High Days Sales Outstanding (DSO) indicates that your company is taking longer to collect payments, which can strain cash flow and hinder financial stability. Efficient management of receivables and credit policies can help reduce DSO, improving liquidity and operational efficiency. Discover effective strategies to manage and lower your DSO by reading the rest of this article.

Table of Comparison

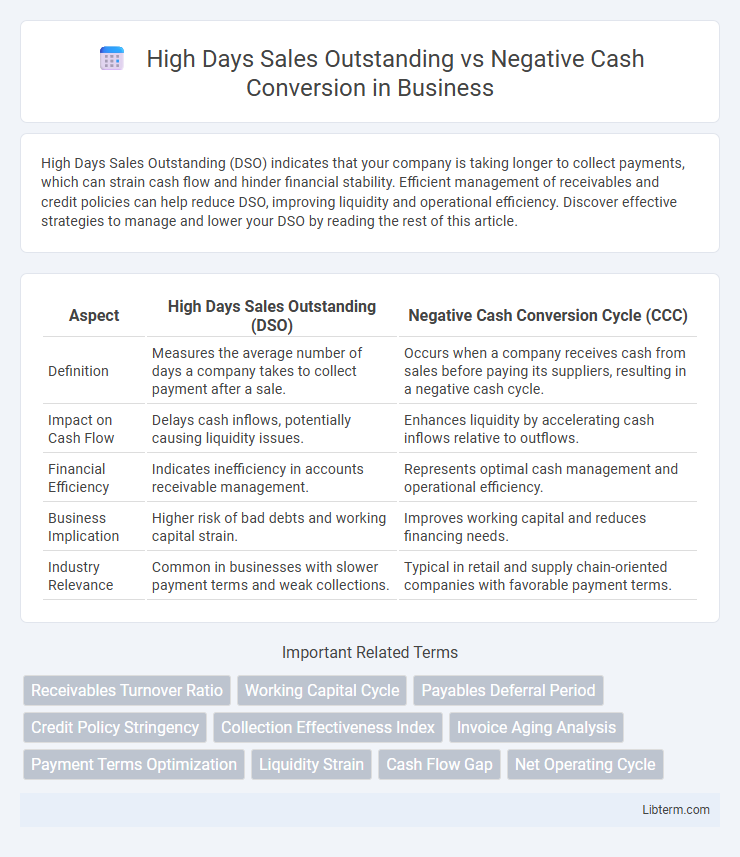

| Aspect | High Days Sales Outstanding (DSO) | Negative Cash Conversion Cycle (CCC) |

|---|---|---|

| Definition | Measures the average number of days a company takes to collect payment after a sale. | Occurs when a company receives cash from sales before paying its suppliers, resulting in a negative cash cycle. |

| Impact on Cash Flow | Delays cash inflows, potentially causing liquidity issues. | Enhances liquidity by accelerating cash inflows relative to outflows. |

| Financial Efficiency | Indicates inefficiency in accounts receivable management. | Represents optimal cash management and operational efficiency. |

| Business Implication | Higher risk of bad debts and working capital strain. | Improves working capital and reduces financing needs. |

| Industry Relevance | Common in businesses with slower payment terms and weak collections. | Typical in retail and supply chain-oriented companies with favorable payment terms. |

Introduction to Days Sales Outstanding (DSO)

Days Sales Outstanding (DSO) measures the average number of days it takes a company to collect payment after a sale, highlighting the efficiency of its accounts receivable process. A high DSO indicates slower cash inflows, which can strain liquidity and increase reliance on external financing. Understanding DSO is critical for managing cash flow and minimizing the risks associated with negative cash conversion cycles, where cash outflows precede cash inflows.

Understanding Negative Cash Conversion Cycle

A negative cash conversion cycle (CCC) occurs when a company collects payment from customers before paying its suppliers, often resulting from longer Days Payable Outstanding (DPO) compared to Days Sales Outstanding (DSO) and Inventory Days. Understanding the relationship between high Days Sales Outstanding (DSO) and negative CCC is critical, as a high DSO typically extends the cash collection period, increasing working capital needs, whereas a negative CCC indicates better cash flow efficiency and liquidity. Efficient management of receivables, payables, and inventory turnover optimizes the cash conversion cycle, enabling companies to fund operations without external financing.

