Affiliate marketing leverages partnerships to promote products or services, generating commissions for referrals. Understanding affiliate networks, tracking tools, and effective content strategies can significantly boost your online income. Explore the rest of this article to master affiliate marketing and maximize your earnings.

Table of Comparison

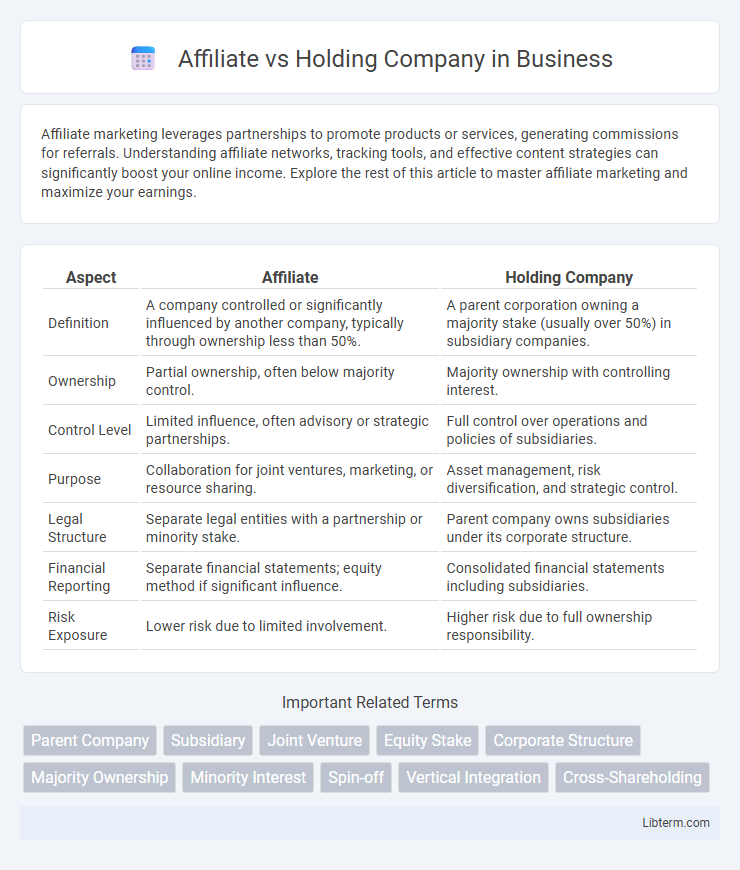

| Aspect | Affiliate | Holding Company |

|---|---|---|

| Definition | A company controlled or significantly influenced by another company, typically through ownership less than 50%. | A parent corporation owning a majority stake (usually over 50%) in subsidiary companies. |

| Ownership | Partial ownership, often below majority control. | Majority ownership with controlling interest. |

| Control Level | Limited influence, often advisory or strategic partnerships. | Full control over operations and policies of subsidiaries. |

| Purpose | Collaboration for joint ventures, marketing, or resource sharing. | Asset management, risk diversification, and strategic control. |

| Legal Structure | Separate legal entities with a partnership or minority stake. | Parent company owns subsidiaries under its corporate structure. |

| Financial Reporting | Separate financial statements; equity method if significant influence. | Consolidated financial statements including subsidiaries. |

| Risk Exposure | Lower risk due to limited involvement. | Higher risk due to full ownership responsibility. |

Understanding Affiliate Companies

Affiliate companies are business entities where one company holds a minority stake or exercises significant influence without full ownership or control, often through shared branding, resources, or strategic partnerships. These entities operate independently but maintain collaborative relationships to achieve mutual benefits, such as market expansion or technology sharing. Understanding affiliate companies involves recognizing their role in diversifying business risks while leveraging synergies without the legal consolidation typical of holding companies.

What is a Holding Company?

A holding company is a business entity created to own shares of other companies, thereby controlling their policies and management without directly engaging in their day-to-day operations. It primarily exists to manage investments and consolidate control over multiple subsidiaries, often reducing risk and enhancing corporate governance. Unlike affiliates that maintain operational independence, holding companies exert significant influence through majority ownership or controlling interest in subsidiaries.

Key Differences: Affiliate vs Holding Company

Affiliate companies are separate legal entities where one company holds a minority stake or exerts significant influence without full control, often collaborating on business operations or marketing strategies. Holding companies, by contrast, own a majority or controlling interest in subsidiary companies, primarily managing investments and overseeing corporate governance without direct operational involvement. The key difference lies in ownership and control level: affiliates maintain independent management, whereas holding companies exercise dominant authority over subsidiaries.

Ownership Structures in Affiliates and Holdings

Affiliate companies are often characterized by partial ownership, where the parent company holds less than 50% of voting shares, enabling influence without full control. Holding companies maintain majority ownership, typically over 50%, to exercise decisive control over subsidiaries and consolidate financial statements. The ownership structure in affiliates allows for strategic partnerships, while holding companies establish clear hierarchical control for streamlined management and operational integration.

Control and Decision-Making Power

An affiliate company is controlled significantly but not wholly owned, allowing the parent company to influence decisions without full authority. A holding company possesses majority ownership or complete control, enabling it to dictate strategic operations, governance, and key decision-making processes. Control in holding companies is centralized, whereas affiliates maintain more independent management structures despite partial oversight.

Financial Implications and Risk Exposure

Affiliate companies often share partial ownership and operational control, leading to shared financial liabilities but limited risk exposure compared to holding companies. Holding companies possess full equity control over subsidiaries, resulting in consolidated financial statements and increased risk exposure due to direct responsibility for subsidiary debts and obligations. The differing ownership structures directly impact financial leverage, risk distribution, and liability management within corporate groupings.

Legal Responsibilities and Liabilities

Affiliate companies maintain separate legal identities, which means each entity bears its own legal responsibilities and liabilities independently, reducing direct risk exposure between them. Holding companies, by contrast, exercise control through ownership of other companies' voting stock but generally are not liable for the subsidiaries' debts and obligations unless they directly guarantee or are involved in the activities causing liability. The distinction plays a critical role in corporate risk management and legal accountability structures within corporate groups.

Taxation Differences: Affiliate vs Holding Company

Affiliate companies are typically taxed as separate entities on their individual profits, resulting in multiple layers of taxation when dividends are distributed to shareholders. In contrast, holding companies often benefit from tax consolidation or group relief schemes, allowing for the offsetting of profits and losses between group members and reducing overall tax liability. Holding companies may also enjoy preferential tax treatment on intercompany dividends, minimizing double taxation compared to affiliates operating independently.

Strategic Advantages of Each Structure

An affiliate structure allows companies to maintain operational independence while leveraging shared resources and brand recognition to enhance market reach and flexibility. Holding companies offer strategic advantages through centralized control and risk management, enabling efficient allocation of capital and protection of assets across subsidiaries. Both structures optimize corporate growth paths, with affiliates fostering collaboration and innovation, and holding companies streamlining governance and financial oversight.

Choosing the Right Structure for Business Growth

Evaluating the choice between an affiliate and a holding company hinges on strategic business goals and growth plans. Affiliates allow operational independence while fostering collaboration and shared resources, ideal for diversification without direct control. Holding companies provide centralized management and consolidated control over subsidiaries, optimizing tax benefits and risk mitigation for scalable expansion.

Affiliate Infographic

libterm.com

libterm.com