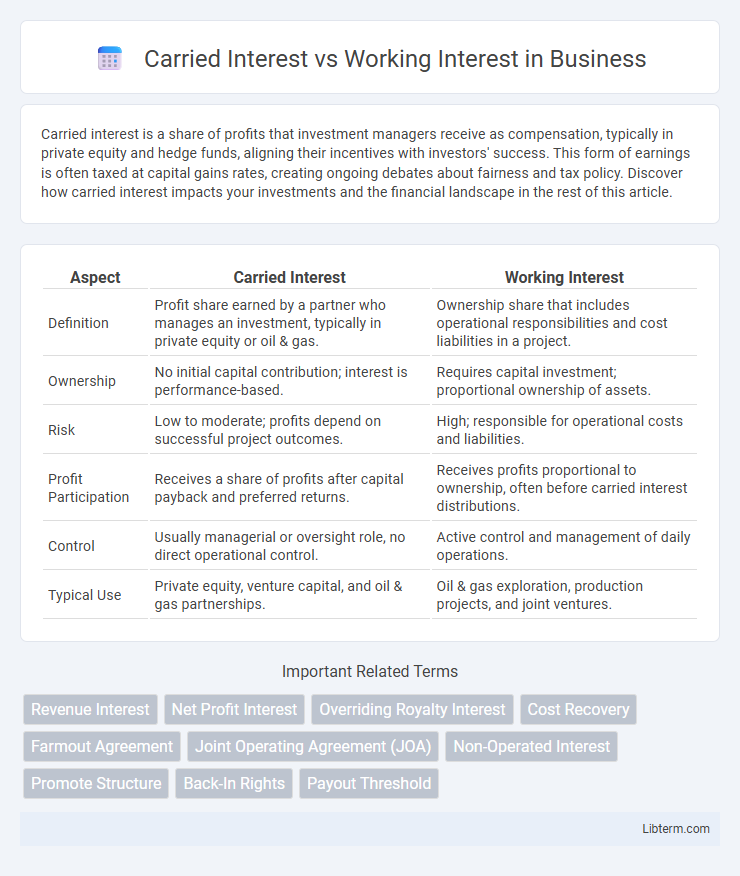

Table of Comparison

| Aspect | Carried Interest | Working Interest |

|---|---|---|

| Definition | Profit share earned by a partner who manages an investment, typically in private equity or oil & gas. | Ownership share that includes operational responsibilities and cost liabilities in a project. |

| Ownership | No initial capital contribution; interest is performance-based. | Requires capital investment; proportional ownership of assets. |

| Risk | Low to moderate; profits depend on successful project outcomes. | High; responsible for operational costs and liabilities. |

| Profit Participation | Receives a share of profits after capital payback and preferred returns. | Receives profits proportional to ownership, often before carried interest distributions. |

| Control | Usually managerial or oversight role, no direct operational control. | Active control and management of daily operations. |

| Typical Use | Private equity, venture capital, and oil & gas partnerships. | Oil & gas exploration, production projects, and joint ventures. |

Introduction to Carried Interest and Working Interest

Carried interest refers to a profit share earned by investment managers or partners without an initial capital contribution, typically in private equity or oil and gas ventures. Working interest denotes an operator's ownership percentage in an oil and gas lease, entailing responsibility for all exploration, development, and operational costs. Understanding the distinction between carried interest and working interest is crucial for stakeholders evaluating financial obligations and profit distribution in resource-based investments.

Defining Carried Interest in Investments

Carried interest in investments represents a share of profits allocated to investment managers or general partners as compensation, typically without requiring an upfront capital contribution. It aligns the interests of managers with investors by rewarding performance after achieving specific return thresholds, often seen in private equity and oil and gas partnerships. Unlike working interest, which involves ownership and operational responsibilities in a project, carried interest is primarily a profit participation arrangement tied to management success.

Understanding Working Interest in Oil and Gas

Working interest in oil and gas represents the ownership stake responsible for operational costs, including drilling, production, and maintenance activities. It entitles the holder to a corresponding share of production revenue, reflecting active participation and financial risk in the project. Unlike carried interest, working interest obligates the owner to cover expenses directly, influencing cash flow and profit potential in upstream oil and gas ventures.

Key Differences Between Carried and Working Interests

Carried interest represents a partnership share that entitles the holder to a portion of profits without requiring capital investment or operational responsibilities, commonly used in private equity and oil and gas ventures. In contrast, working interest involves ownership and operational control of an oil and gas lease, requiring investment and direct involvement in exploration and production activities. The key differences lie in financial risk, management duties, and revenue sources: carried interest holders bear no upfront costs and share profits after partners recover investments, whereas working interest owners bear operational risks and expenses but receive a proportionate share of production revenue.

How Carried Interest Works in Practice

Carried interest represents a profit share granted to investors or partners who do not contribute capital but provide expertise or services, typically seen in private equity and oil and gas ventures. In practice, carried interest allows these partners to receive a percentage of the profits only after the initial investors recoup their capital investment, aligning incentives for performance. This arrangement contrasts with working interest, where participants bear operational costs and risks, owning a direct share of production and expenses.

Financial Implications of Working Interest

Working interest owners bear the full cost and risk of exploration, development, and production activities, directly affecting cash flow and capital expenditure obligations. They receive a proportionate share of production revenue, which can lead to substantial profits if the well performs well, but also significant losses if production declines or costs escalate. The financial implications include exposure to operational liabilities and the need for substantial upfront investment, making working interest participation a high-risk, high-reward scenario in oil and gas ventures.

Tax Treatment: Carried Interest vs Working Interest

Carried interest is generally taxed as a capital gain at favorable long-term rates since it represents profits earned by investment managers without direct capital contribution, whereas working interest income is taxed as ordinary income subject to higher rates because it derives from active participation in oil and gas operations. The IRS treats carried interest as a capital asset, allowing for preferential tax treatment, while working interest owners report revenue and expenses on Schedule E, incurring self-employment taxes. Understanding these distinctions is crucial for investors and operators to optimize tax liabilities in energy sector partnerships.

Risk and Reward Profiles Compared

Carried interest involves a partner receiving a share of profits without contributing capital, exposing them to lower financial risk but higher dependency on project success for rewards. Working interest owners invest capital and bear operational costs, leading to higher financial risk but greater direct profit potential from production. The risk and reward profiles differ significantly, with carried interest offering leveraged upside and working interest presenting a balanced exposure to both risk and return.

Investor Considerations and Decision Factors

Investors evaluating carried interest versus working interest must consider risk exposure, capital commitment, and profit participation structures; carried interest offers opportunistic upside with limited direct operational risk, whereas working interest entails direct ownership and proportional responsibility for expenses and production. Decision factors include tax implications, as carried interest often benefits from favorable long-term capital gains treatment, while working interest income is typically taxed as ordinary income. Alignment with investment goals, cash flow expectations, and risk tolerance heavily influences the choice between passive carried interest involvement and active working interest ownership.

Conclusion: Choosing the Right Interest for Your Portfolio

Selecting between carried interest and working interest depends on your risk tolerance and cash flow preferences; carried interest offers profit-sharing without upfront capital or operational responsibilities, while working interest requires capital investment and active involvement in operations in exchange for direct revenue streams. Understanding the financial implications, tax treatments, and long-term returns associated with each interest type is crucial for aligning with your investment goals. Diversifying your portfolio with a balanced mix of both interests can optimize exposure to oil and gas opportunities while managing overall risk.

Carried Interest Infographic

libterm.com

libterm.com