Unearned revenue represents funds received by a business for goods or services not yet delivered, creating a liability on the balance sheet until the obligations are fulfilled. Properly managing unearned revenue is crucial for accurate financial reporting and compliance with accounting standards, ensuring your financial statements reflect the true state of earnings. Explore the full article to understand how unearned revenue impacts your business and the best practices for handling it.

Table of Comparison

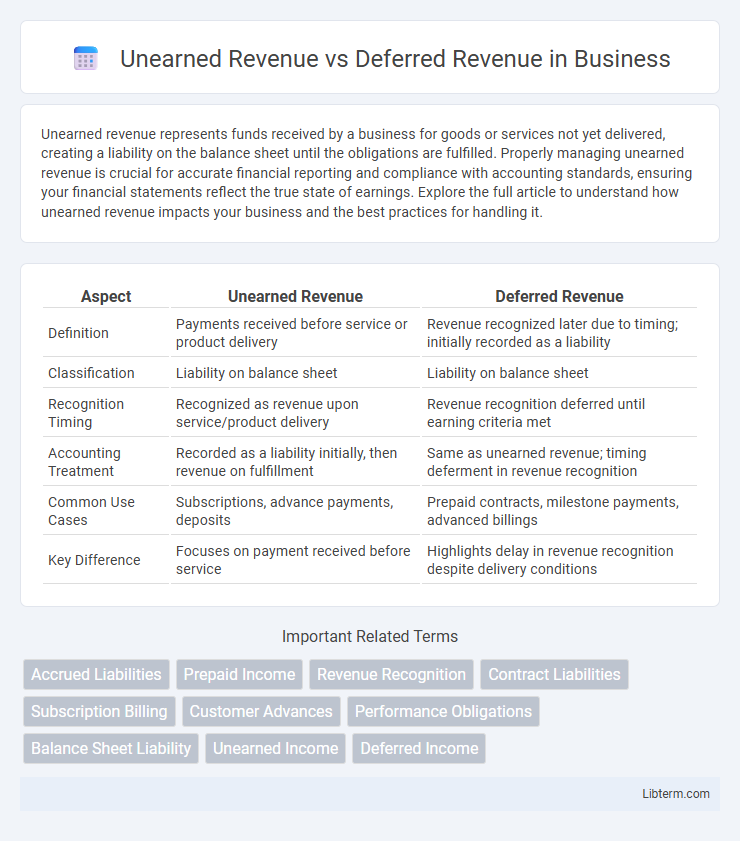

| Aspect | Unearned Revenue | Deferred Revenue |

|---|---|---|

| Definition | Payments received before service or product delivery | Revenue recognized later due to timing; initially recorded as a liability |

| Classification | Liability on balance sheet | Liability on balance sheet |

| Recognition Timing | Recognized as revenue upon service/product delivery | Revenue recognition deferred until earning criteria met |

| Accounting Treatment | Recorded as a liability initially, then revenue on fulfillment | Same as unearned revenue; timing deferment in revenue recognition |

| Common Use Cases | Subscriptions, advance payments, deposits | Prepaid contracts, milestone payments, advanced billings |

| Key Difference | Focuses on payment received before service | Highlights delay in revenue recognition despite delivery conditions |

Understanding Unearned Revenue

Unearned revenue represents payments received by a company for goods or services not yet delivered or performed, making it a liability on the balance sheet until earned. It is often recorded in industries with advance payments, such as subscription services, insurance, or airlines. Understanding unearned revenue is crucial for accurate financial reporting and revenue recognition under accounting standards like GAAP and IFRS.

Defining Deferred Revenue

Deferred revenue, also known as unearned revenue, refers to payments received by a company for goods or services not yet delivered or performed, representing a liability on the balance sheet. It is recognized as revenue only once the company fulfills its obligations to the customer under accrual accounting principles. Understanding deferred revenue is crucial for accurate financial reporting and ensuring compliance with revenue recognition standards such as ASC 606 and IFRS 15.

Key Differences Between Unearned and Deferred Revenue

Unearned revenue refers to payments received by a company before delivering goods or services, representing a liability on the balance sheet until earned. Deferred revenue is often used interchangeably but specifically highlights the revenue recognition aspect under accrual accounting, where revenue is recorded only when earned, not when cash is received. The key difference lies in the emphasis: unearned revenue focuses on the cash received in advance, while deferred revenue emphasizes the timing of revenue recognition in financial statements.

Accounting Principles for Unearned Revenue

Unearned revenue represents cash received before goods or services are delivered, classified as a liability under the matching principle in accounting to reflect the obligation to perform. Deferred revenue is synonymous with unearned revenue, emphasizing the postponement of revenue recognition until earning criteria are met. Proper accounting for unearned revenue ensures financial statements accurately depict liabilities and revenue, adhering to accrual accounting standards and revenue recognition principles.

Recording Deferred Revenue in Financial Statements

Deferred revenue, recorded as a liability on the balance sheet, represents payments received for goods or services not yet delivered. When recording deferred revenue, companies credit a deferred revenue account and debit cash or accounts receivable, reflecting the obligation to perform future services. As the company earns the revenue over time, the deferred revenue is gradually recognized on the income statement by debiting the deferred revenue account and crediting revenue.

Examples of Unearned vs Deferred Revenue

Unearned revenue examples include customer deposits for future services, advance subscription payments, and prepaid tuition fees, where cash is received before the service is performed. Deferred revenue examples often refer to payments recorded as liabilities on the balance sheet until the earned portion of the revenue is recognized, such as software licenses paid annually in advance or gift cards sold but not yet redeemed. Both terms reflect liabilities for companies, but unearned revenue emphasizes cash received upfront, whereas deferred revenue highlights the accounting treatment of revenue recognition over time.

Impact on Balance Sheet and Income Statement

Unearned revenue and deferred revenue both represent liabilities on the balance sheet, reflecting cash received for goods or services not yet delivered. Unearned revenue increases current liabilities until the company fulfills its obligations, upon which the amount is recognized as revenue on the income statement. Deferred revenue affects financial reporting by matching revenue recognition with the delivery of goods or services, ensuring accurate depiction of earnings and financial position.

Revenue Recognition Standards (GAAP & IFRS)

Unearned Revenue and Deferred Revenue both represent payments received before delivering goods or services, requiring recognition as revenue in accordance with GAAP and IFRS standards, specifically ASC 606 and IFRS 15. These standards mandate recognizing revenue when control transfers to the customer, emphasizing a performance obligation approach rather than cash receipt timing. Accurate classification and timing of revenue recognition are critical for compliance and financial reporting integrity under both frameworks.

Common Industries Using Unearned and Deferred Revenue

Common industries using unearned and deferred revenue include software-as-a-service (SaaS), telecommunications, insurance, and subscription-based businesses, where customers pay upfront for services delivered over time. In SaaS, deferred revenue arises when customers pay for annual subscriptions in advance, while insurance companies record premiums as unearned revenue until coverage is provided. Telecommunications companies similarly defer revenue received from prepaid plans, reflecting the obligation to deliver services in future periods.

Best Practices for Managing Advance Payments

Effective management of advance payments involves clearly distinguishing unearned revenue, representing the liability for services or goods yet to be delivered, from deferred revenue, which refers to revenue recognized in financial statements only when earned. Best practices include maintaining accurate tracking systems to monitor the timing of revenue recognition, ensuring compliance with accounting standards like GAAP or IFRS, and regularly reconciling advance payments against delivery milestones. Transparent communication with clients about payment terms and consistent documentation further enhance the accuracy and reliability of financial reporting related to advance payments.

Unearned Revenue Infographic

libterm.com

libterm.com