Retail investors participate in financial markets by purchasing stocks, bonds, and other securities in smaller quantities compared to institutional investors. Understanding the behavior and strategies of retail investors can improve your ability to navigate market trends and make informed decisions. Explore the rest of the article to discover key insights and tips tailored to your investment journey.

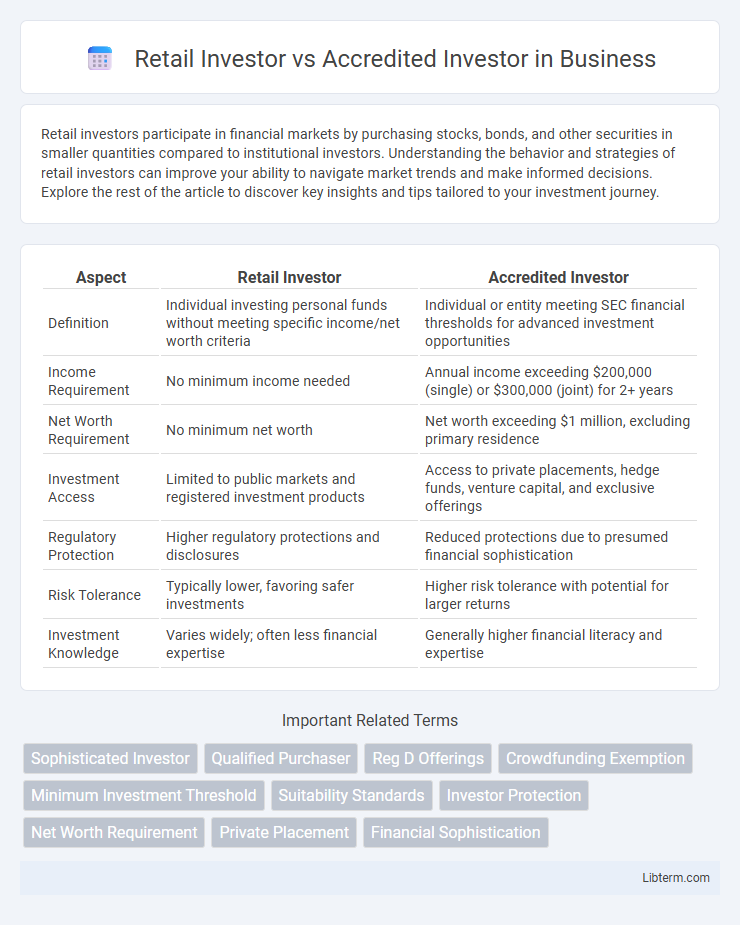

Table of Comparison

| Aspect | Retail Investor | Accredited Investor |

|---|---|---|

| Definition | Individual investing personal funds without meeting specific income/net worth criteria | Individual or entity meeting SEC financial thresholds for advanced investment opportunities |

| Income Requirement | No minimum income needed | Annual income exceeding $200,000 (single) or $300,000 (joint) for 2+ years |

| Net Worth Requirement | No minimum net worth | Net worth exceeding $1 million, excluding primary residence |

| Investment Access | Limited to public markets and registered investment products | Access to private placements, hedge funds, venture capital, and exclusive offerings |

| Regulatory Protection | Higher regulatory protections and disclosures | Reduced protections due to presumed financial sophistication |

| Risk Tolerance | Typically lower, favoring safer investments | Higher risk tolerance with potential for larger returns |

| Investment Knowledge | Varies widely; often less financial expertise | Generally higher financial literacy and expertise |

Introduction: Retail vs Accredited Investors

Retail investors are individual investors who buy and sell securities for personal accounts, often with limited capital and access to investment opportunities. Accredited investors meet specific financial criteria defined by regulatory bodies, such as having a net worth exceeding $1 million or an annual income over $200,000, granting them access to private placements and hedge funds. Understanding the distinction between retail and accredited investors is essential for navigating investment options and regulatory requirements.

Definitions: Who is a Retail Investor?

