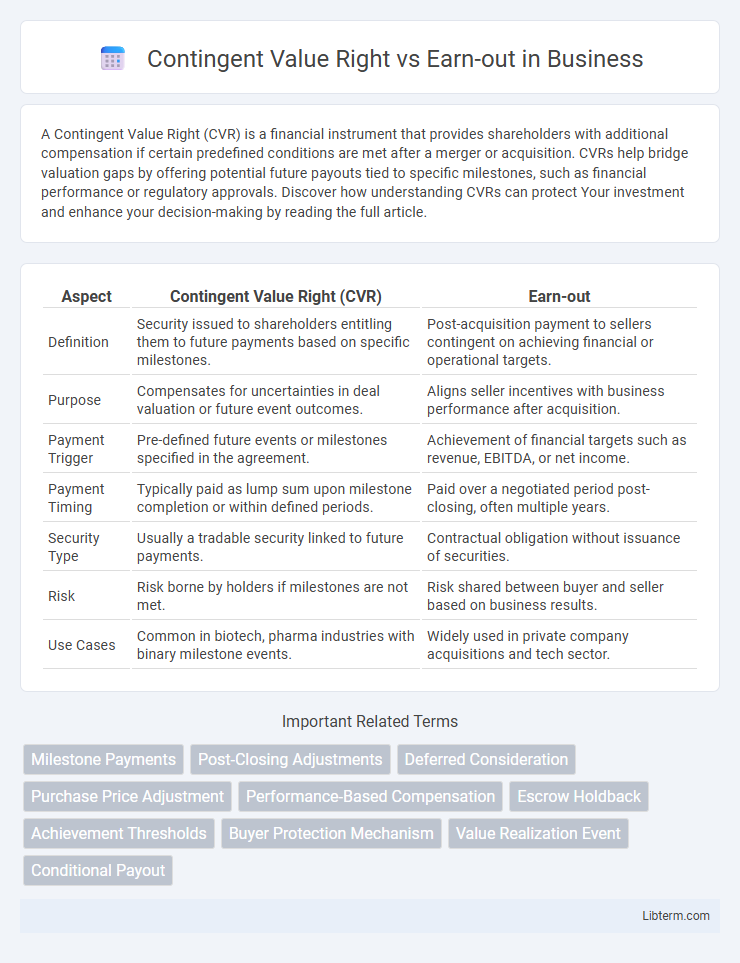

A Contingent Value Right (CVR) is a financial instrument that provides shareholders with additional compensation if certain predefined conditions are met after a merger or acquisition. CVRs help bridge valuation gaps by offering potential future payouts tied to specific milestones, such as financial performance or regulatory approvals. Discover how understanding CVRs can protect Your investment and enhance your decision-making by reading the full article.

Table of Comparison

| Aspect | Contingent Value Right (CVR) | Earn-out |

|---|---|---|

| Definition | Security issued to shareholders entitling them to future payments based on specific milestones. | Post-acquisition payment to sellers contingent on achieving financial or operational targets. |

| Purpose | Compensates for uncertainties in deal valuation or future event outcomes. | Aligns seller incentives with business performance after acquisition. |

| Payment Trigger | Pre-defined future events or milestones specified in the agreement. | Achievement of financial targets such as revenue, EBITDA, or net income. |

| Payment Timing | Typically paid as lump sum upon milestone completion or within defined periods. | Paid over a negotiated period post-closing, often multiple years. |

| Security Type | Usually a tradable security linked to future payments. | Contractual obligation without issuance of securities. |

| Risk | Risk borne by holders if milestones are not met. | Risk shared between buyer and seller based on business results. |

| Use Cases | Common in biotech, pharma industries with binary milestone events. | Widely used in private company acquisitions and tech sector. |

Introduction to Contingent Value Rights and Earn-outs

Contingent Value Rights (CVRs) and earn-outs are financial instruments used in mergers and acquisitions to bridge valuation gaps between buyers and sellers. CVRs provide shareholders with additional payouts contingent on future events or performance milestones, typically with a fixed timeframe. Earn-outs tie a portion of the purchase price to the target company's future financial performance, aligning incentives but often requiring ongoing management performance monitoring.

Defining Contingent Value Rights (CVRs)

Contingent Value Rights (CVRs) are financial instruments issued in mergers and acquisitions that grant shareholders the right to receive additional compensation based on the achievement of specific milestones or performance targets. CVRs provide a structured mechanism to allocate risk between buyers and sellers by tying part of the purchase price to future events, such as regulatory approvals or product development benchmarks. Unlike earn-outs, which often involve ongoing management of the acquired company, CVRs typically have predefined conditions and payout formulas, making them more transparent and easier to manage post-transaction.