Key Differences Between High DSO and Negative Cash Conversion

High Days Sales Outstanding (DSO) measures the average number of days a company takes to collect payment after a sale, indicating efficiency in accounts receivable management. Negative Cash Conversion occurs when a company collects cash from customers before paying its suppliers, leading to a cash flow advantage. The key difference is that high DSO reflects potential collection delays impacting liquidity, while negative cash conversion highlights a favorable timing mismatch between receivables and payables, enhancing working capital management.

Causes of High Days Sales Outstanding

High Days Sales Outstanding (DSO) often results from delayed customer payments, ineffective credit policies, and inefficient invoicing processes, which increase the time between sales and cash collection. Poor credit risk assessment and disputes over invoices further exacerbate payment delays, directly impacting cash flow management. High DSO significantly contributes to negative cash conversion cycles by tying up working capital in accounts receivable rather than cash assets.

Factors Leading to Negative Cash Conversion Cycle

High Days Sales Outstanding (DSO) reflects the average number of days a company takes to collect payments after a sale, directly impacting the cash conversion cycle (CCC). Negative cash conversion occurs when companies receive payments from customers faster than they pay their suppliers, often driven by high DSO reduction, efficient inventory management, and extended payable periods. Key factors leading to a negative CCC include strong customer credit control, favorable supplier terms, and streamlined working capital processes, enhancing liquidity and operational efficiency.

Impact on Business Cash Flow and Liquidity

High Days Sales Outstanding (DSO) indicates delayed receivables collection, directly reducing a company's cash inflow and straining liquidity. Negative Cash Conversion Cycle (CCC) reflects a business receiving payments faster than it pays suppliers, improving cash flow and operational efficiency. Balancing high DSO with a negative CCC optimizes cash management, ensuring sustainable liquidity and minimizing reliance on external financing.

Strategies to Reduce DSO

High Days Sales Outstanding (DSO) indicates the average time it takes for a company to collect receivables, directly impacting cash flow and working capital management. Strategies to reduce DSO include implementing stringent credit policies, offering early payment discounts, leveraging automated invoicing systems, and enhancing collection efforts through consistent follow-ups. Lowering DSO mitigates the risk of negative cash conversion cycles by accelerating cash inflows and improving liquidity.

Leveraging Negative Cash Conversion for Business Growth

High Days Sales Outstanding (DSO) indicates the average number of days a company takes to collect payments, while Negative Cash Conversion reflects a business's ability to receive cash from sales before paying its suppliers. Leveraging Negative Cash Conversion optimizes working capital by using supplier credit as a source of finance, allowing companies to reinvest cash inflows into growth initiatives without requiring external borrowing. Efficient management of payment terms and receivables accelerates cash flow, enabling faster scaling and enhanced liquidity for sustained business expansion.

Risk Factors Associated with High DSO and Negative Cash Conversion

High Days Sales Outstanding (DSO) and negative Cash Conversion Cycle (CCC) both signal critical liquidity risks affecting a company's working capital management and financial health. Elevated DSO indicates delayed customer payments, increasing the risk of bad debts and strained cash flow, while a negative CCC suggests a company's cash is tied up in receivables longer than payables, impacting short-term liquidity and operational flexibility. These risk factors can lead to increased borrowing costs, reduced investment capacity, and heightened vulnerability to economic downturns.

Choosing the Best Approach for Your Business

High Days Sales Outstanding (DSO) indicates the average time a company takes to collect payment after a sale, directly impacting cash flow efficiency. Negative Cash Conversion Cycle (CCC) occurs when a business collects receivables faster than it pays suppliers, reflecting strong working capital management. Choosing the best approach depends on balancing rapid receivables collection with sustainable supplier payment terms to optimize liquidity and operational stability.

High Days Sales Outstanding Infographic

libterm.com

libterm.com