A retail investor is an individual who buys and sells securities for personal accounts, typically with smaller amounts of capital compared to institutional investors. These investors invest in stocks, bonds, mutual funds, and other financial products through brokerage accounts without special regulatory status. Retail investors generally lack access to private placements and complex investment opportunities reserved for accredited investors.

Definitions: Who Qualifies as an Accredited Investor?

An accredited investor is defined by the U.S. Securities and Exchange Commission (SEC) as an individual or entity meeting specific financial criteria, such as having a net worth exceeding $1 million excluding primary residence or an annual income over $200,000 for individuals ($300,000 jointly with a spouse) in the last two years. Retail investors do not meet these thresholds and typically have less access to private market investments or hedge funds. The distinction ensures accredited investors can participate in higher-risk, potentially higher-reward investment opportunities not available to the general public.

Regulatory Differences and Requirements

Retail investors are subject to fewer regulatory requirements but face investment limits to protect them from high-risk assets, while accredited investors must meet specific income or net worth criteria defined by the SEC to access a broader range of securities. Accredited investors benefit from reduced disclosure obligations during private placements, enabling participation in complex investment opportunities like hedge funds and private equity. Regulatory frameworks prioritize retail investor protection through stringent disclosure and suitability rules, contrasting with the enhanced market access granted to accredited investors due to presumed financial sophistication.

Access to Investment Opportunities

Accredited investors have access to a wider range of investment opportunities, including private equity, hedge funds, and venture capital, which are often restricted from retail investors due to regulatory requirements. Retail investors typically invest in publicly traded stocks, bonds, and mutual funds, with limited access to high-risk, high-reward private offerings. The distinction is primarily based on net worth and income thresholds, designed to protect retail investors from complex or illiquid investments.

Risk Profiles and Investment Strategies

Retail investors typically face higher risk exposure due to limited access to exclusive investment opportunities and rely more on diversified, lower-risk strategies like mutual funds or index ETFs. Accredited investors, meeting specific income or net worth thresholds, can pursue higher-risk, high-reward strategies including private equity, hedge funds, and venture capital, benefiting from complex financial instruments and less regulatory protection. Understanding these risk profiles helps tailor investment portfolios that align with regulatory constraints and individual risk tolerance levels.

Advantages of Being a Retail Investor

Retail investors benefit from greater accessibility to a wide range of investment opportunities without stringent income or net worth requirements, enabling broader market participation. They often access diversified portfolios through mutual funds, ETFs, and retirement accounts with lower minimum investments and fees. Regulatory protections like disclosure requirements and investor education programs further safeguard retail investors, enhancing transparency and reducing risk.

Key Benefits for Accredited Investors

Accredited investors enjoy access to exclusive investment opportunities such as private equity, hedge funds, and venture capital, which often provide higher returns compared to retail investor options. They benefit from less regulatory constraints, enabling quicker transaction processes and participation in high-growth ventures not available to retail investors. Enhanced portfolio diversification and potential tax advantages further distinguish accredited investors, offering them superior financial growth and risk management possibilities.

Challenges and Limitations for Each Investor Type

Retail investors often face challenges such as limited access to high-yield investment opportunities and a lack of sophisticated financial knowledge, which can lead to higher risk exposure and lower portfolio diversification. Accredited investors benefit from broader access to private placements and hedge funds but encounter limitations related to stringent income and net worth requirements, restricting eligibility. Both investor types must navigate regulatory constraints that impact their investment options, with retail investors subject to more protective measures and accredited investors facing fewer but more complex compliance obligations.

Choosing the Right Path: Retail or Accredited Investing

Retail investors typically invest smaller amounts and face more regulatory protections, while accredited investors meet specific income or net worth thresholds allowing access to exclusive investment opportunities like private equity and hedge funds. Choosing the right path depends on financial goals, risk tolerance, and investment experience, with retail investors benefiting from diversified, lower-risk options and accredited investors pursuing higher-risk, potentially higher-return alternatives. Understanding eligibility criteria, investment horizons, and liquidity needs ensures informed decisions aligned with long-term wealth-building strategies.

Retail Investor Infographic

libterm.com

libterm.com