Understanding Earn-outs in M&A Transactions

Earn-outs in M&A transactions are performance-based compensation mechanisms where the seller receives additional payment contingent upon the acquired business meeting specified financial or operational targets post-closing. They help bridge valuation gaps by aligning buyer and seller interests, mitigating risk through deferred payouts tied to future results. Understanding earn-outs involves analyzing their structure, measurement periods, performance metrics, and dispute resolution provisions to ensure clear expectations and enforceability.

Key Structural Differences: CVRs vs Earn-outs

Contingent Value Rights (CVRs) are tradable securities granting shareholders additional compensation based on future performance milestones, whereas earn-outs typically involve direct payments from buyers to sellers contingent on achieving specific targets post-acquisition. CVRs separate contingent payouts from the sale price and allow for market liquidity, while earn-outs integrate future payments into the overall transaction and rely on ongoing business performance management. The distinct structural difference lies in CVRs being backed by separate instruments tradable independently, compared to earn-outs being embedded contract terms linked to operational results.

Advantages of Using Contingent Value Rights

Contingent Value Rights (CVRs) provide shareholders with a clear, tradable financial instrument that defines specific future payout conditions, reducing ambiguity compared to earn-outs. CVRs simplify post-transaction valuation by attaching quantifiable metrics directly to the security, which can enhance transparency and investor confidence. This mechanism also limits the operational involvement of sellers, avoiding the complications of ongoing business management or integration typical in earn-out arrangements.

Benefits of Implementing Earn-out Agreements

Earn-out agreements provide a strategic mechanism to bridge valuation gaps by aligning the interests of buyers and sellers through performance-based milestones, ensuring sellers receive additional compensation based on the acquired company's future success. These agreements incentivize continued management involvement and operational focus post-transaction, enhancing the potential for value creation and risk mitigation for buyers. Earn-outs offer flexibility in deal structuring, accommodating market uncertainties and enabling precise valuation adjustments tied to measurable financial or operational targets.

Common Applications: When to Use CVRs or Earn-outs

Contingent Value Rights (CVRs) are commonly used in mergers and acquisitions within the pharmaceutical and biotech sectors to address uncertainties regarding future regulatory approvals or product milestones. Earn-outs are frequently applied in private equity and technology deals to align the seller's incentives with the company's post-transaction performance targets, such as revenue or EBITDA thresholds. CVRs are preferable when payments depend on discrete outcomes, while earn-outs suit scenarios requiring ongoing operational performance tracking.

Challenges and Risks: CVRs versus Earn-outs

Contingent Value Rights (CVRs) often present challenges such as valuation uncertainty, prolonged administrative oversight, and potential disputes over achievement of milestones, making them complex for investors and companies to manage. Earn-outs carry risks including disagreements on financial reporting, operational control conflicts post-acquisition, and difficulties in aligning buyer-seller incentives, which can jeopardize deal outcomes. Both CVRs and earn-outs require detailed contractual definitions to mitigate risks, but earn-outs typically expose sellers to greater operational performance risks while CVRs focus mainly on specific event-driven outcomes.

Legal and Tax Considerations for CVRs and Earn-outs

Contingent Value Rights (CVRs) and earn-outs are commonly structured to manage post-deal valuation risks, with CVRs typically treated as securities and earn-outs classified as adjustments to the purchase price for tax purposes. Legal considerations for CVRs include compliance with securities regulations and the need for clear contractual definitions to avoid disputes, while earn-outs require detailed performance metrics and timing provisions to ensure enforceability. From a tax perspective, CVRs may result in ordinary income or capital gains depending on classification, whereas earn-outs often affect the tax basis of the acquired assets and can influence the timing and character of taxable income for both parties.

Best Practices for Structuring CVRs and Earn-out Agreements

Best practices for structuring Contingent Value Rights (CVRs) and earn-out agreements emphasize clear definition of performance metrics, timelines, and payout formulas to align incentives and minimize disputes. Incorporating measurable milestones such as revenue targets or regulatory approvals ensures objective evaluation, while detailed conditions for payment trigger events prevent ambiguity. Legal counsel involvement and thorough documentation enhance enforceability and support smooth post-transaction integration and value realization.

Contingent Value Right Infographic

libterm.com

libterm.com